/IQVIA%20Holdings%20Inc%20logo%20on%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Durham, North Carolina-based IQVIA Holdings Inc. (IQV) is a global leader in healthcare data, analytics, technology, and clinical research services. With a market cap of $34.6 billion, the company operates across three main segments, Technology & Analytics Solutions, Research & Development Solutions, and Contract Sales & Medical Solutions, serving pharmaceutical, biotech, and healthcare clients in over 100 countries.

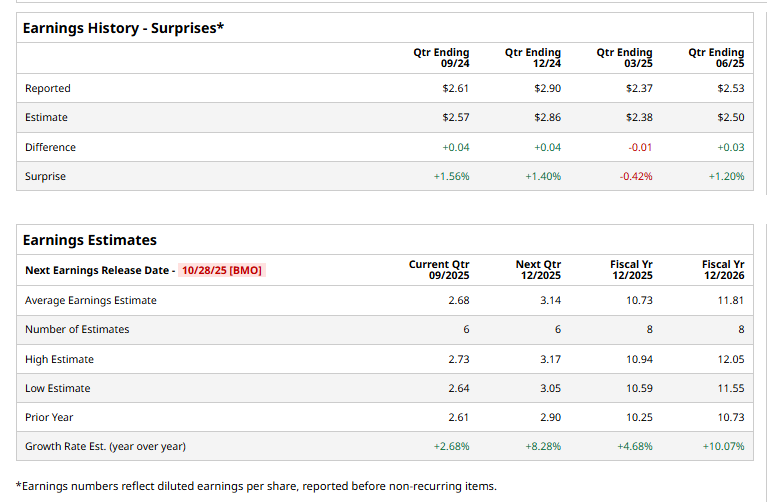

IQV is scheduled to report its Q3 earnings before the market opens on Tuesday, Oct. 28. Ahead of the event, analysts expect the company to report a profit of $2.68 per share, up 2.7% from $2.61 per share in the same quarter last year. The company has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on one other occasion.

For the current year, analysts expect IQV to report an EPS of $10.73, up 4.7% from $10.25 in fiscal 2024. Moreover, the EPS is expected to rise in fiscal 2026, improving 10.1% annually to $11.81.

Over the past 52 weeks, IQV has declined 12.2%, underperforming both the S&P 500 Index's ($SPX) 13.4% rise and the Health Care Select Sector SPDR Fund’s (XLV) 8% decrease over the same period.

On Oct. 11, Truist Financial analyst Jailendra Singh reaffirmed a “Buy” rating on IQVIA, expressing continued confidence in the company’s growth prospects and strong position in the healthcare data and clinical research industry. IQV shares popped 2.8% in the next trading session.

Analysts' consensus view on IQV stock is highly bullish, with an overall "Strong Buy" rating. Among 21 analysts covering the stock, 15 recommend a "Strong Buy," one suggests “Moderate Buy,” and five advise “Hold.” Its mean price target of $220.45 implies a potential upside of 7.7% from the prevailing market price.