/Keycorp%20location-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $20.7 billion, KeyCorp (KEY) operates as the holding company for KeyBank National Association, offering a broad range of retail and commercial banking products and services across the United States. Through its Consumer Bank and Commercial Bank segments, the company provides deposit, lending, investment, wealth management, capital markets, and advisory services to individuals, businesses, and institutional clients.

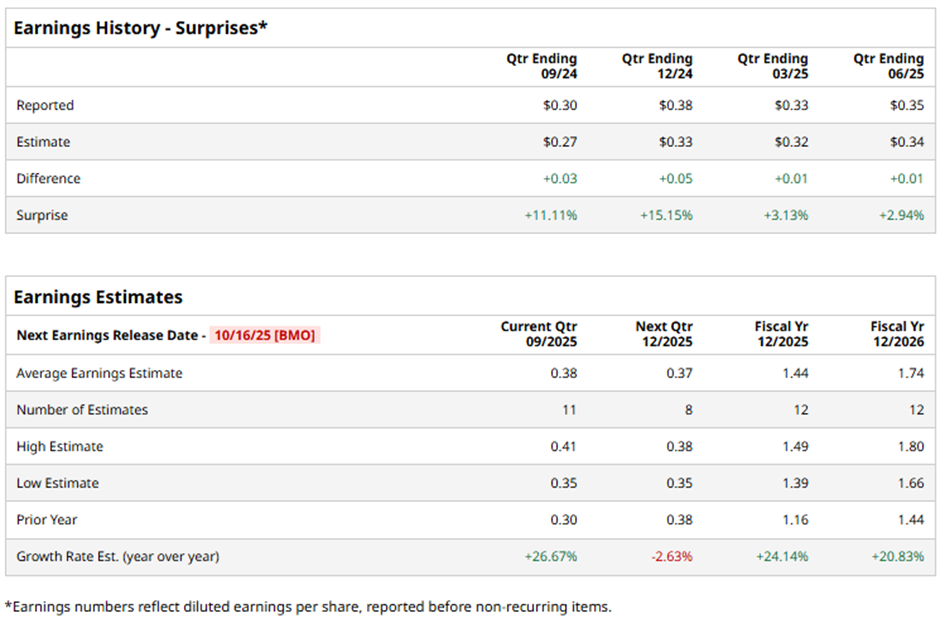

The Cleveland, Ohio-based company is scheduled to announce its fiscal Q3 2025 results before the market opens on Thursday, Oct. 16. Ahead of this event, analysts forecast KeyCorp to report an EPS of $0.38, up 26.7% from $0.30 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2025, analysts expect the company to report an EPS of $1.44, a 24.1% growth from $1.16 in fiscal 2024.

Shares of KeyCorp have increased 13.9% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.2% gain and the Financial Select Sector SPDR Fund’s (XLF) 19.3% return over the same period.

Shares of KeyCorp rose 2.4% on Jul. 22 following stronger-than-expected Q2 2025 results, with EPS of $0.35 beating the consensus estimate and marking a 40% year-over-year increase. Investor sentiment was boosted by a 20.9% rise in total revenues to $1.8 billion, driven by higher net interest income and a 10% increase in non-interest income, particularly from robust fee-based businesses. Additionally, improved capital ratios and sequential loan growth signaled financial strength, offsetting concerns over rising expenses and provisions.

Analysts' consensus view on KEY stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 24 analysts covering the stock, 10 suggest a "Strong Buy," two give a "Moderate Buy," and 12 have "Strong Sells." The average analyst price target for KeyCorp is $20.07, indicating a potential upside of 6.8% from the current levels.