/Biogen%20Inc%20magnified-by%20Casimiro%20PT%20via%20Shutterstock.jpg)

Valued at a market cap of $22.1 billion, Biogen Inc. (BIIB) is a top biotechnology company. Headquartered in Cambridge, Massachusetts, it specializes in the discovery, development, and delivery of therapies for neurological, neurodegenerative, and rare diseases. Founded in 1978, Biogen has built a strong presence in neuroscience, focusing on addressing unmet medical needs in conditions such as multiple sclerosis (MS), spinal muscular atrophy (SMA), and Alzheimer’s disease.

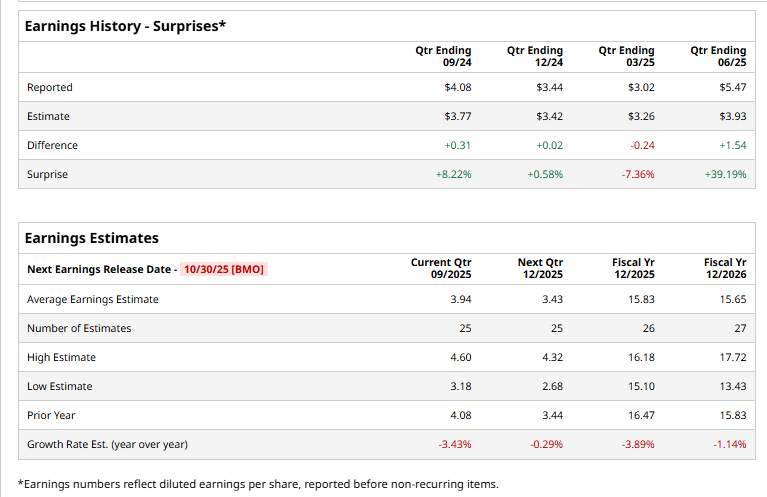

The biotech titan is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Thursday, Oct. 30. Before this event, analysts project the company to report a profit of $3.94 per share, down 3.4% from $4.08 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in three of the last four quarters, while missing on another occasion.

For the current year, analysts expect Biogen to report EPS of $15.83, down 3.9% from $16.47 in fiscal 2024.

Shares of BIIB have declined 19.5% over the past 52 weeks, considerably underperforming both the S&P 500 Index's ($SPX) 16.3% uptick and the Health Care Select Sector SPDR Fund’s (XLV) 6% drop over the same time frame.

Shares of Biogen climbed 1.1% on July 31 following the release of its Q2 2025 results. Its adjusted EPS of $5.47 and revenues of $2.65 billion exceeded analyst expectations, thanks to strong sales of MS therapies, notably Vumerity and Tysabri. The company also raised its full-year adjusted EPS guidance to $15.50–$16, signaling a more optimistic outlook for 2025.

Wall Street analysts are moderately optimistic about Biogen’s stock, with an overall "Moderate Buy" rating. Among 34 analysts covering the stock, 14 recommend "Strong Buy," one indicates a "Moderate Buy," and 19 suggest "Hold.” The mean price target for BIIB is $173.21, implying a 15.8% premium from the current levels.