/Fidelity%20National%20Information%20Services%2C%20Inc_%20logo%20outside%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $41.3 billion, Fidelity National Information Services, Inc. (FIS) is a global leader in financial technology solutions. The Florida-based company serves financial institutions, businesses, and developers through its three main segments: Banking Solutions, Capital Market Solutions, and Corporate and Other.

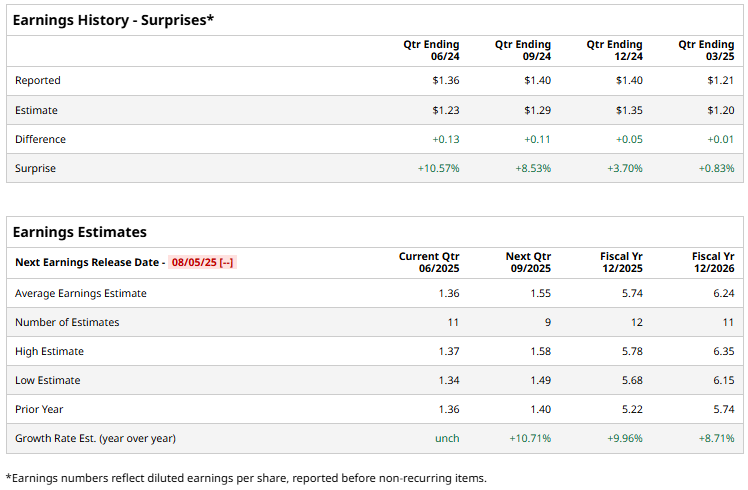

The company is set to report its Q2 earnings on Tuesday, Aug. 5. Ahead of the event, analysts expect FIS to report an EPS of $1.36 per share, flat from the figure reported in the year-ago quarter. It has exceeded analysts' earnings estimates in all of the past four quarters, which is impressive.

For fiscal 2025, analysts expect FIS to report an EPS of $5.74, up 10% from $5.22 in fiscal 2024. Moreover, in fiscal 2026, its EPS is expected to grow 8.7% year-over-year to $6.24.

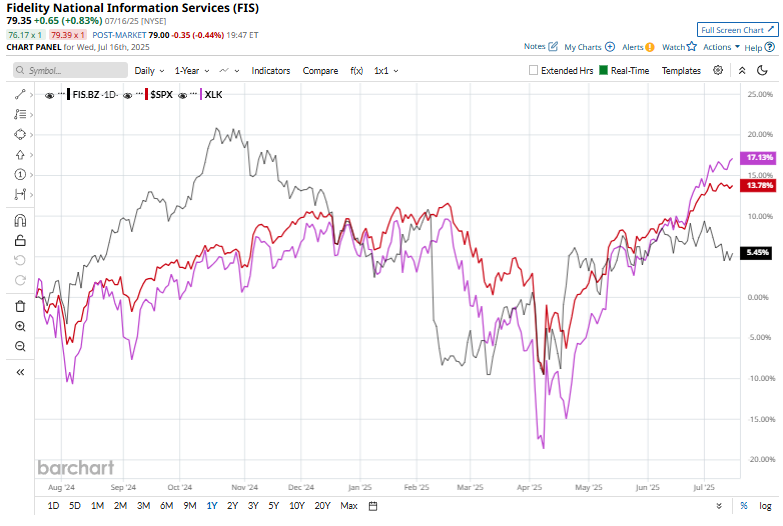

Over the past year, FIS shares have surged 3.2%, underperforming the S&P 500 Index’s ($SPX) 10.5% gains and the Technology Select Sector SPDR Fund’s (XLK) 10.8% rise over the same time frame.

On May 6, FIS shares dropped 3.1% after the company reported its first-quarter earnings. The company posted an adjusted EPS of $1.21, surpassing analyst expectations and marking an 11% year-over-year increase. Revenue rose 4% to $2.5 billion, supported by robust growth across its business segments. Additionally, FIS returned $670 million to shareholders during the quarter, including $450 million through share repurchases and $220 million in dividends.

Moreover, analysts remain moderately bullish about FIS’ stock’s future prospects, with a "Moderate Buy" rating overall. Among 28 analysts covering the stock, 14 recommend a “Strong Buy,” three suggest a “Moderate Buy,” 10 recommend a “Hold,” and one suggests a “Strong Sell.” FIS’ mean price of $88.62 implies a premium of 11.7% from its prevailing price level.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.