/Baxter%20International%20Inc_%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Baxter International Inc. (BAX), headquartered in Deerfield, Illinois, develops and provides a portfolio of healthcare products. With a market cap of $14.6 billion, the company develops, manufactures, and markets products and technologies related to hemophilia, immune disorders, infectious diseases, kidney disease, trauma, and other chronic and acute medical conditions. The company's products are used by hospitals, kidney dialysis centers, nursing homes, rehabilitation centers, doctors' offices, and research laboratories. The global Medtech leader is expected to announce its fiscal second-quarter earnings for 2025 on Tuesday, Aug. 5.

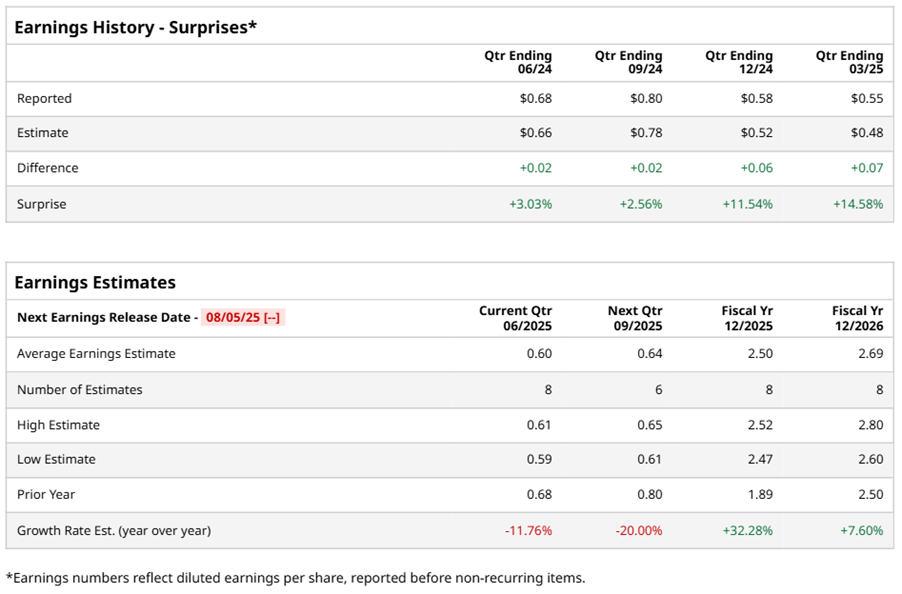

Ahead of the event, analysts expect BAX to report a profit of $0.60 per share on a diluted basis, down 11.8% from $0.68 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect BAX to report EPS of $2.50, up 32.3% from $1.89 in fiscal 2024. Similarly, its EPS is expected to rise 7.6% year-over-year to $2.69 in fiscal 2026.

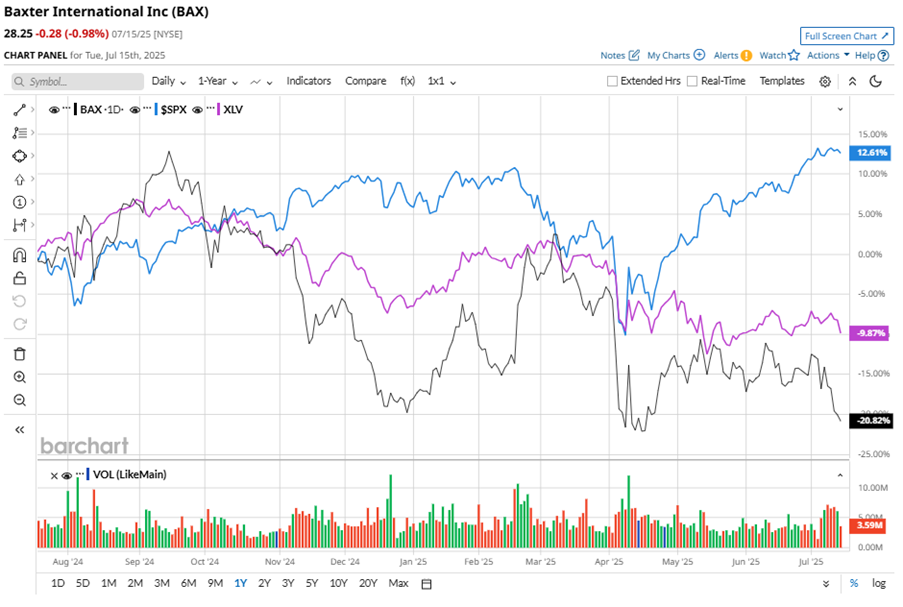

BAX stock has underperformed the S&P 500 Index’s ($SPX) 10.9% gains over the past 52 weeks, with shares down 16.8% during this period. Similarly, it underperformed the Health Care Select Sector SPDR Fund’s (XLV) 10.3% dip over the same time frame.

BAX's decline in performance is a direct result of the considerable expenses resulting from the damage caused by Hurricane Helene to its North Cove facility, which is a critical supplier of IV fluids in the U.S. This indicates weaknesses in the company's operational management and underscores the need for improvements to mitigate such risks in the future.

On May 1, BAX shares closed down more than 1% after the company reported its Q1 results. Its revenue stood at $2.6 billion, up 5.4% year-over-year. The company’s adjusted EPS declined 4.6% year-over-year to $0.62.

Analysts’ consensus opinion on BAX stock is reasonably bullish, with an overall “Moderate Buy” rating. Out of 15 analysts covering the stock, five advise a “Strong Buy” rating, nine give a “Hold,” and one recommends a “Moderate Sell.” BAX’s average analyst price target is $36.28, indicating a potential upside of 28.4% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.