With a market cap of $23.7 billion, Dollar General Corporation (DG) is a leading discount retailer in the United States, offering a wide range of low-priced merchandise across consumables, seasonal items, home products, and apparel. Headquartered in Goodlettsville, Tennessee, the company serves customers primarily in the southern, southwestern, midwestern, and eastern regions of the U.S.

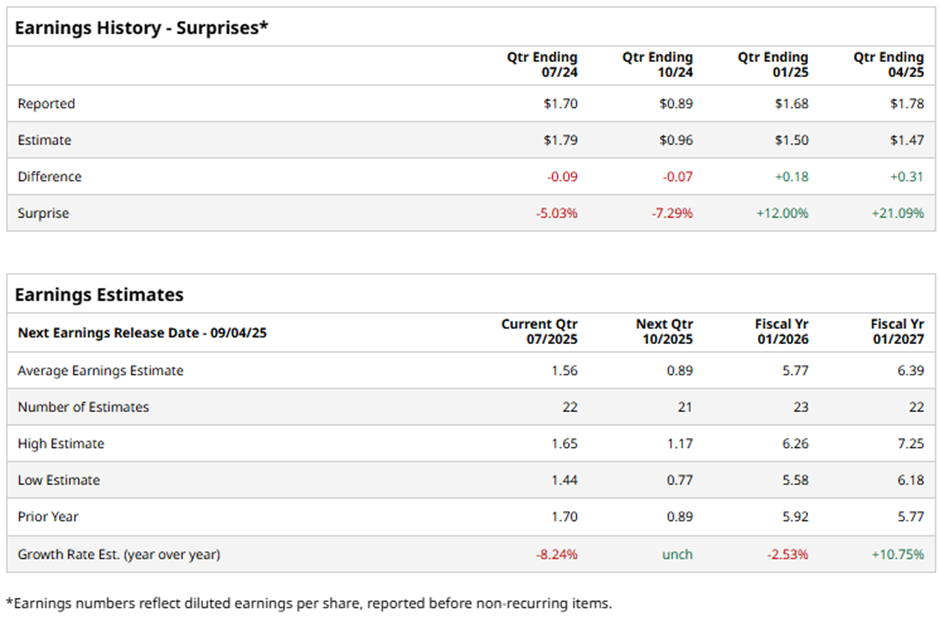

Dollar General is expected to release its fiscal Q2 2025 earnings results on Thursday, Sept. 4. Ahead of this event, analysts forecast the company to report an EPS of $1.56, a decrease of 8.2% from $1.70 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2025, analysts expect Dollar General to report an EPS of $5.77, down 2.5% from $5.92 in fiscal 2024. However, EPS is projected to rebound, growing 10.8% year-over-year to $6.39 in fiscal 2026.

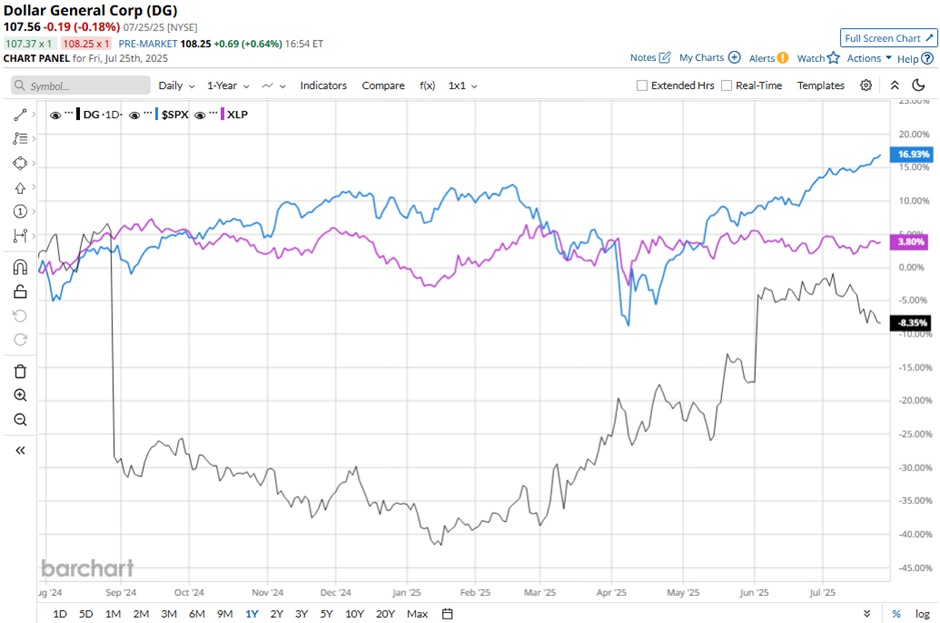

Shares of Dollar General have dropped 9.1% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 18.3% gain and the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.7% rise over the same period.

Shares of Dollar General climbed 15.9% on Jun. 3 after a strong fiscal Q1 2025 performance, with EPS rising 7.9% to $1.78 and net sales increasing 5.3% to $10.4 billion, the consensus estimates. The company raised its full-year guidance, expecting same-store sales growth of 1.5% - 2.5% and increased the low end of its EPS outlook to $5.20. Additionally, Dollar General attracted more middle- and higher-income consumers, expanded essential offerings, and reduced China-import exposure of private-label goods to 70%, all helping it outperform competitors in a challenging retail landscape.

Analysts' consensus view on Dollar General’s stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 28 analysts covering the stock, 10 recommend "Strong Buy," one suggests "Moderate Buy," and 17 advise "Hold." As of writing, the stock is trading below the average analyst price target of $116.64.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.