/Boeing%20Co_%20corporate%20building-by%20Tada%20Images%20via%20Shutterstock.jpg)

The Boeing Company (BA), headquartered in Arlington, Virginia, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense systems, human spaceflight, and launch systems, as well as services. Valued at $163.6 billion by market cap, the company’s global presence spans over 150 countries, serving top clients such as NASA, the U.S. Department of Defense, and major airlines. The aerospace giant is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 29.

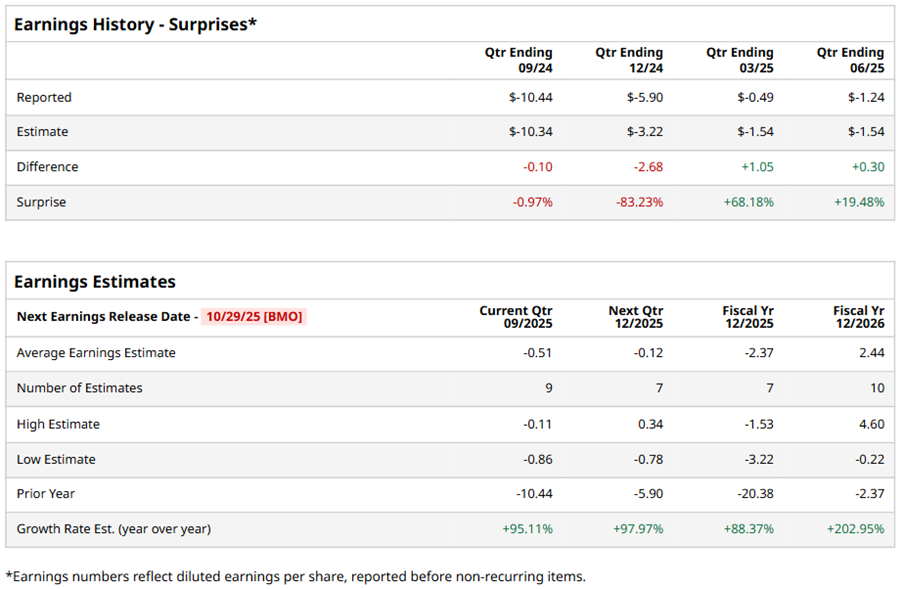

Ahead of the event, analysts expect BA to report a loss of $0.51 per share on a diluted basis, recovering 95.1% from a loss of $10.44 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect BA to report a loss per share of $2.37, up 88.4% from $20.38 in fiscal 2024. Its EPS is expected to rise 203% year over year to $2.44 in fiscal 2026.

BA stock has outperformed the S&P 500 Index’s ($SPX) 17.8% gains over the past 52 weeks, with shares up 43.7% during this period. Similarly, it outpaced the Industrial Select Sector SPDR Fund’s (XLI) 14.7% gains over the same time frame.

Boeing's strong performance is driven by its high-value contracts, including a $7.5 billion deal for Joint Direct Attack Munition (JDAM) kits and a potential $123 million contract for GBU-57 Massive Ordnance Penetrators. The company is also seeing growth in aircraft orders, with deals from Turkish Airlines and Uzbekistan Airways. Additionally, Boeing is in talks for a "huge" aircraft order with China and is working to secure approval for its planned purchase of Spirit AeroSystems, signaling growing confidence in the aerospace giant's operations.

On Jul. 29, BA shares closed down by 4.4% after reporting its Q2 results. Its adjusted loss per share of $1.24 beat Wall Street expectations of $1.54. The company’s revenue was $22.7 billion, surpassing Wall Street forecasts of $21.9 billion.

Analysts’ consensus opinion on BA stock is bullish, with a “Strong Buy” rating overall. Out of 26 analysts covering the stock, 20 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and four give a “Hold.” BA’s average analyst price target is $255.39, indicating a potential upside of 18.1% from the current levels.