With a market cap of $23.4 billion, Constellation Brands, Inc. (STZ) is a leading producer and marketer of beer, wine, and spirits with operations across the United States, Mexico, Canada, Italy, and New Zealand. With a strong portfolio of high-quality brands like Corona, Modelo, Robert Mondavi, Kim Crawford, and SVEDKA, the company serves wholesale distributors, retailers, and on-premise outlets worldwide.

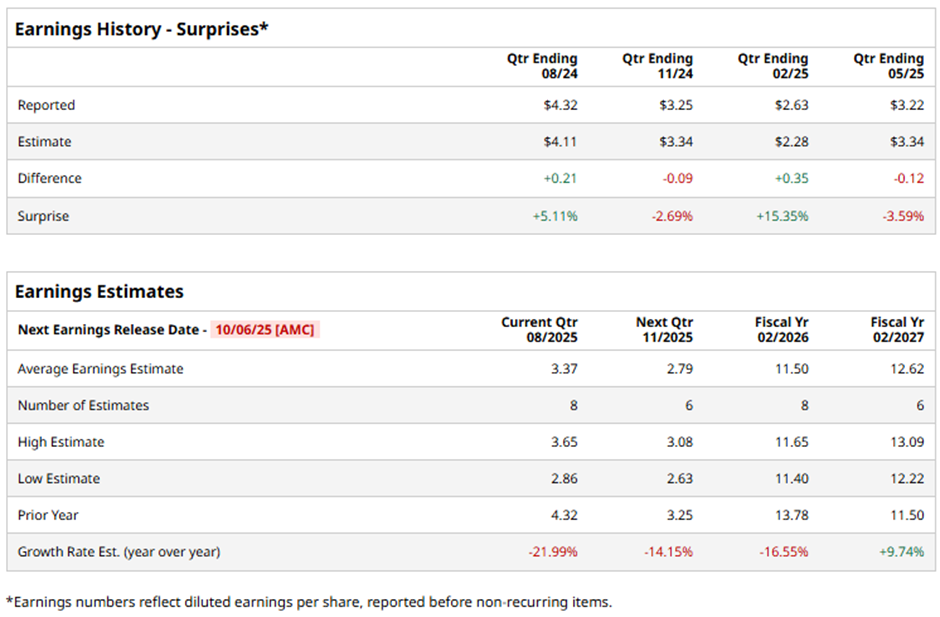

The Rochester, New York-based company is expected to announce its fiscal Q2 2026 results after the market closes on Monday, Oct. 6. Ahead of this event, analysts expect Constellation Brands to report an adjusted EPS of $3.37, down nearly 22% from $4.32 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in two of the last four quarters while missing on two other occasions.

For fiscal 2026, analysts expect the wine, liquor, and beer company to report an adjusted EPS of $11.50, down 16.6% from $13.78 in fiscal 2025. However, adjusted EPS is projected to rebound, growing 9.7% year-over-year to $12.62 in fiscal 2027.

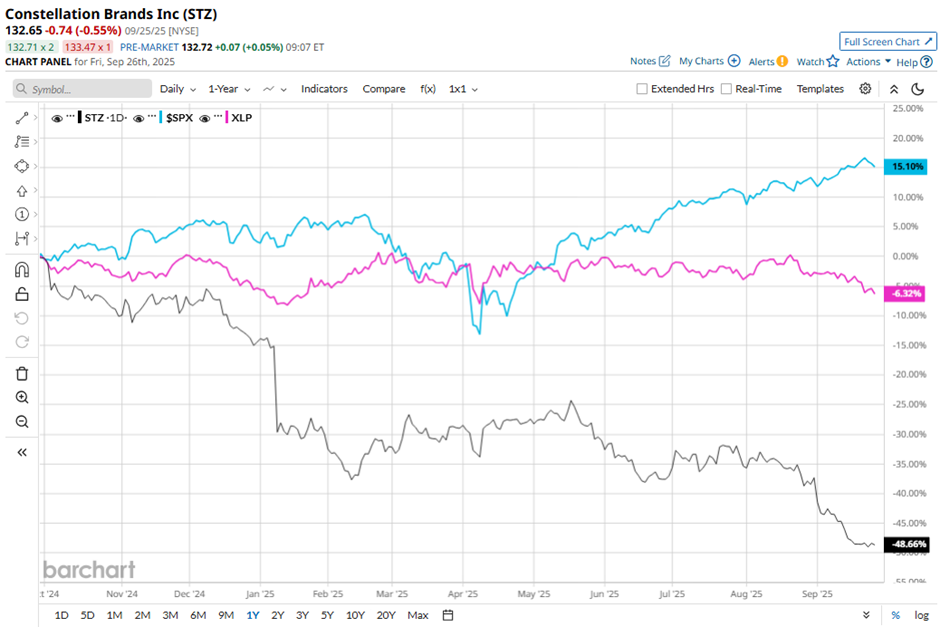

Shares of Constellation Brands have dropped nearly 48% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 15.4% rise and the Consumer Staples Select Sector SPDR Fund’s (XLP) 6.1% dip over the same period.

Despite missing expectations with Q1 2026 adjusted EPS of $3.22 and adjusted revenue of $2.52 billion on Jul. 1, Constellation Brands’ stock rose 4.5% the next day because investors focused on its resilient beer segment. Beer, the company’s largest category, posted only a modest 2% sales decline to $2.2 billion, compared to a steep 28% drop in wine and spirits to $281 million, signaling that its core growth engine remains intact. Moreover, management’s guidance for flat to 3% beer sales growth in fiscal 2026 reassured markets.

Analysts' consensus view on STZ stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 23 analysts covering the stock, nine recommend "Strong Buy," three "Moderate Buys," eight suggest "Hold," one advises "Moderate Sell," and two "Strong Sells." The average analyst price target for Constellation Brands is $178.77, indicating a potential upside of 34.8% from the current levels.