/Expeditors%20International%20Of%20Washington%2C%20Inc_%20logo%20on%20screen-by%20madamF%20via%20Shutterstock.jpg)

With a market cap of $15.5 billion, Expeditors International of Washington, Inc. (EXPD) is a leading global logistics provider offering air and ocean freight forwarding, customs brokerage, and supply chain solutions. The company serves a wide range of industries across the Americas, Asia, Europe, and the Middle East through its extensive network of subsidiaries.

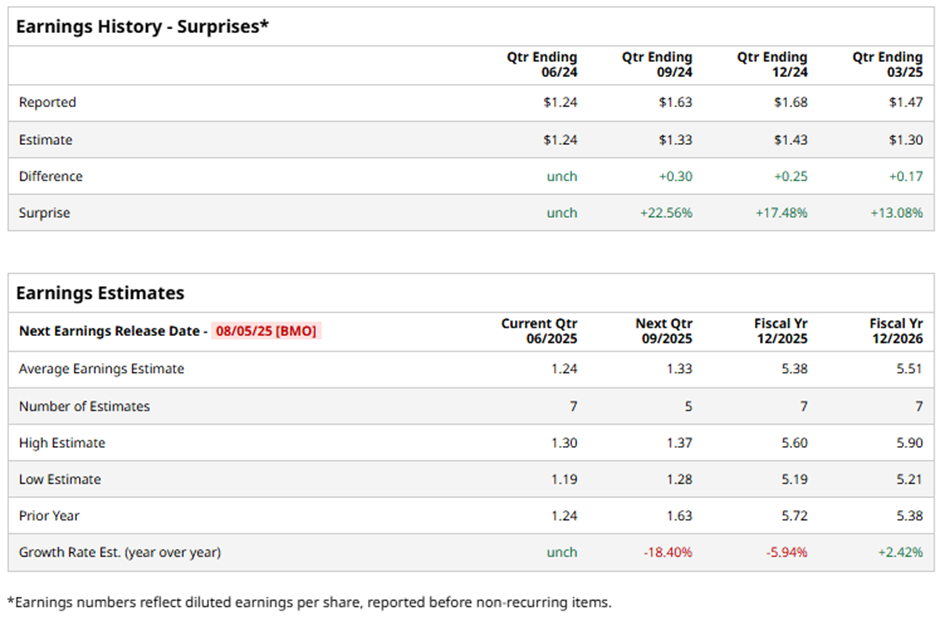

The Bellevue, Washington-based company is expected to release its fiscal Q2 2025 earnings results before the market opens on Tuesday, Aug. 5. Ahead of this event, analysts project Expeditors to report an EPS of $1.24, matching the figure from the year‑ago quarter. The company has exceeded or met Wall Street's bottom-line estimates in the last four quarters. In Q1 2025, EXPD surpassed the consensus EPS estimate by 13.1%.

For fiscal 2025, analysts forecast the logistics services provider to report EPS of $5.38, down nearly 6% from $5.72 in fiscal 2024. However, EPS is expected to grow 2.4% year-over-year to $5.51 in fiscal 2026.

Over the past 52 weeks, EXPD stock has decreased 6.2%, underperforming the broader S&P 500 Index's ($SPX) 12.2% return and the Industrial Select Sector SPDR Fund's (XLI) 19.4% gain over the same period.

Despite reporting better-than-expected Q1 2025 EPS of $1.47 and revenue of $2.7 billion, shares of Expeditors International fell 5% on May 6. The company’s air freight tonnage rose 9% and ocean container volume increased 8%, largely driven by one-time demand spikes as businesses pulled forward shipments ahead of potential tariff hikes. The management warned of ongoing volatility in air capacity and rates, and noted the industry is facing unprecedented regulatory unpredictability.

Analysts' consensus view on Expeditors' stock is moderately bearish, with an overall "Moderate Sell" rating. Among 15 analysts covering the stock, eight suggest a "Hold," one gives a "Moderate Sell," and six provide a "Strong Sell" rating. As of writing, the stock is trading above the average analyst price target of $109.71.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.