/Gilead%20Sciences%2C%20Inc_%20pills-by%20%20Marc%20Bruxelle%20via%20Shutterstock.jpg)

Headquartered in Foster City, California, Gilead Sciences, Inc. (GILD) is a global biopharmaceutical leader committed to discovering, developing, and delivering transformative therapies for life-threatening diseases. The company, currently valued at a market cap of $134.7 billion, has established a strong presence across several critical therapeutic areas, including HIV, viral hepatitis, oncology, and inflammatory diseases.

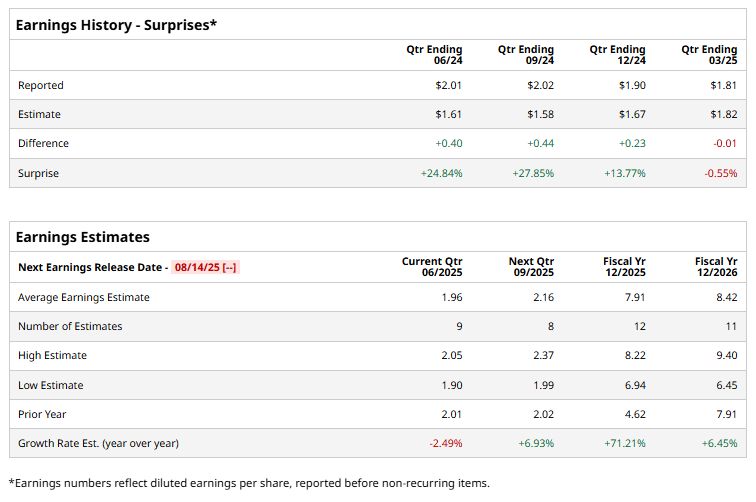

Gilead has been a pioneer in antiviral research, particularly in the treatment and prevention of HIV/AIDS, where its therapies have significantly improved patient outcomes and quality of life. The company is set to release its fiscal Q2 earnings results on Thursday, Aug. 14. Ahead of the event, analysts expect GILD to report a profit of $1.96 per share, down 2.5% from $2.01 per share in the year-ago quarter. The company surpassed Wall Street’s bottom-line estimates in three of the past four quarters, while missing in the recent quarter.

For the current year, analysts expect GILD to report EPS of $7.91, up 71.2% from $4.62 in fiscal 2024.

GILD stock has delivered robust gains over the past year, surging 52.2%, outpacing the S&P 500’s ($SPX) 13.4% gains and the Health Care Select Sector SPDR Fund’s (XLV) 10.2% decline over the same time frame.

On June 10, Gilead Sciences shares fell over 2% following negative news about one of its investigational HIV programs, contrasting with the S&P 500’s 0.6% gain. The FDA ordered Gilead to halt clinical trials of a two-drug HIV treatment (GS-1720 and GS-4182) due to observed low CD4+ T-cell counts in some participants. The drugs were being tested against Gilead’s current HIV therapy, Biktarvy.

The consensus opinion on GILD stock is fairly bullish, with an overall “Moderate Buy” rating. Among the 28 analysts covering the stock, 18 advise a “Strong Buy” rating, one “Moderate Buy,” and nine suggest “Hold.” GILD’s average analyst price target is $118.16, indicating a potential upside of 7.3% from the current price levels.