With a market cap of $214.1 billion, Woking, the United Kingdom-based Linde plc (LIN) is a leading global industrial gases and engineering company, serving customers across industries such as healthcare, chemical and energy, manufacturing, and electronics. It produces and supplies atmospheric and process gases worldwide, while also designing and constructing turnkey process plants for various industrial applications.

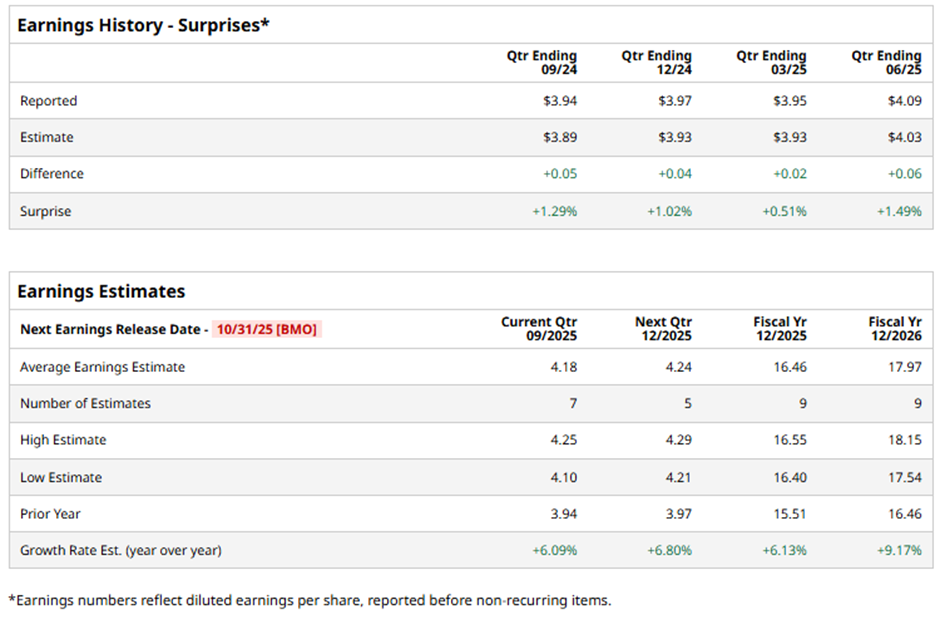

Linde is slated to announce its fiscal Q3 2025 results before the market opens on Friday, Oct. 31. Ahead of this event, analysts expect the company to report an adjusted EPS of $4.18, a 6.1% rise from $3.94 in the year-ago quarter. It has exceeded Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts forecast Linde to report adjusted EPS of $16.46, a 6.1% growth from $15.51 in fiscal 2024. Moreover, adjusted EPS is anticipated to increase 9.2% year-over-year to $17.97 in fiscal 2026.

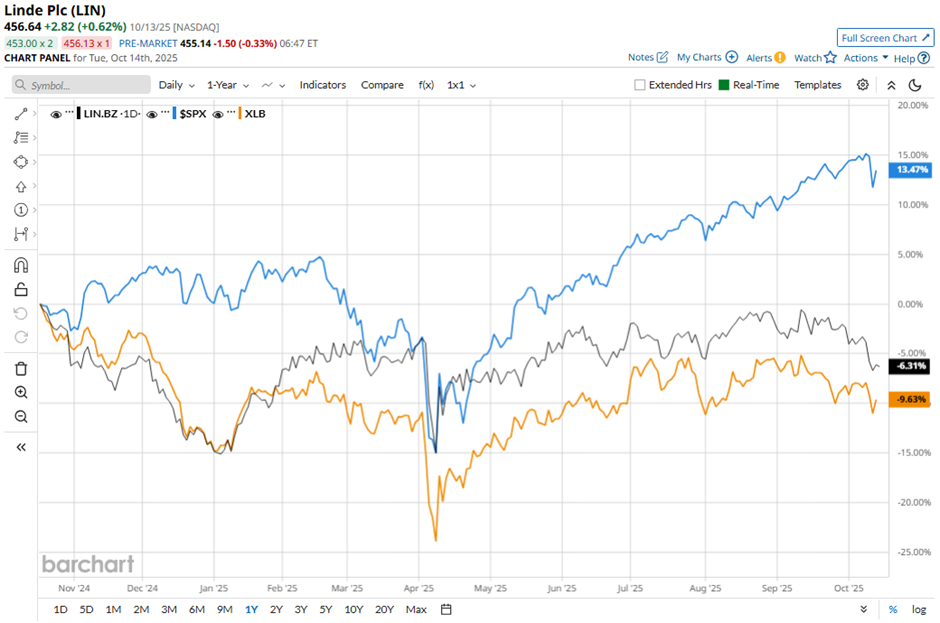

Shares of Linde have dipped nearly 5% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 14.4% return. However, the stock has shown a less pronounced decline than the Materials Select Sector SPDR Fund's (XLB) 9.4% decrease over the same time frame.

Despite Linde’s better-than-expected Q2 2025 adjusted EPS of $4.09 and revenues of $8.5 billion, shares fell marginally on Aug. 1. The Engineering segment’s operating profit fell to $90 million, missing the estimate, and the EMEA segment saw lower volumes in key end markets like metals & mining and manufacturing despite higher pricing.

Analysts' consensus view on LIN stock is bullish, with an overall "Strong Buy" rating. Among 27 analysts covering the stock, 18 suggest a "Strong Buy," two give a "Moderate Buy," and seven recommend a "Hold." The average analyst price target for Linde is $518.30, indicating a potential upside of 13.5% from the current levels.