/Humana%20Inc_%20app%20on%20phone%20-by%20rafapress%20via%20Shutterstock.jpg)

Valued at a market cap of $34.2 billion, Humana Inc. (HUM) is an integrated health and well-being company, primarily focused on providing managed care services through its extensive health insurance offerings. The Louisville, Kentucky-based company leverages data analytics and integrated care delivery to improve patient outcomes, enhance member experience, and reduce healthcare costs. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Wednesday, Nov. 5.

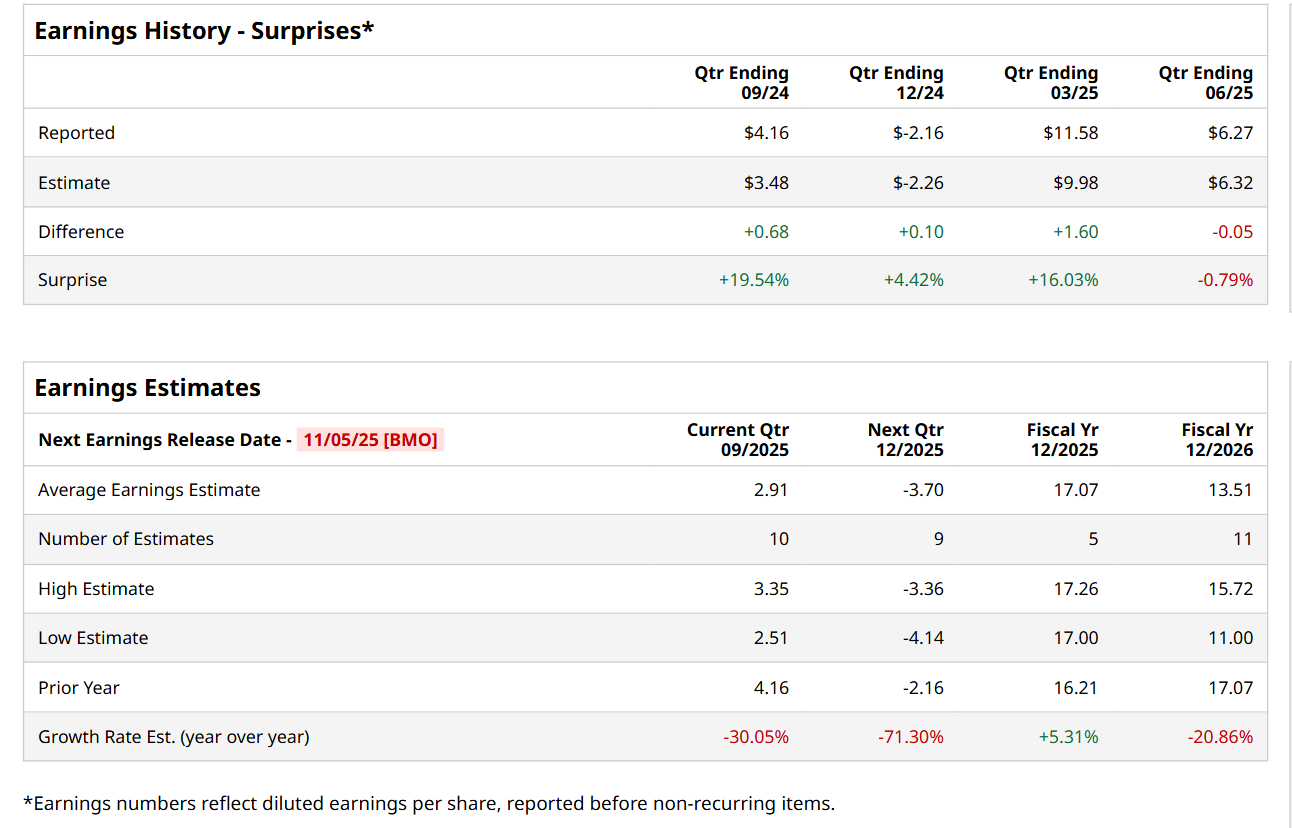

Ahead of this event, analysts expect this health insurance company to report a profit of $2.91 per share, down 30.1% from $4.16 per share in the year-ago quarter. The company has surpassed Wall Street’s earnings estimates in three of the last four quarters, while missing on another occasion. In Q2, HUM’s EPS of $6.27 fell short of the forecasted figure by a slight margin.

For fiscal 2025, analysts expect HUM to report a profit of $17.07 per share, up 5.3% from $16.21 per share in fiscal 2024. However, its EPS is expected to decline by 20.9% year-over-year to $13.51 in fiscal 2026.

HUM has lagged behind the S&P 500 Index's ($SPX) 15.1% return over the past 52 weeks, with its shares up 13.3% over the same time frame. However, it has outperformed the Health Care Select Sector SPDR Fund’s (XLV) 4.1% fall over the same time period.

On Oct. 20, shares of HUM surged 3.3%, followed by another 3.9% gain in the next trading session, after the company announced a strategic collaboration with Providence, a Washington-based health system. The initiative aims to streamline and secure data exchange to better support value-based care, helping members reduce administrative burdens and focus more on their health.

Wall Street analysts are moderately optimistic about HUM’s stock, with an overall "Moderate Buy" rating. Among 26 analysts covering the stock, six recommend "Strong Buy," two indicate “Moderate Buy," 17 suggest "Hold,” and one advises a “Strong Sell” rating. While the company is trading above its mean price target of $292.42, its Street-high price target of $347 implies a 17.5% premium to its current price levels.