/Hubbell%20Inc_%20logo%20and%20stock%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Headquartered in Shelton, Connecticut, Hubbell Incorporated (HUBB) designs, manufactures, and markets a broad portfolio of electrical and utility solutions. With a market capitalization of roughly $25 billion, the company supplies wiring devices, connectors, grounding products, lighting fixtures, industrial controls, and communication systems, alongside utility offerings such as distribution gear, arresters, insulators, smart meters, and protection devices.

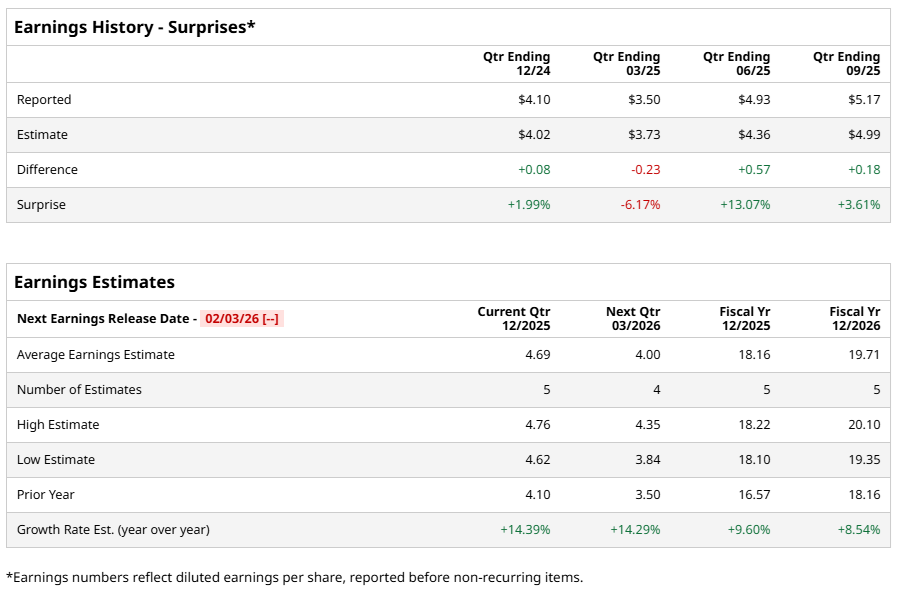

Against this backdrop, earnings visibility takes center stage. Hubbell is scheduled to report fiscal 2025 fourth-quarter results shortly. Analysts expect diluted EPS of $4.69, a 14.4% increase from $4.10 in the prior-year quarter. Importantly, the company has topped EPS estimates in three of the past four quarters, while missing expectations in just one.

Looking beyond the near term, Wall Street expects full-year fiscal 2025 diluted EPS of $18.16, implying 9.6% year-over-year growth. Momentum is projected to continue into fiscal 2026, with analysts expecting EPS of $19.71, an 8.5% increase from the prior year.

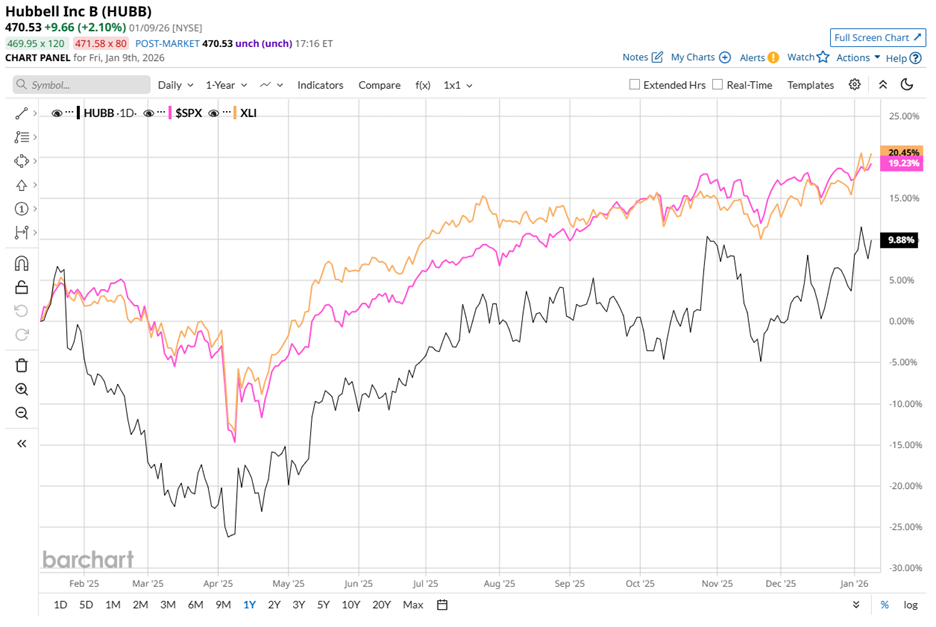

Share-price performance offers a contrasting signal. Hubbell’s shares have climbed 8.2% over the past 52 weeks and nearly 6% year-to-date (YTD). Over the same periods, the S&P 500 Index ($SPX) rose 17.7% and 1.8%, respectively.

The divergence widens when viewed through a sector lens. The State Street Industrial Select Sector SPDR ETF (XLI) climbed nearly 21.9% over the past 52 weeks and rose 4.4% YTD.

Hubbell’s fiscal Q3 2025 results triggered a strong market response on Oct. 28, 2025, with shares climbing approximately 4.9%. Revenue rose 4.1% year over year to $1.50 billion, falling short of the Street’s forecast of $1.53 billion. Meanwhile, adjusted EPS increased 12.1% to $5.17, comfortably beating analyst estimates of $4.98.

Investors prioritized profitability over the modest revenue miss, encouraged by solid organic growth in Electrical Solutions and Grid Infrastructure. These gains offset a sharp decline in Grid Automation tied to project roll-offs, highlighting Hubbell’s ability to defend margins across uneven demand conditions.

That confidence deepened as management raised full-year adjusted EPS guidance to $18.10–$18.30 and reaffirmed expectations for full-year 2025 total sales growth and organic net sales growth of 3%–4%. The improved outlook pushed the stock another 3.8% higher the following day.

Heading into the release, Wall Street maintains a “Moderate Buy” consensus rating on HUBB stock, unchanged over the past three months. Of 15 analysts covering the stock, seven rate it “Strong Buy” while eight recommend “Hold.”

HUBB’s mean price target of $500.67 represents potential upside of 6.4%. Meanwhile, the Street-high target of $575 suggests a gain of 22.2% from current levels.