/Brown%20%26%20Brown%2C%20Inc_%20HQ%20photo-by%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $31.5 billion, Brown & Brown, Inc. (BRO) is a leading provider of insurance products and services operating in the United States, Canada, Ireland, the United Kingdom, and internationally. The company operates through four segments: Retail; Programs; Wholesale Brokerage; and Services, offering a wide range of insurance, risk management, and claims administration solutions to commercial, public, and individual clients.

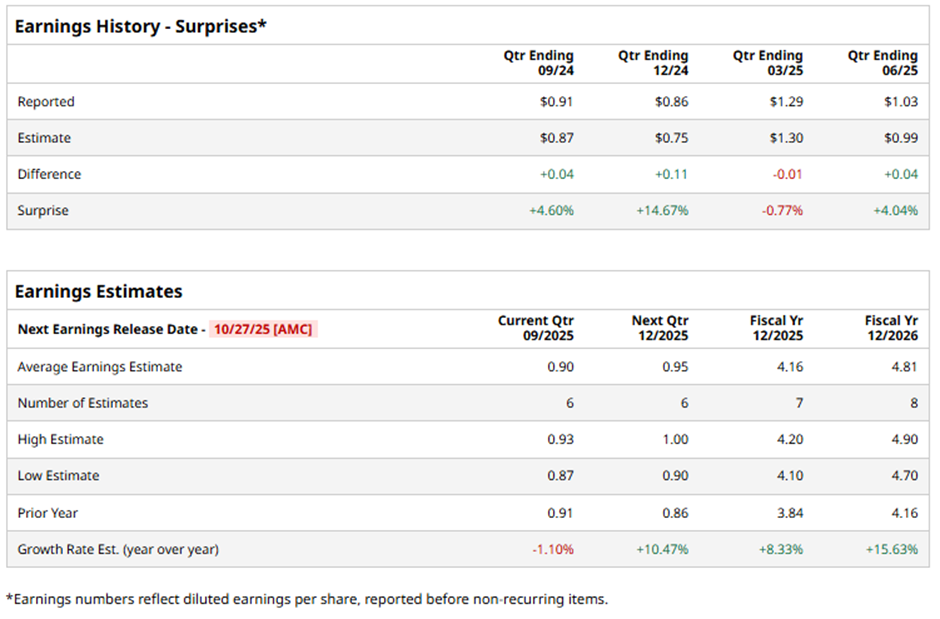

The Daytona Beach, Florida-based company is expected to announce its fiscal Q3 2025 results after the market closes on Monday, Oct. 27. Ahead of this event, analysts expect Brown & Brown to report an adjusted EPS of $0.90, down 1.1% from $0.91 in the year-ago quarter. It has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect the insurance company to report an adjusted EPS of $4.16, an 8.3% increase from $3.84 in fiscal 2024. In addition, adjusted EPS is anticipated to grow 15.6% year-over-year to $4.81 in fiscal 2026.

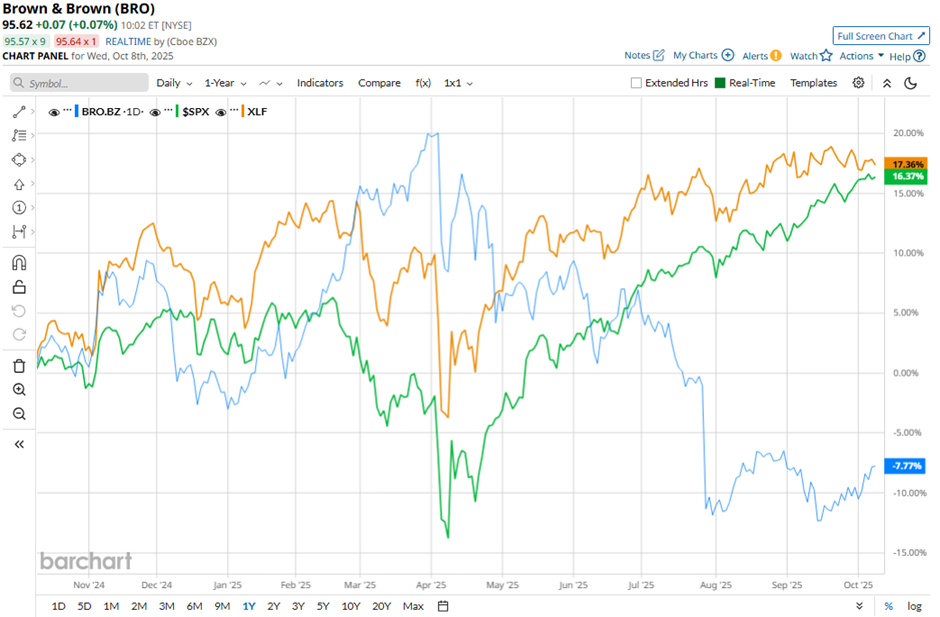

Shares of Brown & Brown have dropped 9.4% over the past 52 weeks, underperforming both the S&P 500 Index's ($SPX) 16.9% gain and the Financial Select Sector SPDR Fund's (XLF) 18.4% return over the period.

Despite beating estimates with Q2 2025 adjusted EPS of $1.03 and revenue of $1.29 billion on Jul. 28, Brown & Brown’s shares tumbled 10.4% the next day. Investors focused on the 10.1% year-over-year decline in income before income taxes to $311 million and margin compression, as margins dropped sharply to 24.2% from 29.4% in the prior-year quarter.

Analysts' consensus view on BRO stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 18 analysts covering the stock, five recommend "Strong Buy," one suggests "Moderate Buy," 11 indicate “Hold,” and one has a "Moderate Sell."

The average analyst price target for Brown & Brown is $111.93, indicating a potential upside of 17.1% from the current levels.