/Ingersoll-Rand%20Inc%20steam%20roller-by%20bmcent1%20via%20iStock.jpg)

Davidson, North Carolina-based Ingersoll Rand Inc. (IR) provides mission-critical air, fluid, energy, and medical technologies worldwide. Valued at $30.2 billion by market cap, the company offers vacuum systems, bottle blowers, pumps, and air and gas compressors. The global provider of industrial equipment and services is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Thursday, Oct. 30.

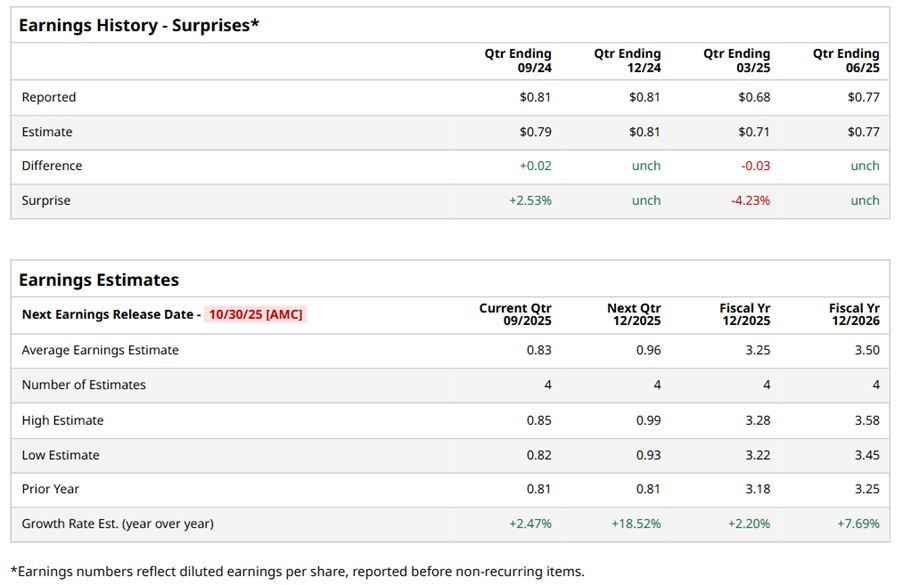

Ahead of the event, analysts expect IR to report a profit of $0.83 per share on a diluted basis, up 2.5% from $0.81 per share in the year-ago quarter. The company beat or met consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect IR to report EPS of $3.25, up 2.2% from $3.18 in fiscal 2024. Its EPS is expected to rise 7.7% year over year to $3.50 in fiscal 2026.

IR stock has considerably underperformed the S&P 500 Index’s ($SPX) 13.4% gains over the past 52 weeks, with shares down 24.6% during this period. Similarly, it significantly underperformed the Industrial Select Sector SPDR Fund’s (XLI) 10.1% gains over the same time frame.

On Jul. 31, Ingersoll Rand's Q2 results showed revenue growth of 4.6% to $1.9 billion, beating consensus estimates by 2.7%. Its adjusted EPS of $0.80 met analyst forecasts. The company also raised its fiscal 2025 guidance. However, its shares plummeted 11.4% amid a 3.6% year-over-year decline in adjusted EPS, a 40-basis-point drop in adjusted EBITDA margin, and a 25.7% decrease in free cash flow, raising concerns about profitability.

Analysts’ consensus opinion on IR stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 15 analysts covering the stock, seven advise a “Strong Buy” rating, and eight give a “Hold.” IR’s average analyst price target is $91.92, indicating a potential upside of 19% from the current levels.