/Marriott%20International%2C%20Inc_%20sign%20by-%20Iryna%20Tolmachova%20via%20iStock.jpg)

With a market cap of $72.3 billion, Marriott International, Inc. (MAR) is a global leader in operating, franchising, and licensing hotels, residences, timeshares, and other lodging properties. The company manages a diverse portfolio of brands across various price and service levels, including JW Marriott, The Ritz-Carlton, Sheraton, W Hotels, and Courtyard by Marriott, among others.

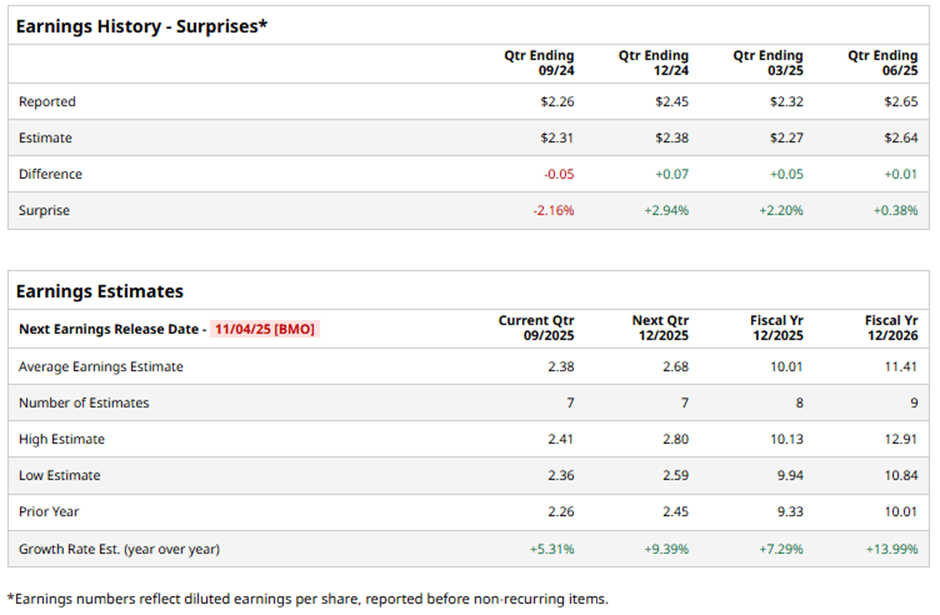

The Bethesda, Maryland-based company is expected to announce its fiscal Q3 2025 results before the market opens on Tuesday, Nov. 4. Ahead of this event, analysts expect Marriott to report an adjusted EPS of $2.38, up 5.3% from $2.26 in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect the hotel company to report an adjusted EPS of $10.01, a 7.3% rise from $9.33 in fiscal 2024. Moreover, adjusted EPS is anticipated to grow nearly 14% year-over-year to $11.41 in fiscal 2026.

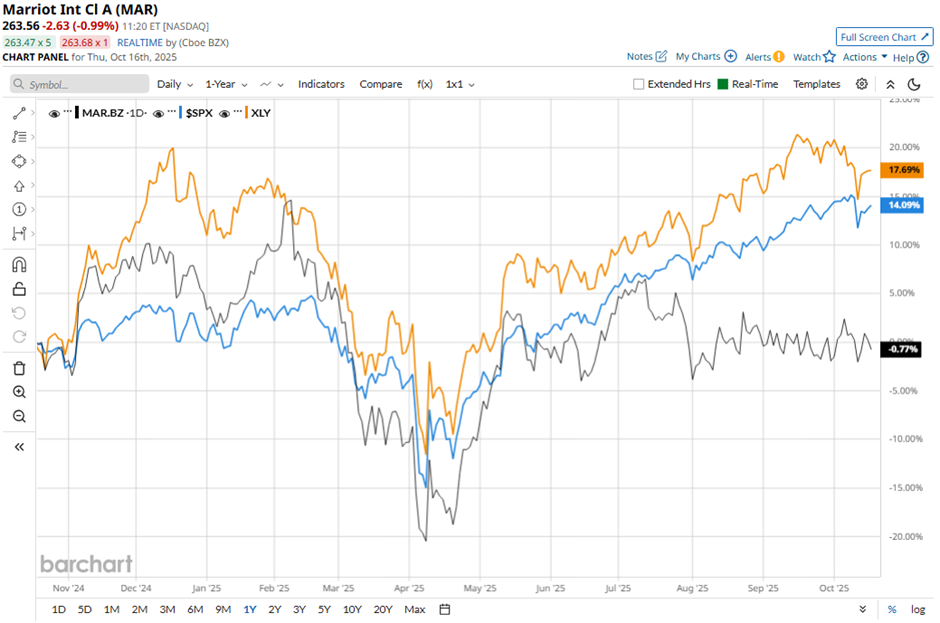

Shares of MAR have risen marginally over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 14.6% increase and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 18.2% return over the period.

Shares of Marriott International rose marginally on Aug. 5 after the company reported Q2 2025 adjusted EPS of $2.65, slightly above Wall Street estimates. Revenue of $6.7 billion also topped forecasts, with strength in its upscale and luxury segment - room revenue in U.S. and Canada luxury properties grew 4.1%, offsetting a 1.5% decline in select-service brands.

Analysts' consensus view on MAR stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 25 analysts covering the stock, seven recommend "Strong Buy," two suggest "Moderate Buy," 15 indicate “Hold,” and one has a "Strong Sell." The average analyst price target for Marriott International is $286.88, indicating a potential upside of 8.8% from the current levels.