/Huntington%20Ingalls%20Industries%20Inc%20logo%20and%20chart-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Newport News, Virginia-based Huntington Ingalls Industries, Inc. (HII) designs, builds, overhauls, and repairs military ships in the United States. With a market cap of $11.3 billion, Huntington Ingalls operates through Ingalls, Newport News, and Mission Technologies segments.

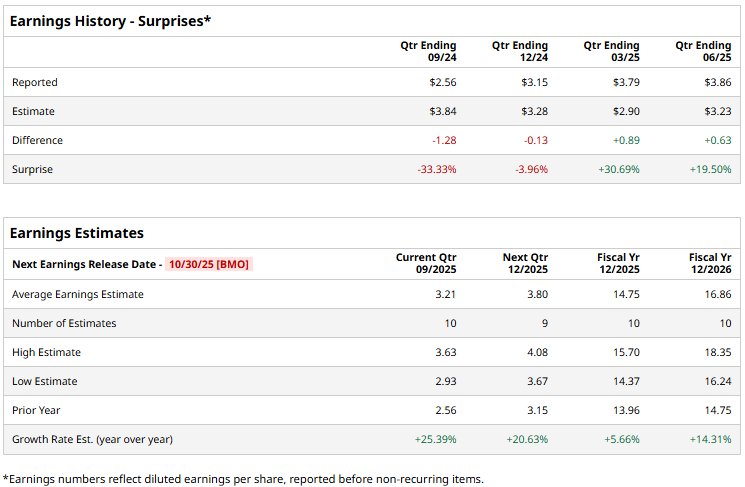

The industrial major is set to announce its third-quarter earnings before the markets open on Thursday, Oct. 30. Ahead of the event, analysts expect HII to report an EPS of $3.21, marking a notable 25.4% growth from $2.56 reported in the year-ago quarter. While the company has surpassed the Street’s bottom-line estimates twice over the past four quarters, it has missed the projections on two other occasions.

For the full fiscal 2025, analysts project HII’s earnings to come in at $14.75 per share, up 5.7% from $13.96 per share reported in fiscal 2024. While in fiscal 2026, its earnings are expected to grow 14.3% year-over-year to $16.86 per share.

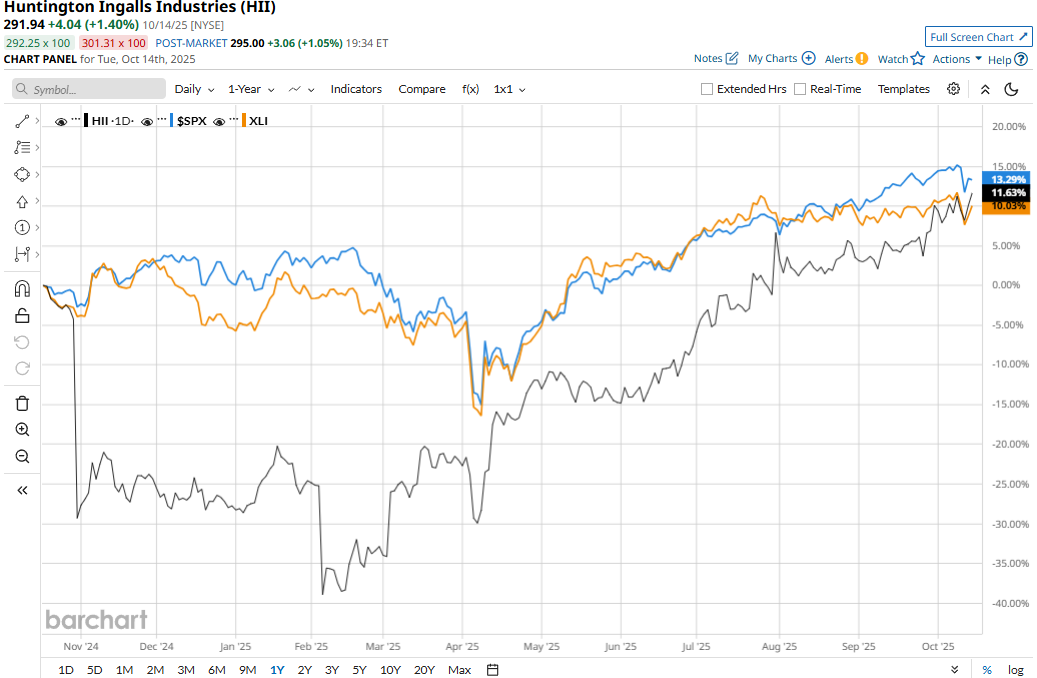

HII stock prices have gained 11.9% over the past 52 weeks, outpacing the Industrial Select Sector SPDR Fund’s (XLI) 10.1% gains, but lagging behind the S&P 500 Index’s ($SPX) 13.4% returns during the same time frame.

Huntington Ingalls’ stock prices soared 7.9% in a single trading session following the release of its better-than-expected Q2 results on Jul. 31. The company continued to make steady progress on its operational initiatives for the fiscal year 2025 and made targeted investments to stabilize its workforce and supply chain. Driven by a notable uptick in product as well as service revenues, HII’s overall topline grew 3.5% year-over-year to $3.1 billion, beating the Street’s expectations by 5.2%.

Meanwhile, the company’s EPS dropped 11.9% year-over-year to $3.86, but surpassed the consensus estimates by a staggering 19.5%. Further, Huntington raised its full-year free cash from guidance from the previous range of $300 million - $500 million to $500 million - $600 million, boosting investor confidence.

The consensus opinion on HII stock remains moderately optimistic, with an overall “Moderate Buy” rating. Of the 11 analysts covering the stock, opinions include three “Strong Buys,” seven “Holds,” and one “Moderate Sell.” As of writing, the stock is trading slightly above its mean price target of $287.60.