/Fidelity%20National%20Information%20Services%2C%20Inc_%20logo%20on%20phone-by%20IgorGolovniov%20via%20Shutterstock.jpg)

Jacksonville, Florida-based Fidelity National Information Services, Inc. (FIS) engages in the provision of financial services technology solutions for financial institutions, businesses, and developers worldwide. With a market cap of $35.4 billion, FIS operates through Banking Solutions, Capital Market Solutions, and Corporate and Other segments.

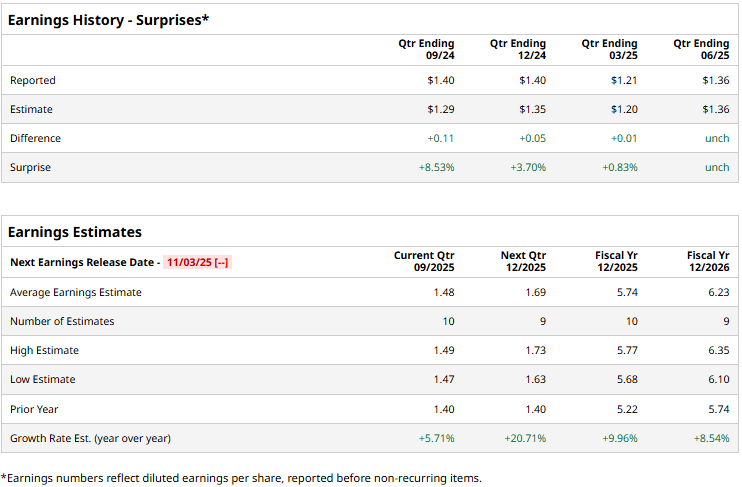

The service provider is expected to announce its third-quarter results by the first week of November. Ahead of the event, analysts expect FIS to deliver an adjusted profit of $1.48 per share, up 5.7% from $1.40 per share reported in the year-ago quarter. Further, the company has met or surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, Fidelity’s adjusted EPS is expected to come in at $5.74, up nearly 10% from $5.22 reported in 2024. While in fiscal 2026, its earnings are expected to grow 8.5% year-over-year to $6.23 per share.

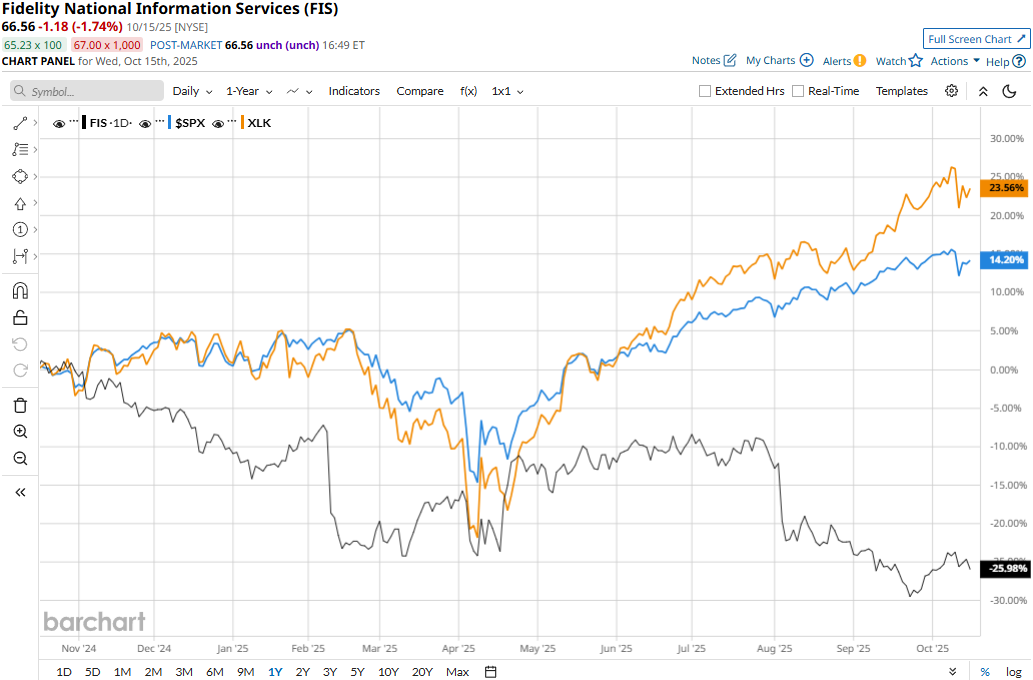

FIS stock prices have plummeted 25.3% over the past 52 weeks, notably underperforming the Technology Select Sector SPDR Fund’s (XLK) 24.3% surge and the S&P 500 Index’s ($SPX) 14.7% returns during the same time frame.

Fidelity National’s stock prices dropped 8.5% in the trading session following the release of its Q2 results on Aug. 5. The company’s banking solutions revenues grew by 5.7%, while its capital market solutions revenues increased by 6%. Overall, FIS reported a topline of $2.6 billion, marking a 5.8% growth compared to the year-ago quarter, beating the Street’s expectations by 1.6%. Meanwhile, its adjusted EPS inched up 1.5% year-over-year to $1.36, matching analyst estimates.

However, investor sentiment got dampened due to the $598 million loss FIS registered during the quarter from its investment in Worldpay Holdco, which wasn’t recorded in the bottom-line calculation under the non-GAAP accounting method.

Analysts maintain an optimistic outlook on FIS; the stock has a consensus “Moderate Buy” rating overall. Of the 25 analysts covering the stock, opinions include 12 “Strong Buys,” three “Moderate Buys,” nine “Holds,” and one “Strong Sell.” Its mean price target of $86.75 suggests a 30.3% upside potential from current price levels.