Denver, Colorado-based Healthpeak Properties, Inc. (DOC) is a diversified real estate investment trust that owns and develops healthcare real estate for Lab, Outpatient Medical, and Continuing Care Retirement Community ("CCRC") tenants. With a market cap of $13.5 billion, Healthpeak operates and holds interests in hundreds of properties across the U.S.

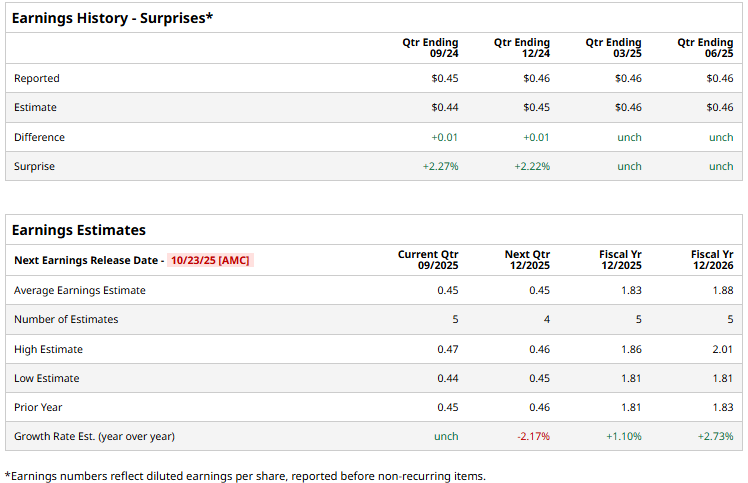

The real estate major is set to announce its third-quarter results after the market closes on Thursday, Oct. 23. Ahead of the event, analysts expect DOC to deliver an adjusted funds from operations (AFFO) of $0.45 per share, remaining flat year-over-year. The company has a solid AFFO surprise history. It has met or surpassed the Street’s AFFO estimates in each of the past four quarters.

For the full fiscal 2025, Healthpeak’s AFFO is expected to come in at $1.83 per share, up 1.1% from $1.81 per share in 2024. While in fiscal 2026, its AFFO is expected to grow 2.7% year-over-year to $1.88 per share.

DOC stock prices have declined 13% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.2% surge and the Real Estate Select Sector SPDR Fund’s (XLRE) 4.3% decline during the same time frame.

Healthpeak Properties’ stock prices declined 6.7% in the trading session following the release of its mixed Q3 results on Jul. 24. While the company observed a modest growth in resident fees and services revenues, its rental revenues observed a notable drop. Overall, DOC’s topline came in at $694.3 million, down 17 bps from the year-ago quarter and slightly below the Street’s expectations. Meanwhile, its AFFO inched up 2.2% year-over-year to $0.46 per share, meeting analysts’ projections.

Market sentiments were primarily hurt due to the company reducing its full-year Nareit FFO per share guidance from the previous range of $1.81 – $1.87 to $1.78 – $1.84 and its EPS guidance range from $0.30 – $0.36 to $0.25 – $0.31.

Nonetheless, analysts remain optimistic about the stock’s prospects. DOC has a consensus “Moderate Buy” rating overall. Of the 20 analysts covering the stock, opinions include nine “Strong Buys,” three “Moderate Buys,” and eight “Holds.” Its mean price target of $20.94 suggests an 8.8% upside potential from current price levels.