/Cooper%20Companies%2C%20Inc_%20phone%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

San Ramon, California-based The Cooper Companies, Inc. (COO) is a specialty medical device company. It operates through CooperVision and CooperSurgical segments. CooperVision manufactures and sells a wide range of contact lenses, and CooperSurgical sells a variety of medical devices and surgical instruments. With a market cap of $14.6 billion, Cooper’s operations span the Americas, Indo-Pacific, Europe, and internationally.

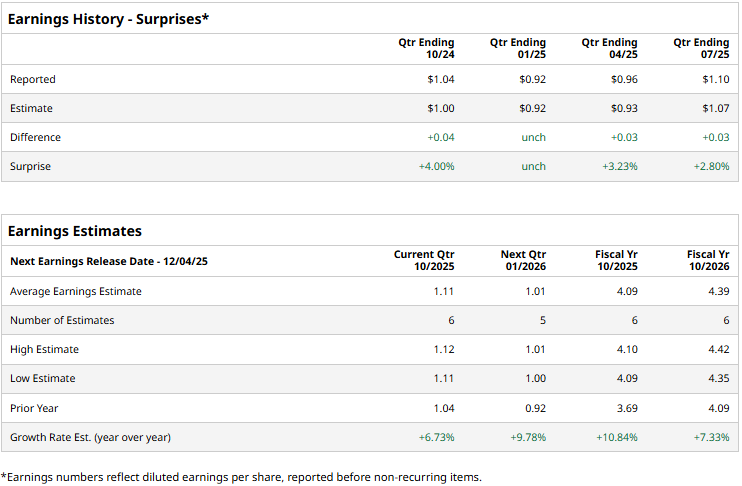

The healthcare major is expected to announce its fourth-quarter results by early December. Ahead of the event, analysts expect the COO to deliver an adjusted profit of $1.11 per share, up 6.7% from $1.04 per share reported in the year-ago quarter. The company has a solid earnings surprise history. It has met or surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, Cooper’s adjusted EPS is expected to come in at $4.09, up a notable 10.8% from $3.69 reported in 2024. While in fiscal 2026, its earnings are expected to grow 7.3% year-over-year to $4.39 per share.

COO stock prices have plummeted 32.4% over the past 52 weeks, notably underperforming the Health Care Select Sector SPDR Fund’s (XLV) 1.5% decline and the S&P 500 Index’s ($SPX) 18.4% gains during the same time frame.

Cooper Companies’ stock prices tanked 12.9% in a trading session following the release of its mixed Q3 results on Aug. 27. The company’s organic revenues grew by 2% compared to the year-ago quarter, which missed the Street’s expectations. Further, its overall sales came in at $1.1 billion, up 5.7% year-over-year and falling 50 bps short of expectations. Moreover, the company expects its Q4 results to remain soft, which unsettled investor confidence and led to the sell-off.

On the positive note, Cooper’s adjusted EPS increased 14.6% year-over-year to $1.10, surpassing the consensus estimates by 2.8%.

Analysts remain optimistic about the stock’s long-term prospects. COO has a consensus “Moderate Buy” rating overall. Of the 17 analysts covering the stock, opinions include 10 “Strong Buys,” one “Moderate Buy,” five “Holds,” and one “Strong Sell.” Its mean price target of $81.88 suggests a 12.4% upside potential from current price levels.