/CDW%20Corp%20smartphone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Valued at a market cap of $23.6 billion, CDW Corporation (CDW) is a leading provider of technology products and solutions tailored for business, government, education, and healthcare clients across the U.S., U.K., and Canada. Headquartered in Vernon Hills, Illinois, the Fortune 500 and S&P 500 company distributes over 100,000 products and services from more than 1,000 brands, including PCs, servers, networking equipment, storage, and software.

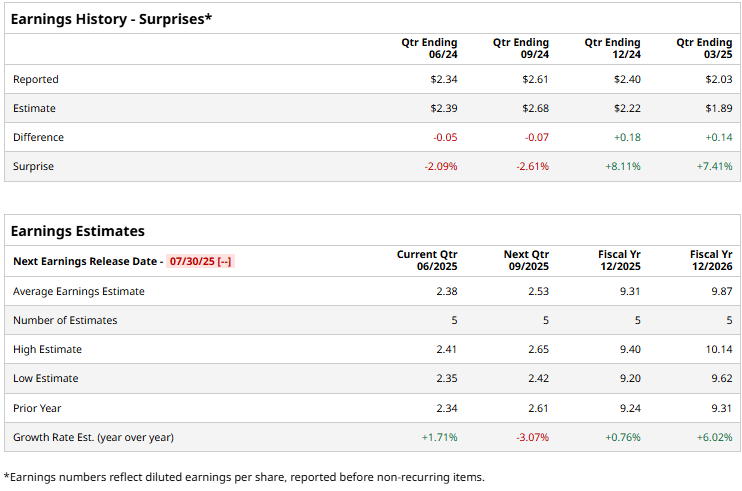

The tech company is expected to release its Q2 2025 earnings before the market opens on Wednesday, July 30. Ahead of this event, analysts project CDW to report earnings of $2.38 per share, which represents a 1.7% growth from $2.34 in the same quarter last year. The company has surpassed Wall Street’s bottom-line estimates in two of the past four quarters while missing on two other occasions.

For fiscal 2025, analysts forecast CDW to report an EPS of $9.31, marking a marginal increase from $9.24 reported in fiscal 2024. Moreover, in fiscal 2026, its earnings are expected to grow 6% year-over-year to $9.87 per share.

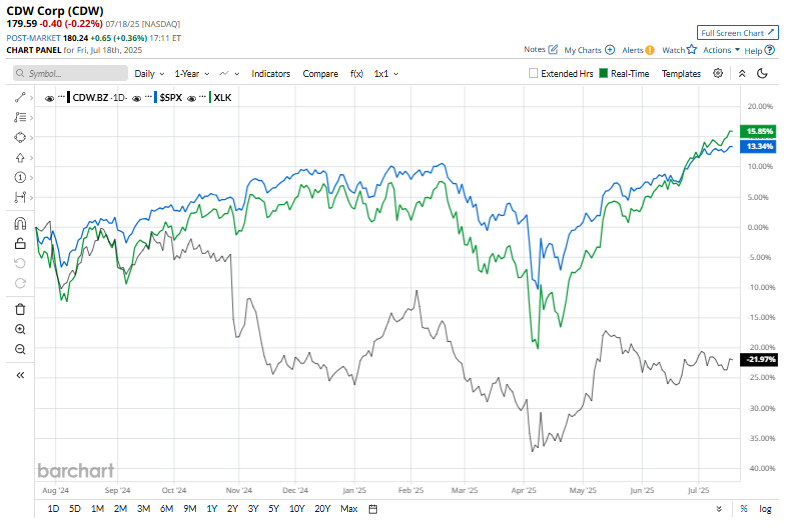

Shares of CDW have declined 23.2% over the past 52 weeks, significantly underperforming the S&P 500 Index’s ($SPX) 13.6% gain and the Technology Select Sector SPDR Fund’s (XLK) 16.3% return during the same period.

On May 7, CDW shares surged 7.1% after the company reported strong Q1 earnings. Net sales climbed 6.7% year-over-year to $5.2 billion, exceeding Wall Street expectations, fueled by robust demand for mobile devices, desktops, software, and services. The company’s adjusted operating margin improved to 8.5% from 8.3% a year ago, contributing to a 10% increase in adjusted operating income to $444 million. Additionally, adjusted EPS rose 11.9% year-over-year to $2.15, topping analyst forecasts.

Analysts' consensus view on CDW is moderately optimistic, with an overall "Moderate Buy" rating. Out of 11 analysts covering the stock, opinions include five "Strong Buys," two "Moderate Buys," and four "Holds.” Its mean price target of $208 suggests a 15.8% upside potential from current price levels.