/Gilead%20Sciences%2C%20Inc_%20pills-by%20%20Marc%20Bruxelle%20via%20Shutterstock.jpg)

Gilead Sciences, Inc. (GILD), headquartered in Foster City, California, is a biopharmaceutical company that discovers, develops, and commercializes medicines for unmet medical needs. Valued at $152.8 billion by market cap, the company’s primary areas of focus include HIV, AIDS, liver disease, and severe cardiovascular and respiratory conditions. The HIV giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Thursday, Oct. 30.

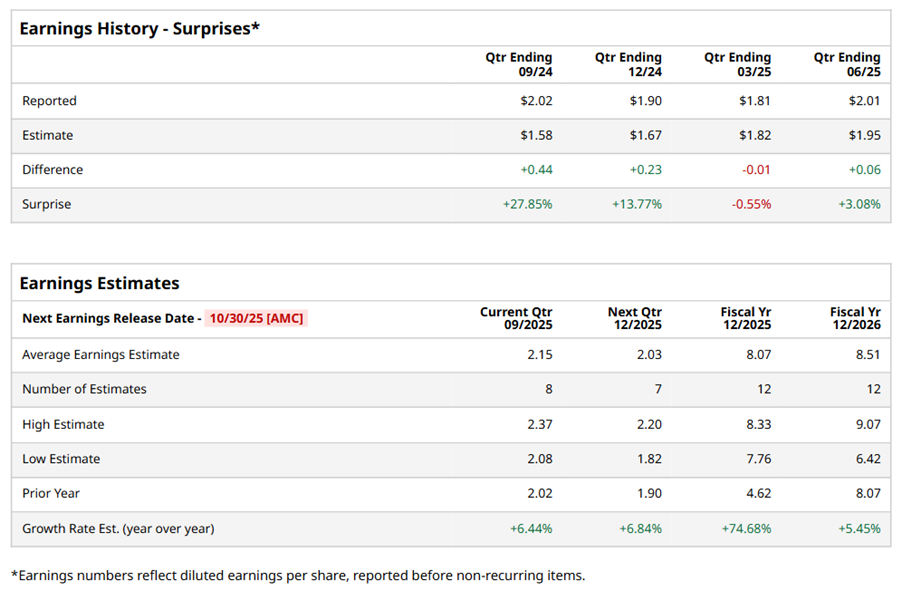

Ahead of the event, analysts expect GILD to report a profit of $2.15 per share on a diluted basis, up 6.4% from $2.02 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect GILD to report EPS of $8.07, up 74.7% from $4.62 in fiscal 2024. Its EPS is expected to rise 5.5% year over year to $8.51 in fiscal 2026.

GILD stock has notably outperformed the S&P 500 Index’s ($SPX) 15.1% gains over the past 52 weeks, with shares up 43.8% during this period. Similarly, it considerably outperformed the Health Care Select Sector SPDR Fund’s (XLV) 4.1% losses over the same time frame.

GILD's strong performance is driven by sales growth in HIV, Livdelzi, and Trodelvy, despite declining sales in HCV and Veklury. The approval of lenacapavir strengthens GILD's HIV portfolio, particularly with Truvada facing generic competition. GILD's market-leading HIV portfolio includes Biktarvy and Descovy, with a long-acting injectable PrEP, Yeztugo, offering a competitive advantage.

On Aug. 7, GILD reported its Q2 results, and its shares closed up more than 8% in the following trading session. Its adjusted EPS of $2.01 surpassed Wall Street expectations of $1.95. The company’s revenue was $7.1 billion, topping Wall Street's $7 billion forecast. GILD expects full-year adjusted EPS in the range of $7.95 to $8.25.

Analysts’ consensus opinion on GILD stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 29 analysts covering the stock, 19 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and eight give a “Hold.” GILD’s average analyst price target is $127.54, indicating a potential upside of 2.8% from the current levels.