/Leidos%20Holdings%20Inc%20logo%20on%20website-by%20monticello%20via%20Shutterstock.jpg)

Leidos Holdings, Inc. (LDOS) is a Virginia-based technology company specializing in defense, aviation, information technology, and biomedical research. With a market cap of $23.9 billion, Leidos employs approximately 47,000 people and operates across four primary divisions: National Security & Digital, Health & Civil, Commercial & International, and Defense Systems. The global science and technology leader is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Tuesday, Nov. 4.

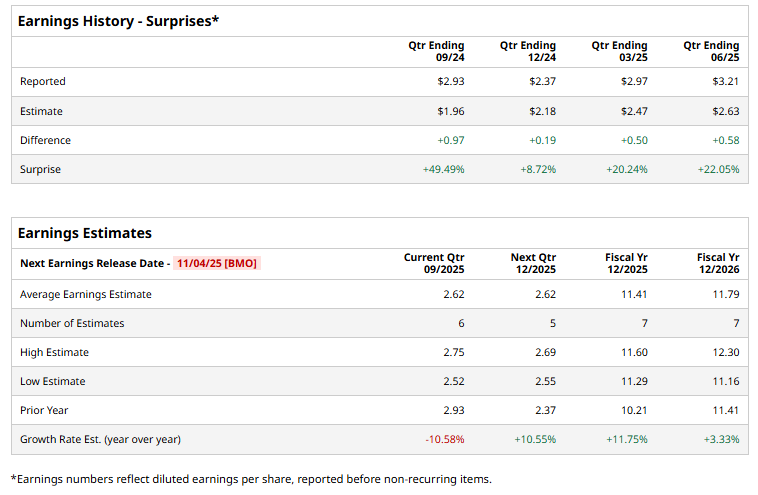

Ahead of the event, analysts expect LDOS to report a profit of $2.62 per share on a diluted basis, down 10.6% from $2.93 per share in the year-ago quarter. On the bright side, the company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect LDOS to report EPS of $11.41, up 11.8% from $10.21 in fiscal 2024.

Over the past 52 weeks, LDOS stock has climbed 9.7%, trailing the S&P 500 Index’s ($SPX) 13.5% gains and the Technology Select Sector SPDR Fund’s (XLK) 24% gains over the same time frame.

On Aug. 5, Leidos Holdings’ shares surged 7.5% following the release of its strong Q2 results and continued positive momentum for the subsequent six sessions. Its revenue rose 2.9% year over year to $4.3 billion, beating expectations. Non-GAAP EPS jumped 22.1% to $3.21, well above consensus, while free cash flow climbed 27.7% to $457 million, further strengthening investor confidence.

Analysts’ consensus opinion on LDOS stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 16 analysts covering the stock, ten advise a “Strong Buy” rating, one suggests “Moderate Buy,” and five give a “Hold.” LDOS’ average analyst price target is $196.28, indicating a potential upside of 6.4% from the current levels.