/Elevance%20Health%20Inc%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Elevance Health, Inc. (ELV) is a leading healthcare company with a market cap of $71.7 billion. Headquartered in Indianapolis, it serves approximately 46.8 million members through its health plans and services, including medical, dental, vision, pharmacy benefits, and clinical care solutions via its Carelon units.

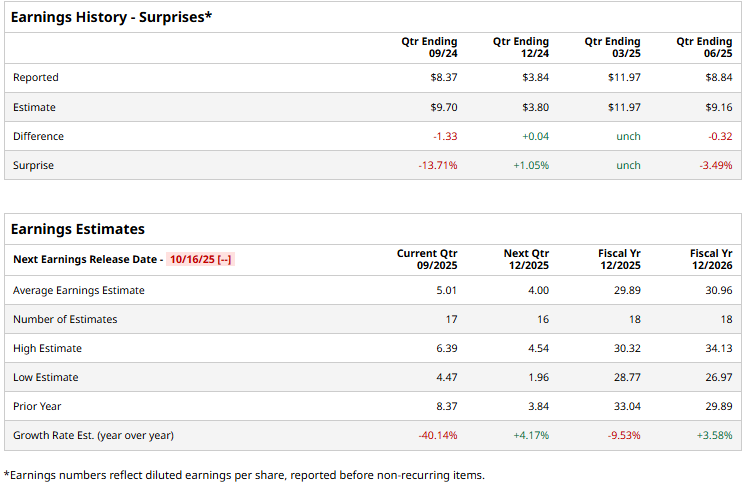

The company is expected to announce its fiscal Q3 earnings for 2025 on Thursday, Oct. 16. Analysts project this health care company to report a profit of $5.01 per share, down 40.1% from $8.37 per share in the year-ago quarter. The company has met or surpassed Wall Street’s bottom-line estimates in two of the last four quarters, while missing on two other occasions.

For the current year, analysts expect ELV to report EPS of $29.89, down 9.5% from $33.04 in fiscal 2024. However, its EPS is expected to rebound in FY2026, rising 3.6% year over year to $30.96.

Shares of Elevance Health have declined 38.8% over the past 52 weeks, considerably lagging behind both the S&P 500 Index's ($SPX) 15.6% uptick and the Health Care Select Sector SPDR Fund’s (XLV) 11.5% loss over the same time frame.

On Sept. 25, shares of Elevance Health dropped 3% after the U.S. Commerce Department launched a national security investigation into medical equipment imports, including syringes, infusion pumps, and surgical instruments. Conducted under Section 232 of the Trade Expansion Act, the probe raises the possibility of new tariffs aimed at boosting domestic manufacturing, introducing uncertainty for the healthcare sector.

Wall Street analysts are fairly optimistic about ELV’s stock, with an overall “Moderate Buy" rating. Among 21 analysts covering the stock, 13 recommend "Strong Buy," one suggests a “Moderate Buy,” six indicate “Hold,” and one advises a “Strong Sell.” The mean price target for ELV is $359.06, indicating a 12.7% potential upside from current levels.