/Baxter%20International%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Deerfield, Illinois-based Baxter International Inc. (BAX) is a global healthcare technology company specializing in essential hospital and renal-care products like IV solutions, infusion systems, and dialysis therapies. With a market cap of $11.8 billion, its operations span globally, distributing products through direct sales and a network of distributors across many countries. The med-tech giant is expected to announce its fiscal third-quarter earnings before the market opens on Thursday, Oct. 30.

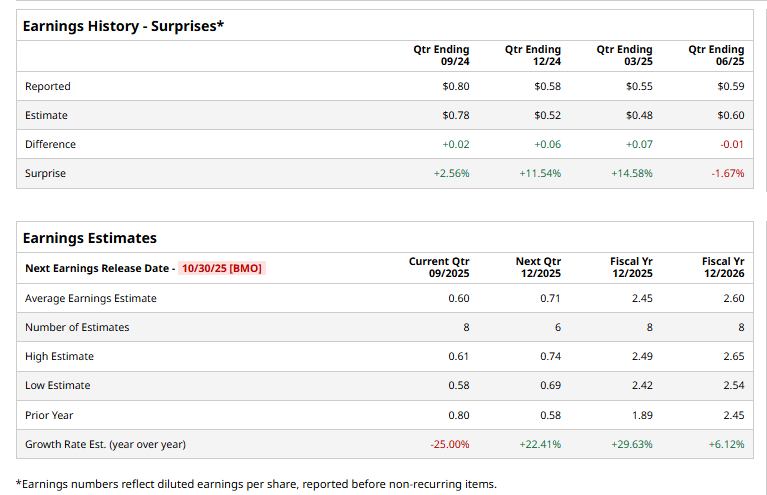

Ahead of the event, analysts expect BAX to report a profit of $0.60 per share on a diluted basis, down 25% from $0.80 per share in the year-ago quarter. The company has surpassed Wall Street’s EPS estimates in three of the last four quarterly reports, while missing on another occasion.

For the current year, analysts expect BAX to report EPS of $2.45, up 29.6% from $1.89 in fiscal 2024. Similarly, its EPS is expected to rise 6.1% annually to $2.60 in FY2026.

BAX stock has faced challenges over the past year, slumping 37.3%, trailing both the S&P 500 Index’s ($SPX) 16.9% gains and Health Care Select Sector SPDR Fund’s (XLV) 2.3% dip over the same time frame.

Baxter International has been under pressure lately, with shares slipping as global trade tensions and regulatory uncertainty cloud the healthcare landscape. On Oct. 10, its shares fell 3% amid a market-wide sell-off following President Trump’s sharp comments on China, which reignited fears of supply chain disruptions tied to Beijing’s rare earth export controls.

Just weeks earlier, BAX shares fell 3.7% on Sept. 25 after the U.S. Commerce Department launched a national security probe into medical equipment imports under Section 232 of the Trade Expansion Act. The investigation, which could lead to new tariffs on devices like syringes and infusion pumps, sparked concerns over higher costs and supply-chain disruptions across the healthcare sector.

Analysts’ consensus opinion on BAX stock is neutral, with an overall “Hold” rating. Out of 16 analysts covering the stock, three advise a “Strong Buy” rating, 12 give a “Hold,” and one recommends a “Moderate Sell.” BAX’s average analyst price target is $27.71, indicating a potential upside of 20.4% from the current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.