/Dover%20Corp_%20logo%20and%20data-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

Valued at $22.8 billion by market cap, Dover Corporation (DOV) operates as an industrial conglomerate producing a wide range of specialized industrial products and manufacturing equipment. The Downers Grove, Illinois-based company operates through Engineered Products, Clean Energy & Fueling, Imaging & Identification, Pumps & Process Solutions, and Climate & Sustainability Technologies segments.

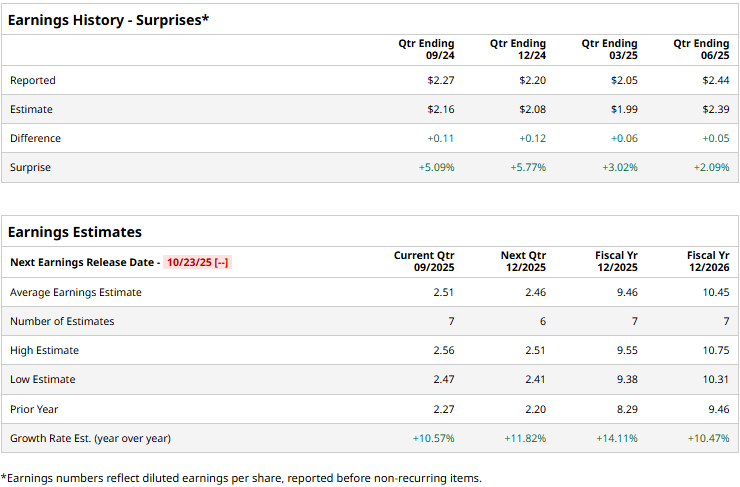

The industrial sector giant is expected to announce its third-quarter results before the market opens on Thursday, Oct. 23. Ahead of the event, analysts expect Dover to deliver a profit of $2.51 per share, up 10.6% from $2.27 per share reported in the year-ago quarter. The company has a solid earnings surprise history overall. DOV has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, Dover is expected to report an adjusted EPS of $9.46, up 14.1% from $8.29 in 2024. In fiscal 2026, DOV’s earnings are expected to grow 10.5% year-over-year to $10.45 per share.

DOV stock prices have declined 12.1% over the past 52 weeks, notably underperforming the S&P 500 Index’s ($SPX) 17.8% surge and the Industrial Select Sector SPDR Fund’s (XLI) 14.7% gains during the same time frame.

Dover’s stock prices dipped 2.2% in the trading session following the release of its Q2 results on Jul. 24. The company reported a solid 5.2% year-over-year growth in revenues to $2.05 billion, surpassing the consensus estimates by 57 bps. Further, its adjusted EPS surged 16.2% year-over-year to $2.44, exceeding Street expectations by 2.1%.

However, the company has observed a 1.1% contraction in adjusted EBITDA margin from 25.1% in Q1 to 24% in Q2. This was primarily influenced by higher SG&A expenses. Of the five operating segments, Dover observed an EBITDA contraction in three of them. Moreover, this contraction occurred despite a gross margin expansion, highlighting the company’s inefficiency in managing expenses.

Nonetheless, analysts remain optimistic about the stock’s prospects. DOV maintains a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include 10 “Strong Buy” and seven “Holds.” Its mean price target of $214.88 suggests a 29% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.