/Corning%2C%20Inc_%20logo%20and%20website-by%20T_Schneoder%20via%20Shutterstock.jpg)

New York-based Corning Incorporated (GLW) is a top materials science and specialty glass manufacturer known for its cutting-edge innovations across various industries. The company boasts a market capitalization of $74.2 billion, reflecting its prominent position across multiple industries. Corning is all set to release its third-quarter earnings before the market opens on Tuesday, Oct. 28.

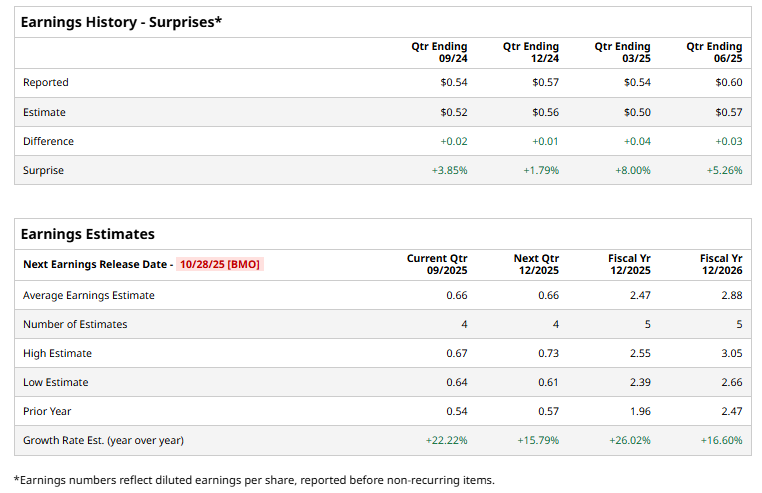

Ahead of the event, analysts expect Corning to report a non-GAAP profit of $0.66 per share, up 22.2% from $0.54 per share reported in the year-ago quarter. It boasts a strong track record of earnings performance, having exceeded analysts’ bottom-line expectations in each of the last four quarters.

Analysts expect Corning to deliver an adjusted EPS of $2.47 in the current year, up 26% from $1.96 in fiscal 2024. Looking ahead to FY2026, its adjusted EPS is projected to improve 16.6% annually to $2.88

GLW stock has soared a whopping 88.5% over the past 52 weeks, outperforming the S&P 500 Index’s ($SPX) 13.5% surge and the Technology Services Select Sector SPDR ETF Fund’s (XLK) 24% rise during the same time frame.

Corning has been outperforming the broader market thanks to robust growth across its key businesses and strong execution of its strategic “Springboard” plan. Additionally, demand for its optical communications products has surged amid accelerating investments in generative AI, data centers, and network infrastructure.

On Oct. 8, GLW shares jumped 2.4% after the company declared a quarterly dividend of $0.28 per share payable on December 12, 2025. The dividend declaration reinforced investor confidence in Corning’s strong cash flow generation and solid balance sheet, signaling management’s commitment to returning value to shareholders.

The consensus opinion on GLW stock is highly bullish, with an overall “Strong Buy” rating. Out of the 13 analysts covering the stock, 11 recommend “Strong Buy,” and two advise a “Hold” rating. It currently trades above its mean price target of $78.38.