/Deere%20%26%20Co_%20logo%20on%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $127.8 billion, Deere & Company (DE) manufactures agricultural, construction, forestry machinery, diesel engines, and drivetrains used in heavy equipment, and lawn care equipment. The Moline, Illinois-based company also offers financial services through John Deere Financial, which provides financing for equipment purchases and leases. It is scheduled to announce its fiscal Q4 earnings for 2025 in the near future.

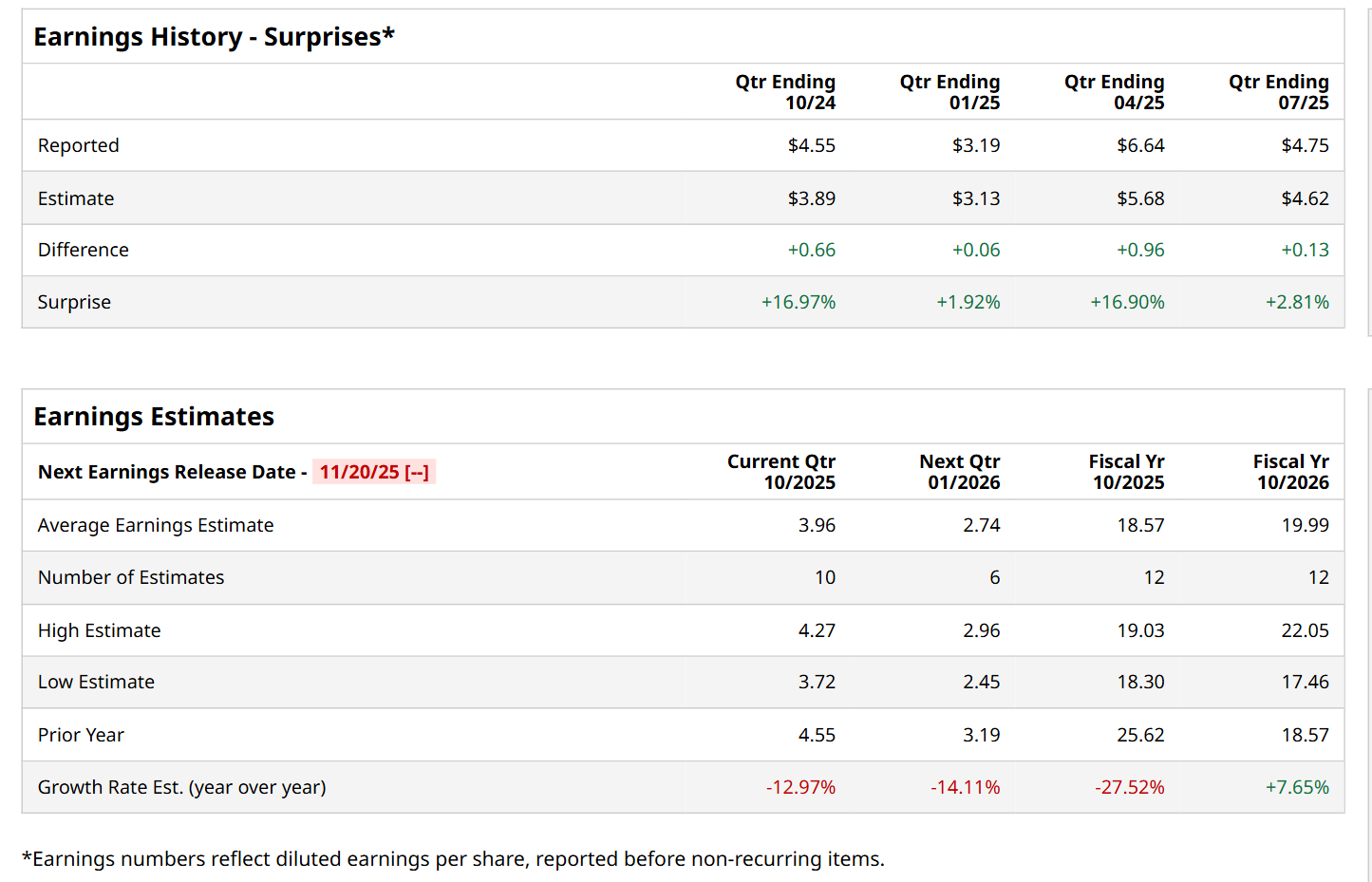

Ahead of this event, analysts expect this farm & heavy construction machinery giant to report a profit of $3.96 per share, down 13% from $4.55 per share in the year-ago quarter. The company has a promising trajectory of consistently beating Wall Street’s earnings estimates in each of the last four quarters. In Q3, DE’s EPS of $4.75 outpaced the forecasted figure by 2.8%.

For fiscal 2025, analysts expect DE to report a profit of $18.57 per share, down 27.5% from $25.62 per share in fiscal 2024. Nonetheless, its EPS is expected to rebound and grow by 7.7% year-over-year to $19.99 in fiscal 2026.

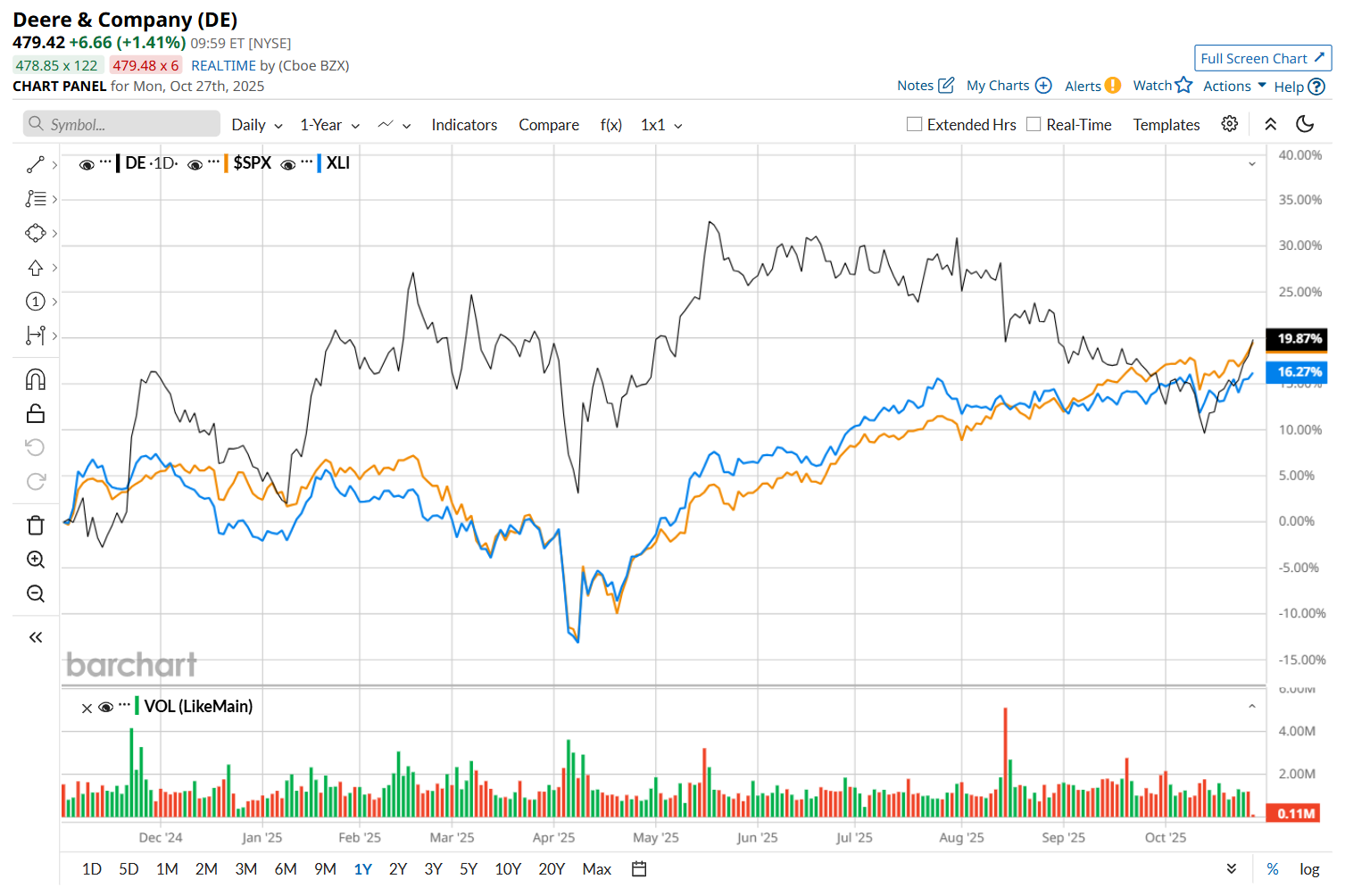

DE has soared 17.6% over the past 52 weeks, outpacing both the S&P 500 Index's ($SPX) 16.9% return and the Industrial Select Sector SPDR Fund’s (XLI) 15% uptick over the same time period.

Despite posting better-than-expected Q3 total revenue of $12 billion and EPS of $4.75, shares of DE plunged 6.8% on Aug. 14. The downtick came as the company’s net sales fell across all major segments, led by a sharp 16.2% drop in the Production & Precision Agriculture division. Overall, its revenue was down 8.6% year-over-year, while net income per share declined 24.5% from the same period last year.

DE also narrowed its fiscal 2025 net income guidance, citing a challenging operating environment. High interest rates and trade uncertainties have weakened demand in key markets, especially in North America, further dampening investor sentiment.

Wall Street analysts are moderately optimistic about DE’s stock, with an overall "Moderate Buy" rating. Among 23 analysts covering the stock, 11 recommend "Strong Buy," two indicate "Moderate Buy,” nine suggest "Hold,” and one advises a "Strong Sell” rating. The mean price target for DE is $523.52, indicating a 10.7% potential upside from the current levels.