/C_H_%20Robinson%20Worldwide%2C%20Inc_logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

C.H. Robinson Worldwide, Inc. (CHRW), headquartered in Eden Prairie, Minnesota, provides freight transportation and related logistics and supply chain services. Valued at $14.8 billion by market cap, the company also provides customs brokerage services, and other logistics services, such as fee-based managed warehousing, and other services. The freight giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Wednesday, Oct. 29.

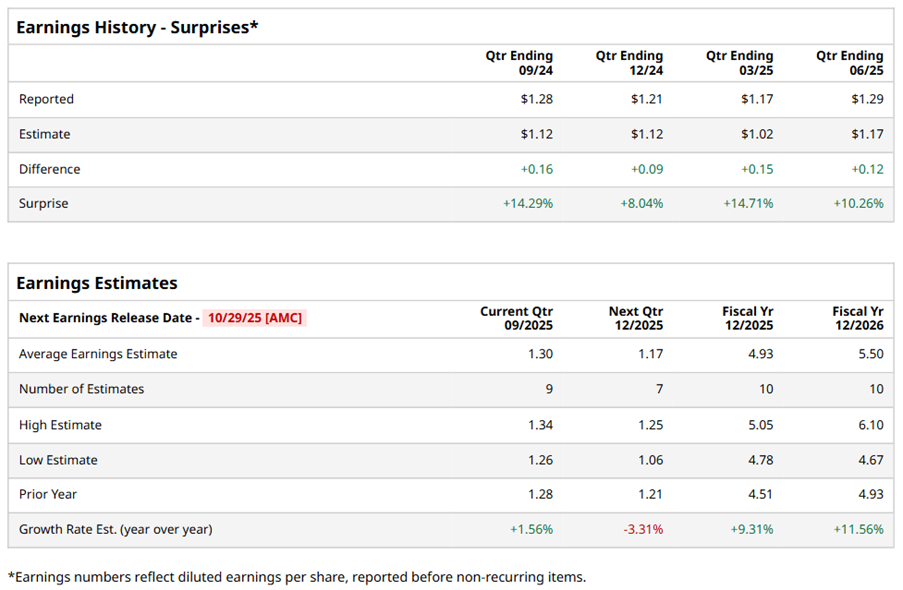

Ahead of the event, analysts expect CHRW to report a profit of $1.30 per share on a diluted basis, up 1.6% from $1.28 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CHRW to report EPS of $4.93, up 9.3% from $4.51 in fiscal 2024. Its EPS is expected to rise 11.6% year over year to $5.50 in fiscal 2026.

CHRW stock has underperformed the S&P 500 Index’s ($SPX) 14.4% gains over the past 52 weeks, with shares up 12.9% during this period. However, it outperformed the Industrial Select Sector SPDR Fund’s (XLI) 9.4% gains over the same time frame.

On Jul. 30, C.H. Robinson's Q2 results sent its shares soaring 18.1% in the next trading session. Although revenue dropped 7.7% year over year to $4.1 billion, missing estimates by 1.9%, its adjusted EPS rose 12.2% to $1.29, beating analyst expectations by 10.3%. Disciplined execution of strategic initiatives drove margin growth, boosting profitability.

Analysts’ consensus opinion on CHRW stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 26 analysts covering the stock, 13 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 11 give a “Hold,” and one recommends a “Strong Sell.” CHRW’s average analyst price target is $131.04, indicating a potential upside of 5.3% from the current levels.