Richmond, Virginia-based Dominion Energy, Inc. (D) provides regulated electricity and natural gas services. Valued at a market cap of $51.8 billion, the company focuses on enhancing reliability, safety, and sustainability while supporting the transition to low-carbon and renewable energy sources, including solar, wind, and battery storage projects. It is expected to announce its fiscal Q3 earnings for 2025 before the market opens on Friday, Oct. 31.

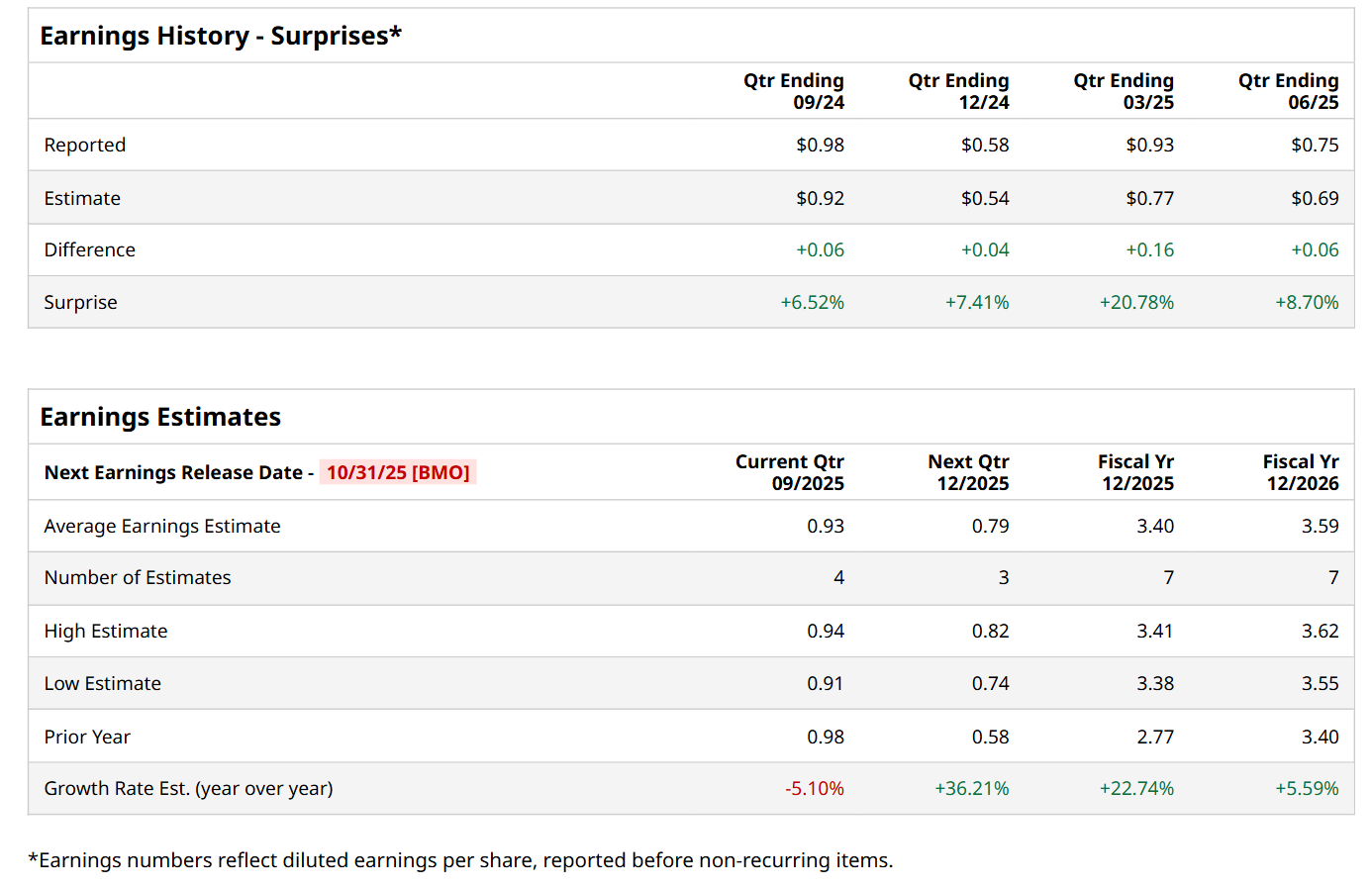

Before this event, analysts expect this utility company to report a profit of $0.93 per share, down 5.1% from $0.98 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $0.75 per share in the previous quarter topped the consensus estimates by a notable margin of 8.7%.

For fiscal 2025, analysts expect D to report a profit of $3.40 per share, representing a 22.7% increase from $2.77 per share in fiscal 2024. Moreover, its EPS is expected to grow 5.6% year-over-year to $3.59 in fiscal 2026.

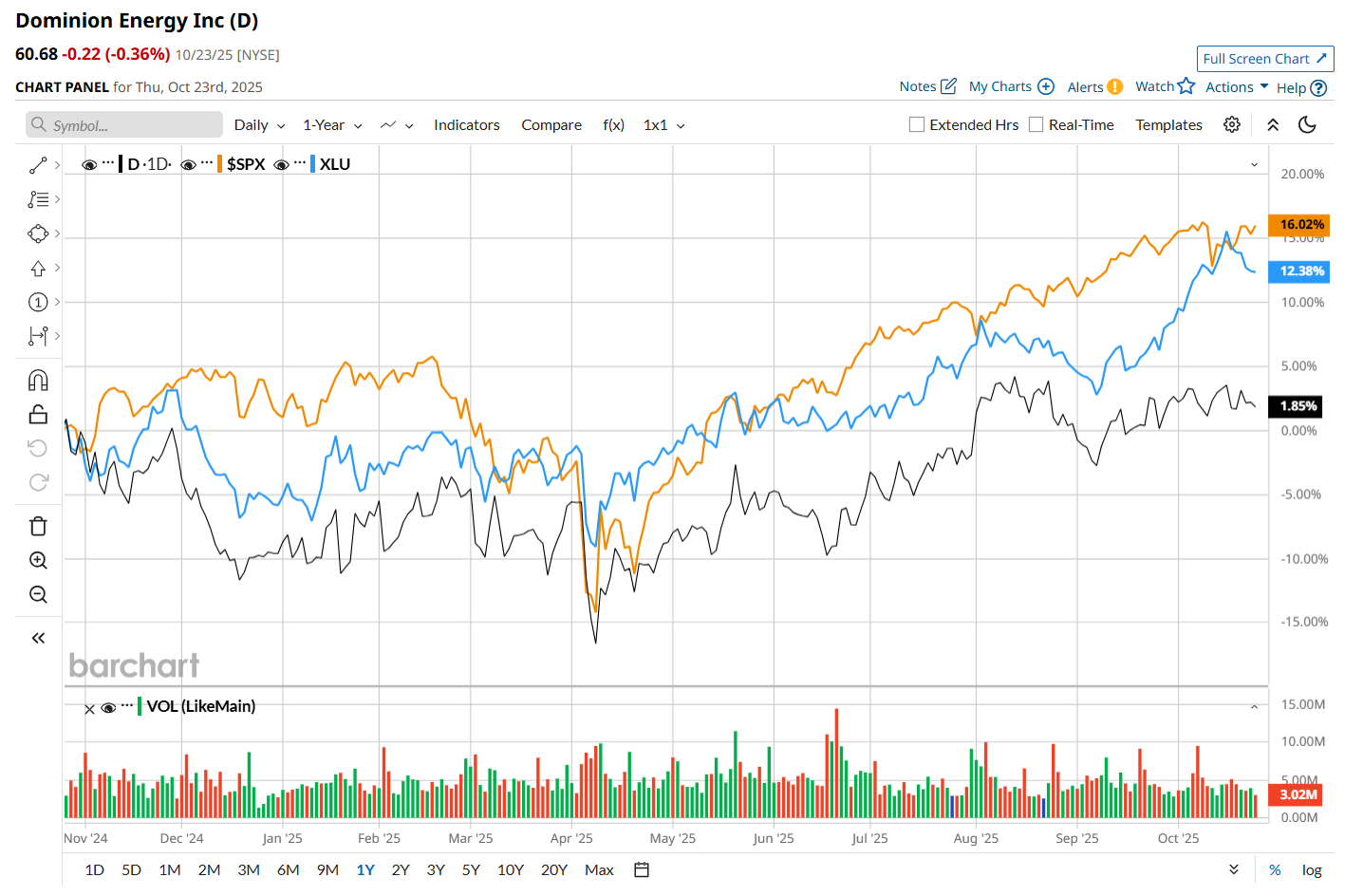

Shares of D have declined marginally over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.2% return and the Utilities Select Sector SPDR Fund’s (XLU) 11.6% uptick over the same time frame.

On Aug. 1, shares of D soared 3.4% after reporting its Q2 results. The company’s total operating revenue increased 9.3% year-over-year to $3.8 billion, while its operating earnings of $0.75 per share grew 15.4% from the year-ago quarter, surpassing consensus estimates by a notable margin of 8.7%.

Wall Street analysts are cautious about D’s stock, with an overall "Hold" rating. Among 19 analysts covering the stock, two recommend "Strong Buy," 16 suggest "Hold,” and one advises a “Strong Sell” rating. The mean price target for D is $63.25, implying a 4.2% potential upside from the current levels.