/McDonald)

With a market cap of $217.9 billion, McDonald's Corporation (MCD) is a leading global fast-food chain that operates and franchises restaurants under the McDonald’s brand. The company serves a wide variety of food and beverages across its U.S., International Operated, and International Developmental Licensed Markets segments.

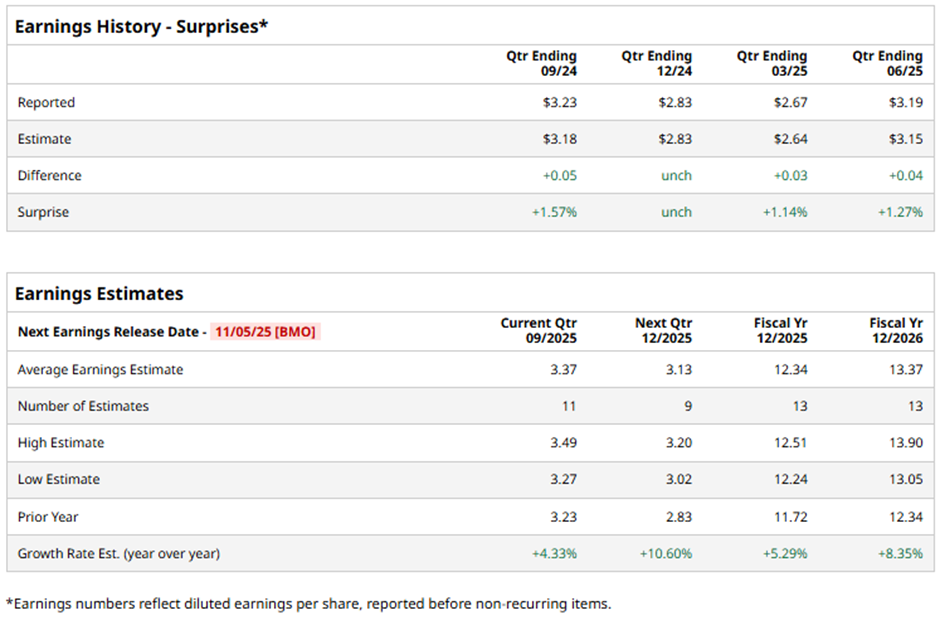

The Chicago, Illinois-based company is expected to announce its Q3 2025 results before the market opens on Wednesday, Nov. 5. Ahead of this event, analysts expect McDonald's to report an adjusted EPS of $3.37, up 4.3% from $3.23 in the year-ago quarter. It has exceeded or met Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the fast-food giant to report an adjusted EPS of $12.34, a 5.3% rise from $11.72 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow 8.4% year-over-year to $13.37 in fiscal 2026.

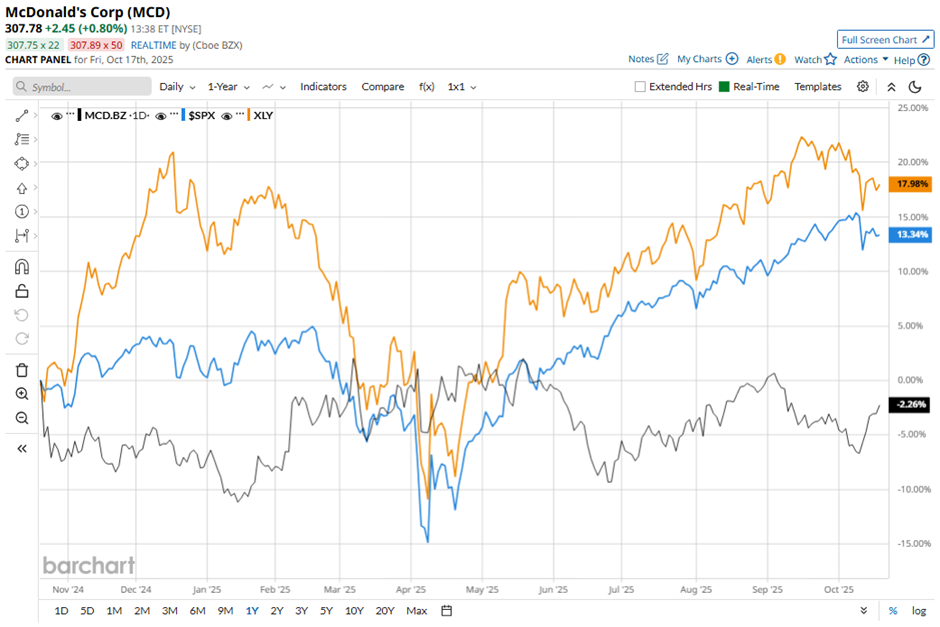

Shares of McDonald's have fallen 2.3% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 13.6% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 17.5% increase over the period.

McDonald’s shares rose nearly 3% on Aug. 6 after Q2 2025 results beat expectations, with adjusted EPS of $3.19 and revenue of $6.8 billion. Global same-store sales grew 3.8%, above the expected, driven by strong demand in the U.S. and international markets, along with a 5.6% jump in its developmental licensed segment. Affordable meal bundles, promotions like the $5 meal deal and “Minecraft” Happy Meals, and new menu items such as McCrispy Chicken Strips helped attract budget-conscious diners and boost traffic.

Analysts' consensus view on MCD stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 35 analysts covering the stock, 14 recommend "Strong Buy," one suggests "Moderate Buy," 19 indicate “Hold,” and one advises "Strong Sell." The average analyst price target for McDonald's is $337.45, indicating a potential upside of 9.6% from the current levels.