Valued at a market cap of $18.1 billion, Evergy, Inc. (EVRG) generates, transmits, distributes, and sells electricity to residences, commercial firms, industrials, municipalities, and other electric utilities. The Kansas City, Missouri-based company generates electricity through coal, landfill gas, uranium, natural gas, as well as solar, wind, and other renewable energy sources. It is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Nov. 6.

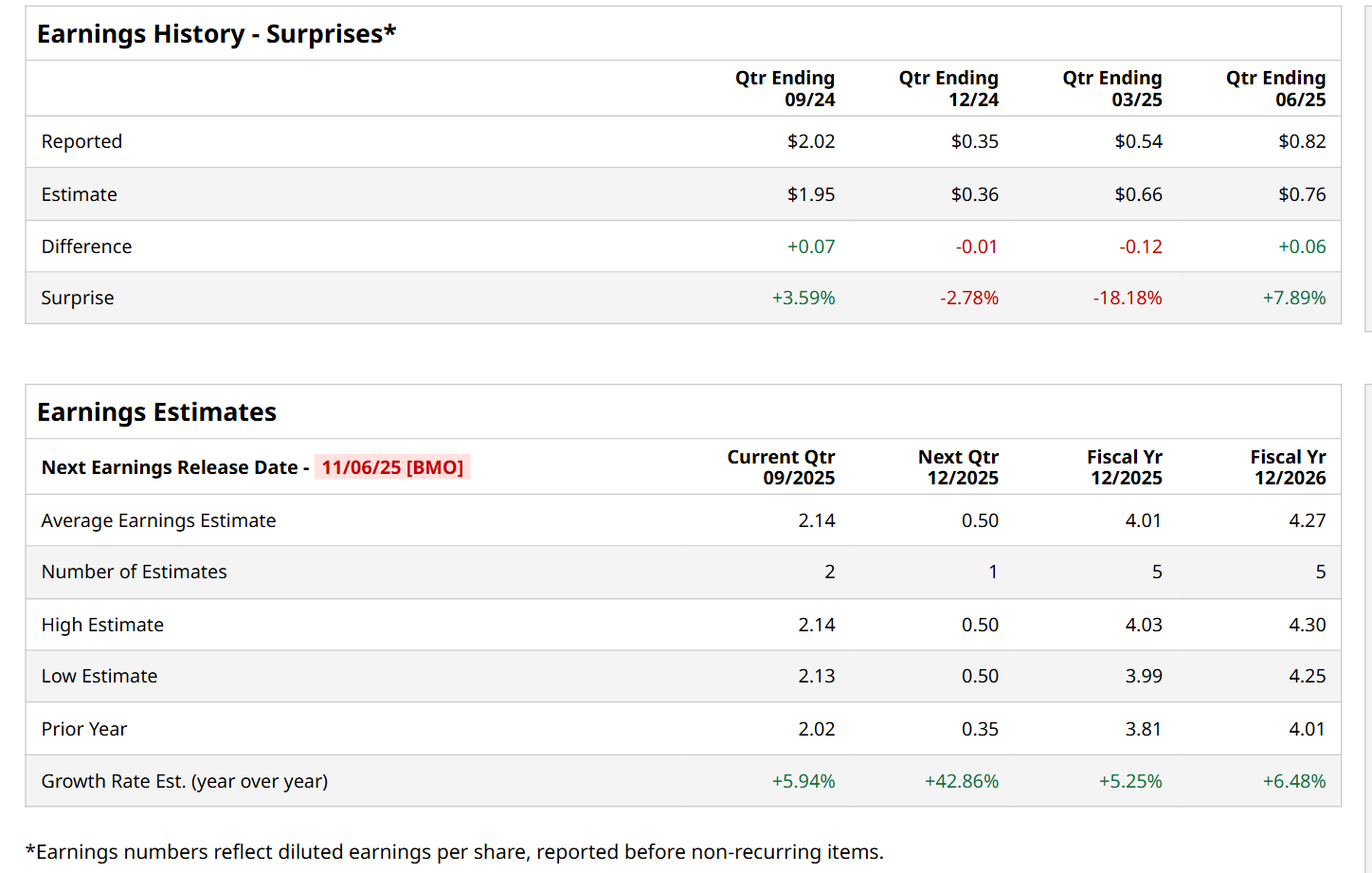

Before this event, analysts expect this utility company to report a profit of $2.14 per share, up 5.9% from $2.02 per share in the year-ago quarter. The company has exceeded Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions. Its earnings of $0.82 per share in the previous quarter topped the consensus estimates by a notable margin of 7.9%.

For fiscal 2025, analysts expect Evergy to report a profit of $4.01 per share, representing a 5.3% increase from $3.81 per share in fiscal 2024. Furthermore, its EPS is expected to grow 6.5% year-over-year to $4.27 in fiscal 2026.

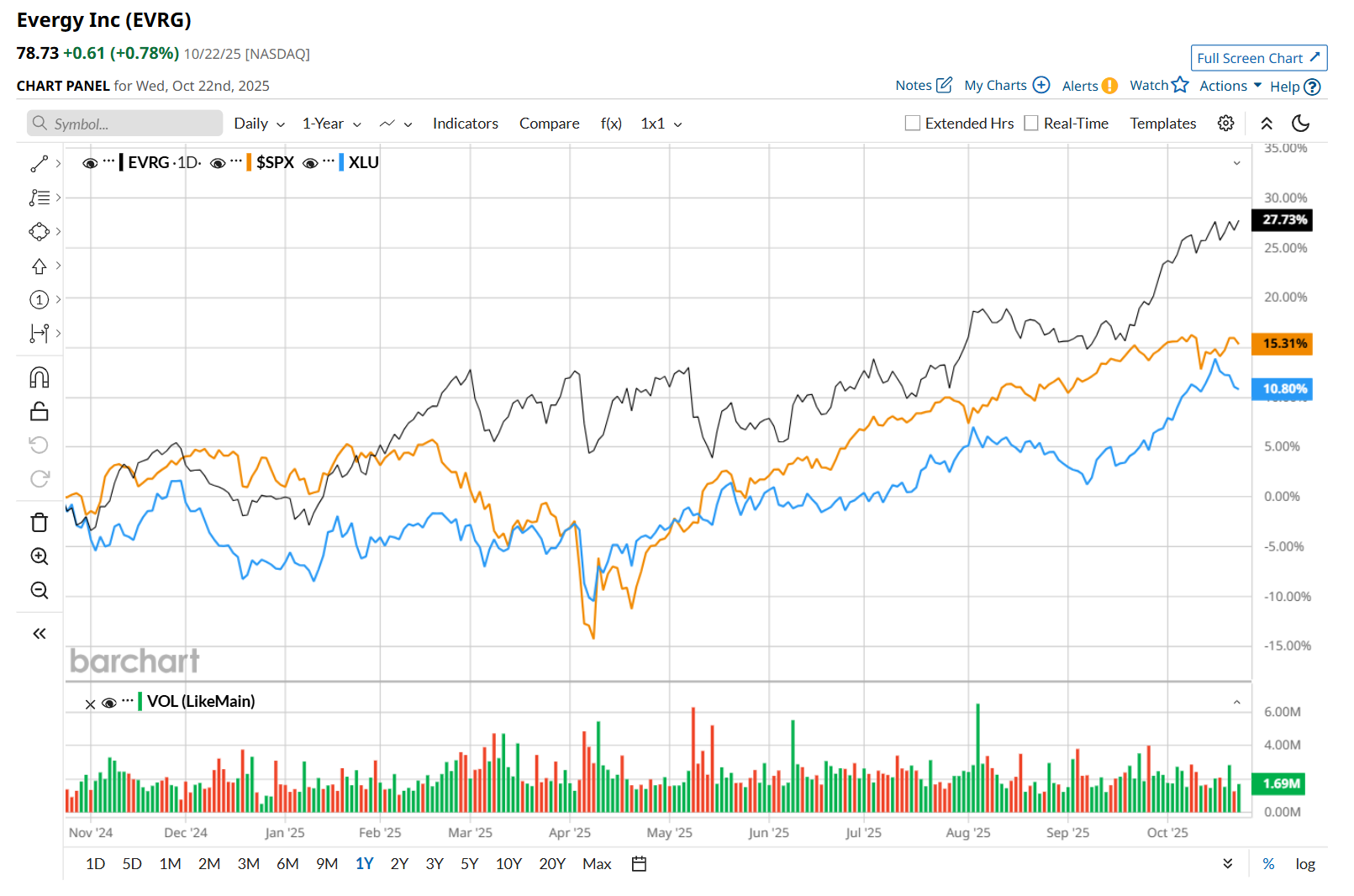

Shares of Evergy have rallied 28% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 14.5% return and the Utilities Select Sector SPDR Fund’s (XLU) 11.1% rise over the same time frame.

Evergy’s shares declined marginally on Aug. 7, after delivering its Q2 results. While the company’s adjusted EPS of $0.82 declined 8.9% from the year-ago quarter, it came in 7.9% ahead of analyst estimates. Its bottom line was negatively impacted by milder weather, an increase in operations and maintenance expenses, and higher interest and depreciation.

Wall Street analysts are highly optimistic about EVRG’s stock, with an overall "Strong Buy" rating. Among 12 analysts covering the stock, nine recommend "Strong Buy," and three suggest "Hold.” The mean price target for Evergy is $78.88, implying a slight potential upside from the current price levels.