/Hologic%2C%20Inc_%20%20magnified%20-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

With a market cap of $14.7 billion, Hologic, Inc. (HOLX) is a Massachusetts-based medical technology company specializing in women's health. Hologic develops, manufactures, and supplies diagnostic products, medical imaging systems, and surgical devices. Its core business segments include Diagnostics, Breast Health, GYN Surgical, and Skeletal Health.

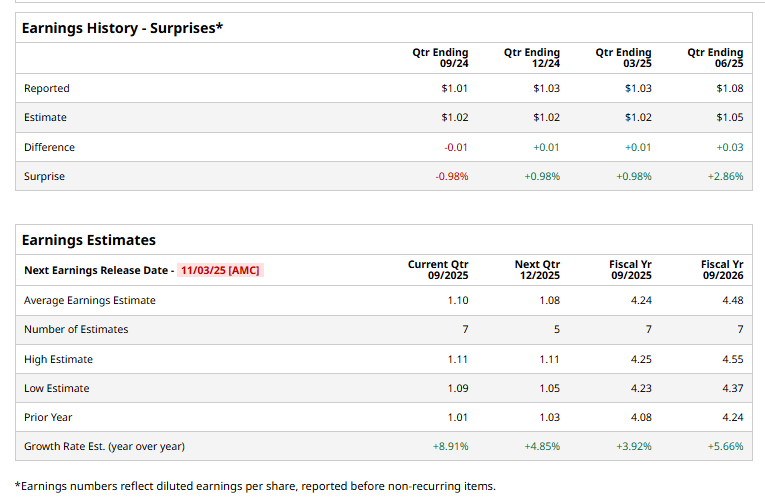

HOLX is all geared up for its fiscal Q4 2025 results after the market closes on Wednesday, Nov. 3. Before this event, analysts project this company to report an adjusted EPS of $1.10, up 8.9% from $1.01 in the year-ago quarter. The company has surpassed Wall Street's bottom-line estimates in three of the last four quarters, while falling short in one quarter.

For fiscal 2025, analysts expect HOLX to report an adjusted EPS of $4.24, up 3.9% year over year from $4.08 in fiscal 2024. Moreover, in fiscal 2026, the company’s adjusted EPS is expected to increase 5.7% year-over-year to $4.48.

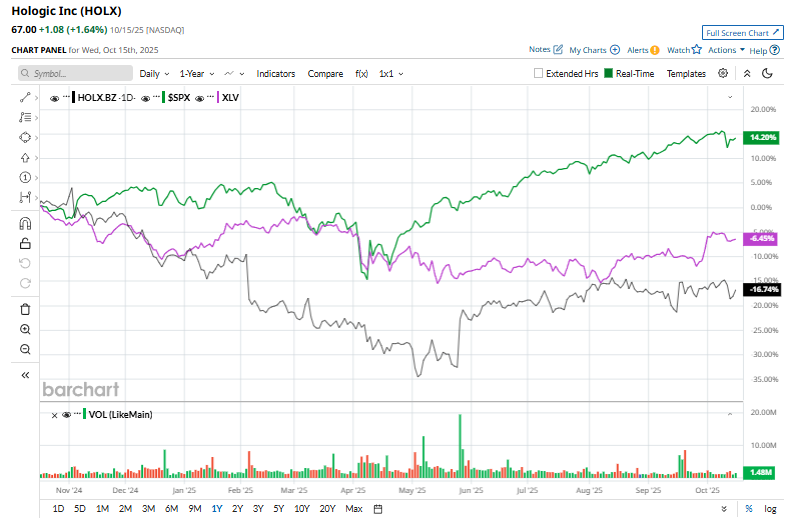

HOLX stock has declined 18% over the past 52 weeks, trailing both the S&P 500 Index's ($SPX) 14.7% gain and the Health Care Select Sector SPDR Fund’s (XLV) 6.7% decline over the same time frame.

On Oct. 2, Hologic shares rose 1.3% after the FDA granted 510(k) clearance for its Panther Fusion® Gastrointestinal Bacterial and Expanded Bacterial Assays, which also received CE marking in the EU. These tests are designed to detect common bacterial pathogens causing infectious gastroenteritis quickly.

Analysts are moderately optimistic about HOLX’s stock, with an overall "Moderate Buy" rating. Among 20 analysts covering the stock, eight recommend "Strong Buy," two suggest a “Moderate Buy,” and 10 advise “Hold.” The mean price target of $75.25 indicates a 12.3% potential upside from HOLX’s current price levels.