/Citigroup%20Inc%20ATMs-by%20TennesseePhotographer%20via%20iStock.jpg)

Valued at a market cap of $187.1 billion, Citigroup Inc. (C) operates as one of the largest financial institutions in the world. The New York-based financial giant focuses on safeguarding assets, lending money, making payments, and accessing the capital markets on behalf of its clients. Its customers include corporations, governments, institutions, and individuals.

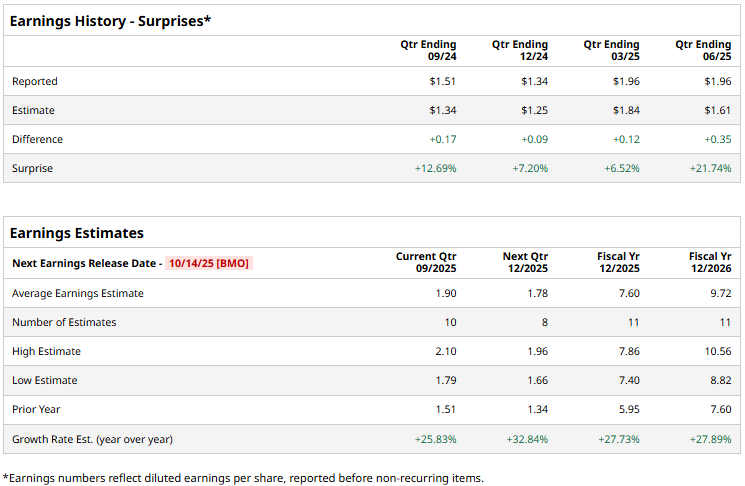

The financial sector giant is expected to report its third-quarter results before the market opens on Tuesday, Oct. 14. Ahead of the event, analysts expect Citi to report an adjusted EPS of $1.90, up a staggering 25.8% from the $1.51 reported in the year-ago quarter. Further, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect Citi to deliver an adjusted EPS of $7.60, up 27.7% year-over-year from $5.95 reported in 2024. Further in fiscal 2026, its earnings are expected to surge 27.9% year-over-year to $9.72 per share.

Citigroup’s stock prices have soared 69.1% over the past 52 weeks, substantially outpacing the S&P 500 Index’s ($SPX) 15.4% gains and the Financial Select Sector SPDR Fund’s (XLF) 19.4% surge during the same time frame.

Citigroup’s stock prices gained 3.7% following the release of its impressive Q2 results on Jul. 15. The company showcased its resilience by delivering a solid 8.2% year-over-year growth in total revenues to $21.7 billion despite the macro uncertainties. This figure also surpassed the Street's expectations by 4.4%. Furthermore, driven by higher net income and share repurchases, its EPS for the quarter came in at $1.96, up 28.9% year-over-year and 21.7% above the consensus estimate.

The consensus opinion on Citigroup remains optimistic with an overall “Moderate Buy” rating. Out of the 24 analysts covering the stock, 12 recommend “Strong Buy,” four advise “Moderate Buy,” and eight advocate a “Hold” rating. As of writing, the stock is trading slightly below its mean price target of $104.37.