With a market cap of $32 billion, CoStar Group, Inc. (CSGP) is a leading provider of information, analytics, and online marketplace services for the global commercial real estate industry. The company offers a comprehensive suite of digital platforms and data solutions that support property sales, leasing, marketing, valuation, and investment decisions across multiple sectors and regions.

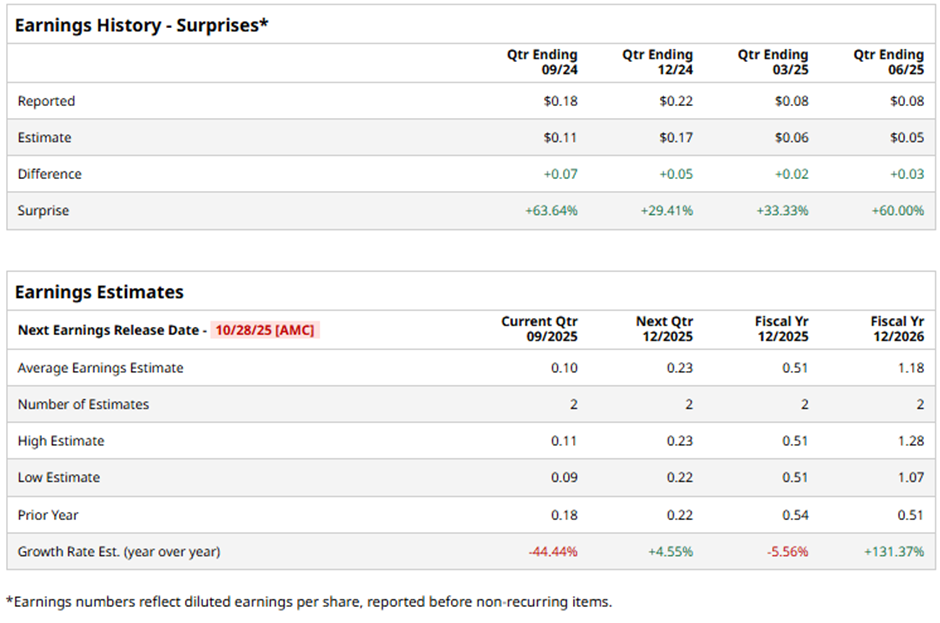

The Arlington, Virginia-based company is set to release its fiscal Q3 2025 results after the market closes on Tuesday, Oct. 28. Ahead of this event, analysts project CoStar Group to report an EPS of $0.10, a 44.4% drop from $0.18 in the year-ago quarter. However, it holds a solid track record of consistently surpassing Wall Street's bottom-line estimates in the last four quarterly reports.

For fiscal 2025, analysts forecast the real estate information provider to report EPS of $0.51, down 5.6% from $0.54 in fiscal 2024. Nevertheless, EPS is anticipated to surge 131.4% year-over-year to $1.18 in fiscal 2026.

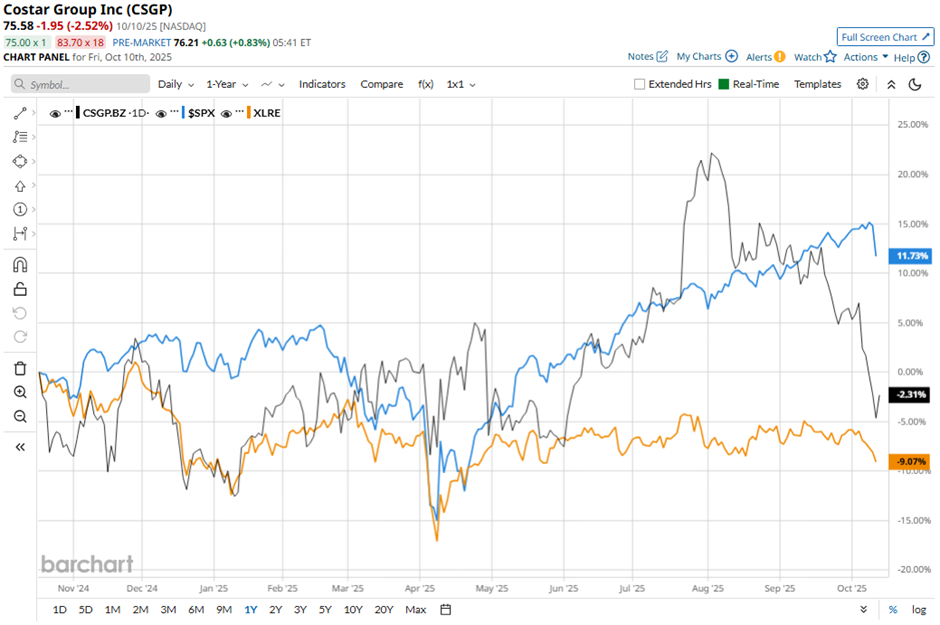

CSGP stock has risen 1% over the past 52 weeks, lagging behind the broader S&P 500 Index's ($SPX) 13.4% increase. However, the stock has outperformed the Real Estate Select Sector SPDR Fund's (XLRE) 5.4% decrease over the same time frame.

Shares of CoStar Group climbed 6.9% following its Q2 2025 results on Jul. 22 after the company reported adjusted EPS of $0.17, surpassing analyst expectations. Revenue also beat estimates, reaching $781.3 million, driven by a 65% jump in net new bookings, including Apartments.com’s strongest quarter in two years and a 56% sequential increase for Homes.com. Additionally, CoStar raised its full-year revenue forecast to $3.14 billion - $3.16 billion.

Analysts' consensus view on CSGP stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 17 analysts covering the stock, nine suggest a "Strong Buy," two give a "Moderate Buy," five recommend a "Hold," and one has a "Strong Sell." The average analyst price target for CoStar Group is $97, indicating a potential upside of 28.3% from the current levels.