/Howmet%20Aerospace%20Inc%20logo%20and%20data-by%20rafapress%20via%20Shutterstock.jpg)

With a market cap of $73.2 billion, Howmet Aerospace Inc. (HWM) is a leading aerospace and industrial components manufacturer. Headquartered in Pennsylvania, the company specializes in engineered metal products, including turbine engine components, fasteners, and structural parts for the aerospace, defense, and industrial markets.

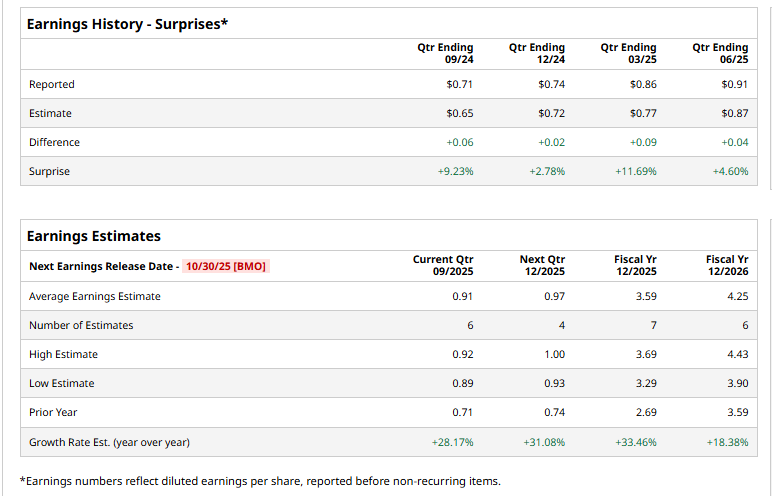

The company is expected to release its fiscal Q3 2025 earnings results on Thursday, Oct. 30. Ahead of this event, analysts project HWM to report an adjusted EPS of $0.91, a 28.2% growth from $0.71 in the year-ago quarter. The company has exceeded Wall Street's bottom-line estimates in the last four quarters.

For fiscal 2025, analysts forecast the company to report adjusted EPS of $3.59, up 33.5% from $2.69 in fiscal 2024.

HWM stock has climbed 85.5% over the past 52 weeks, significantly outperforming the broader S&P 500 Index's ($SPX) 15.1% return and the Industrial Select Sector SPDR Fund's (XLI) 11.6% gain over the same period.

On September 30, Howmet Aerospace shares rose 2.3% after the company announced a dividend of $0.12 per share, payable on November 25, 2025, reflecting Howmet’s ongoing commitment to returning capital to shareholders.

Analysts' consensus view on Howmet Aerospace stock is bullish, with a "Strong Buy" rating overall. Among 22 analysts covering the stock, 17 suggest a "Strong Buy," one gives a "Moderate Buy," and four provide a "Hold" rating. The mean price target of $210.67 represents a premium of 6.8% from the current market prices.