/Carmax%20Inc%20storefront%20by-jetcityimage%20via%20iStock.jpg)

With a market cap of $8.6 billion, CarMax, Inc. (KMX) is the largest retailer of used vehicles in the U.S. and a leading operator of wholesale vehicle auctions. The company operates through two segments: CarMax Sales Operations, which covers auto merchandising and related services, and CarMax Auto Finance, which provides financing solutions for customers.

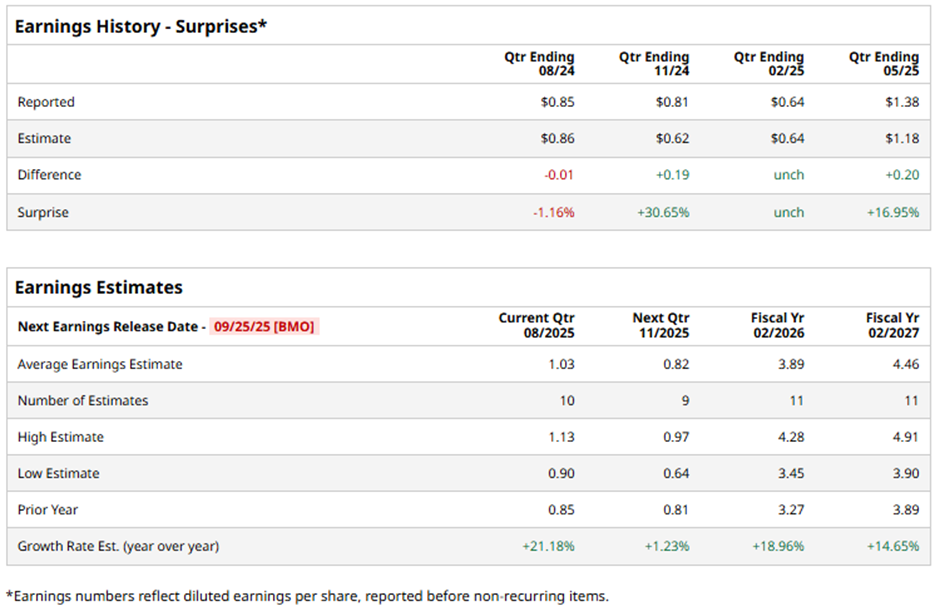

The Richmond, Virginia-based company is expected to announce its Q2 2026 results before the market opens on Thursday, Sept. 25. Ahead of this event, analysts forecast CarMax to report an EPS of $1.03, up 21.2% from $0.85 in the year-ago quarter. It has exceeded or met Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2026, analysts predict the used car dealership chain to report an EPS of $3.89, up nearly 19% from $3.27 in fiscal 2025.

Shares of CarMax have dropped 24.5% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.4% gain and the Consumer Discretionary Select Sector SPDR Fund's (XLY) 19.1% return over the period.

Shares of CarMax climbed 6.6% on Jun. 20 after the company delivered Q1 2026 results that beat expectations, with revenue up 6% to $7.55 billion and record EPS of $1.38, up 42% from last year. Used unit comparable sales rose 8.1%, 80% of retail sales were digital-driven, and SG&A leverage improved by 180 basis points. Investor confidence was also boosted by a $632 million non-prime loan securitization and AI-driven efficiency gains, including 24% higher consultant productivity and 30% improvement in customer self-service containment.

Analysts' consensus view on KMX stock is moderately optimistic, with a "Moderate Buy" rating overall. Among 19 analysts covering the stock, nine recommend "Strong Buy," three suggest "Moderate Buy," five indicate “Hold,” one "Moderate Sell," and one advises "Strong Sell." This configuration is slightly more bullish than three months ago, with eight analysts suggesting a "Strong Buy."

The average analyst price target for CarMax is $79.81, indicating a potential upside of 38.3% from the current levels.