Goodlettsville, Tennessee-based Dollar General Corporation (DG) operates as a discount retailer providing various merchandise products, including consumable products, laundry products, food & beverage, and more. With a market cap of approximately $22.5 billion, Dollar General operates thousands of retail stores across the U.S.

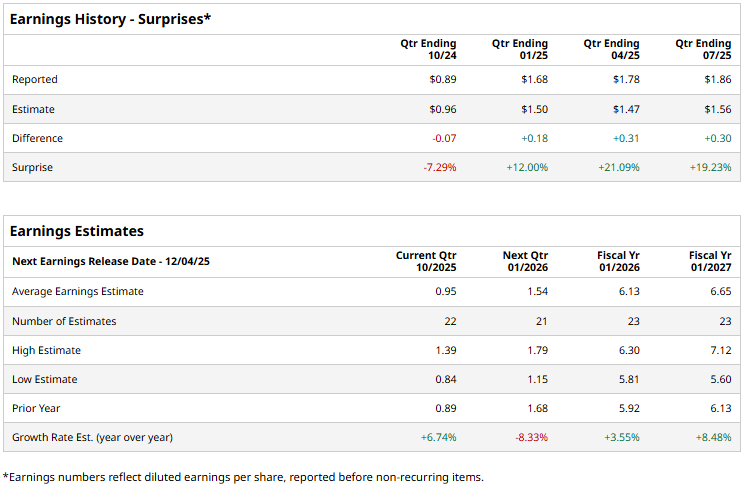

The retail giant is expected to announce its third-quarter results in early December. Ahead of the event, analysts expect DG to report a profit of $0.95 per share, up 6.7% from $0.89 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates thrice over the past four quarters while missing on one other occasion.

For the full fiscal 2026, analysts expect Dollar General to report an EPS of $6.13, up 3.6% from $5.92 in fiscal 2025. While in fiscal 2027, its earnings are expected to grow 8.5% year-over-year, reaching $6.65 per share.

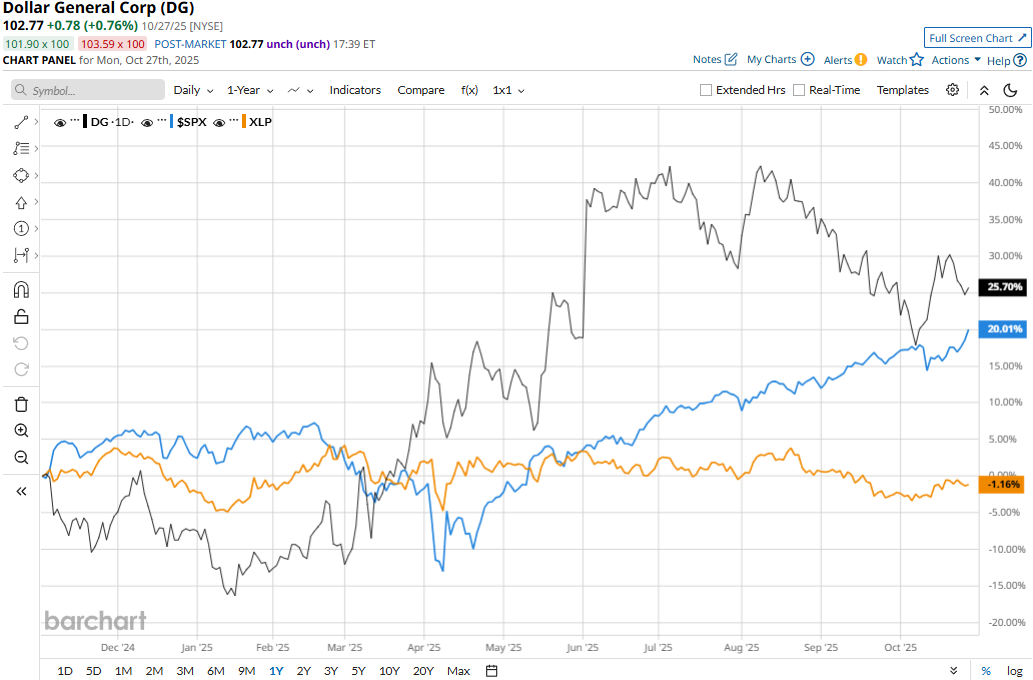

DG stock prices have soared 27.9% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 18.4% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% decline during the same time frame.

Dollar General’s stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q2 results on Aug. 28. The improved execution, along with progress in advancing its key initiative, has resonated with its existing as well as new customers, leading to a 2.8% growth in same-store sales. Meanwhile, the company’s overall net sales for the quarter jumped 5.1% year-over-year to $10.7 billion, exceeding the Street expectations by 47 bps. Moreover, driven by margin expansion, Dollar General’s EPS grew by a robust 9.4% year-over-year to $1.86, surpassing the consensus estimates by a staggering 19.2%.

Analysts remain optimistic about the stock’s prospects. DG has a consensus “Moderate Buy” rating overall. Of the 30 analysts covering the stock, opinions include 12 “Strong Buys,” one “Moderate Buy,” and 17 “Holds.” Its mean price target of $120.86 suggests a 17.6% upside potential from current price levels.

.png?w=600)