DoorDash, Inc. (DASH), headquartered in San Francisco, California, operates a commerce platform that connects merchants, consumers, and independent contractors. Valued at $113.6 billion by market cap, the company develops technology to connect customers with merchants through an on-demand food delivery application. The food delivery giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Wednesday, Nov. 5.

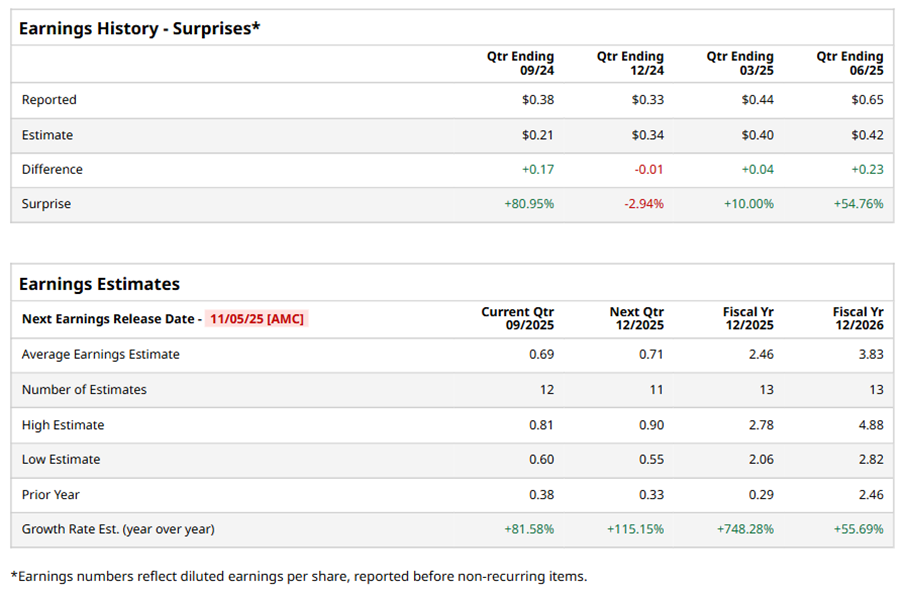

Ahead of the event, analysts expect DASH to report a profit of $0.69 per share on a diluted basis, up 81.6% from $0.38 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect DASH to report EPS of $2.46, up 748.3% from $0.29 in fiscal 2024. Its EPS is expected to rise 55.7% year over year to $3.83 in fiscal 2026.

DASH stock has considerably outperformed the S&P 500 Index’s ($SPX) 13.4% gains over the past 52 weeks, with shares up 84.1% during this period. Similarly, it significantly outperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 15.9% gains over the same time frame.

DASH's outperformance is driven by its new partnership with Criteo to boost advertising opportunities, strong demand in food and grocery delivery, and growing customer engagement. The company's order volume and frequency have increased, with notable strength in the U.S. marketplace and rapid international growth. Its advertising business has exceeded $1 billion in annualized revenue, further expanded by the acquisition of Symbiosys.

On Aug. 7, DASH reported its Q2 results, and its shares surged 5% in the following trading session. Its adjusted EPS of $0.65 beat the consensus estimate by 54.8%. The company’s revenues were $3.3 billion, beating the consensus mark by 3.8%.

Analysts’ consensus opinion on DASH stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 38 analysts covering the stock, 24 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and 12 give a “Hold.” DASH’s average analyst price target is $299.06, indicating a potential upside of 12.4% from the current levels.