/JPMorgan%20Chase%20%26%20Co_%20sign-by%20Robson90%20via%20Shutterstock.jpg)

New York-based JPMorgan Chase & Co. (JPM) is a leader in the financial services sector, offering the highest quality service to millions of consumers, small businesses, corporations, institutions, and government clients. With a market cap of $861.8 billion, JPMorgan’s operations span 100+ countries in the Americas, EMEA, and the Indo-Pacific.

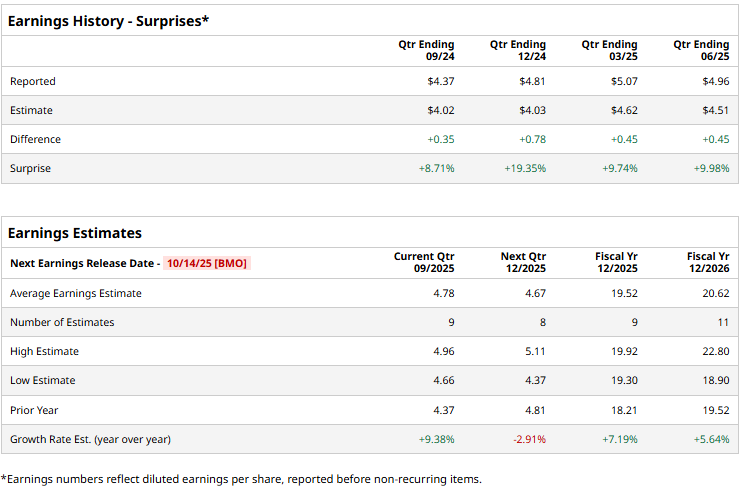

The financial sector behemoth is expected to release its Q3 results before the market opens on Tuesday, Oct. 14. Ahead of the event, analysts expect JPM to deliver an adjusted EPS of $4.78, up 9.4% from $4.37 reported in the year-ago quarter. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts project JPM to deliver an EPS of $19.52, up 7.2% from $18.21 reported in fiscal 2024. In fiscal 2026, its earnings are expected to further grow 5.6% year-over-year to $20.62 per share.

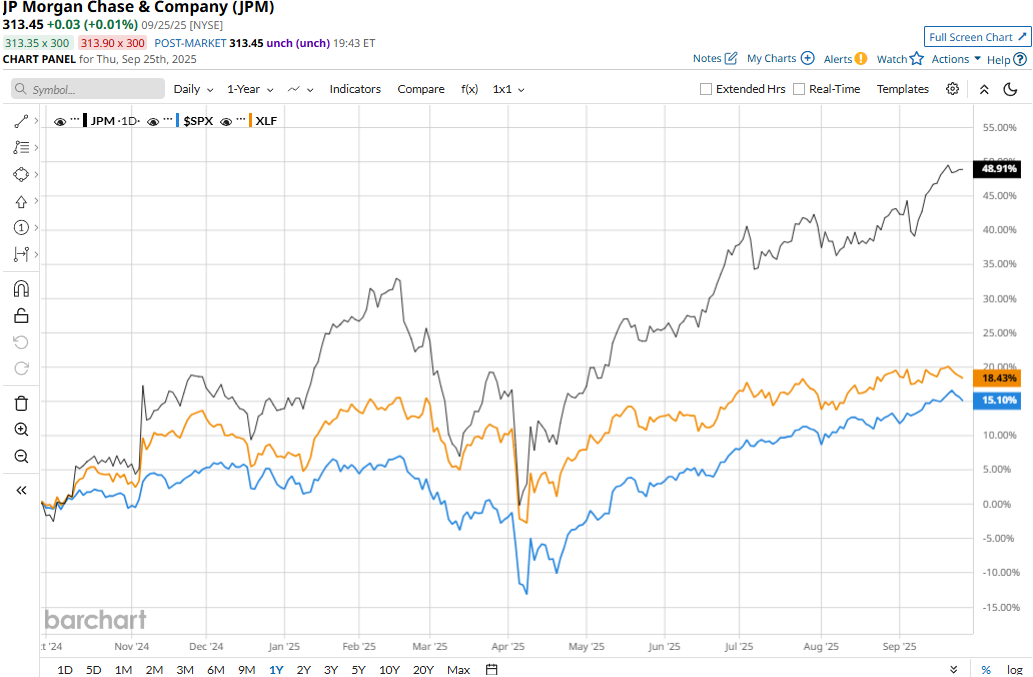

JPM stock prices have soared 49.1% over the past 52 weeks, substantially outpacing the S&P 500 Index’s ($SPX) 15.4% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.4% surge during the same time frame.

Despite delivering better-than-expected results, JPMorgan’s stock prices observed a marginal dip in the trading session following the release of its Q2 results on Jul. 15. Driven by a decline in interest expenses, the firm’s net interest income inched up 2% year-over-year to $23.2 billion. Meanwhile, JPM delivered notable growth in investment banking fees and asset management fees. However, its other income observed a significant drop, leading to a 20.9% decline in non-interest revenues. Overall, the company’s topline came in at $44.9 billion, down 10.5% year-over-year, but 2.5% ahead of the Street’s expectations. Meanwhile, its adjusted EPS declined 5.3% year-over-year to $4.96, but exceeded the consensus estimates by a notable 10%.

Analysts remain optimistic about JPMorgan’s prospects; the stock has a consensus “Moderate Buy” rating overall. Out of the 27 analysts covering the JPM stock, 13 recommend “Strong Buy,” three advocate “Moderate Buy,” 10 recommend “Hold,” and one advises a “Strong Sell” rating. As of writing, the stock is trading notably above its mean price target of $304.20.