/Autozone%20Inc_%20%20logo%20and%20chart%20by-%20IgorGolovniov%20via%20Shutterstock.jpg)

Memphis, Tennessee-based AutoZone, Inc. (AZO) is the leading retailer and distributor of automotive replacement parts and accessories. Valued at a market cap of $64 billion, the company serves both do-it-yourself (DIY) customers and professional repair shops through an extensive network of stores and distribution centers. It is expected to announce its fiscal Q1 earnings for 2026 in the near future.

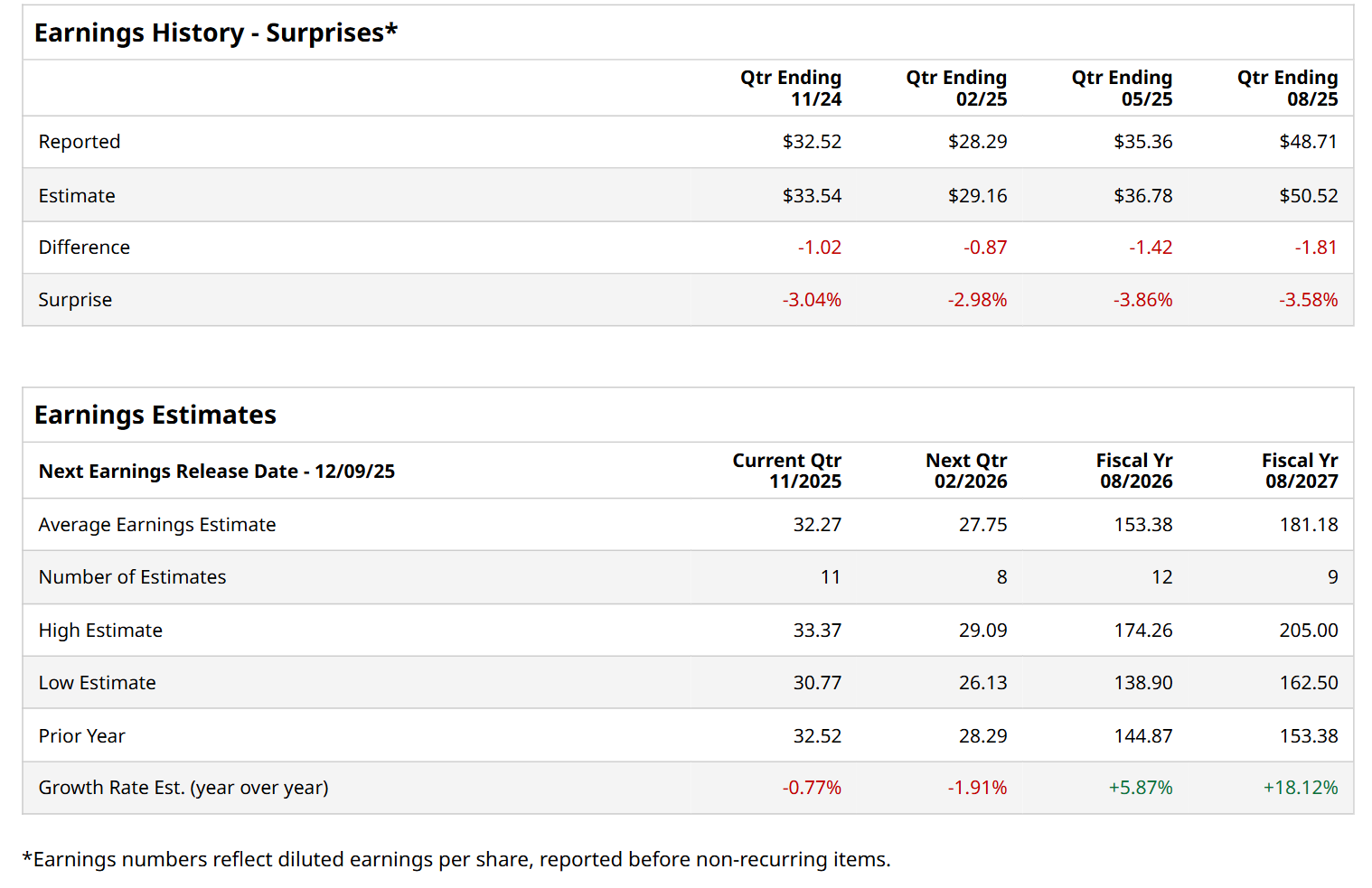

Before this event, analysts expect this auto parts retailer to report a profit of $32.27 per share, marginally down from $32.52 per share in the year-ago quarter. The company has missed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $48.71 per share in the previous quarter fell short of the consensus estimates by 3.6%.

For fiscal 2026, analysts expect AutoZone to report a profit of $153.38 per share, representing a 5.9% increase from $144.87 per share in fiscal 2025. Furthermore, its EPS is expected to grow 18.1% year-over-year to $181.18 in fiscal 2027.

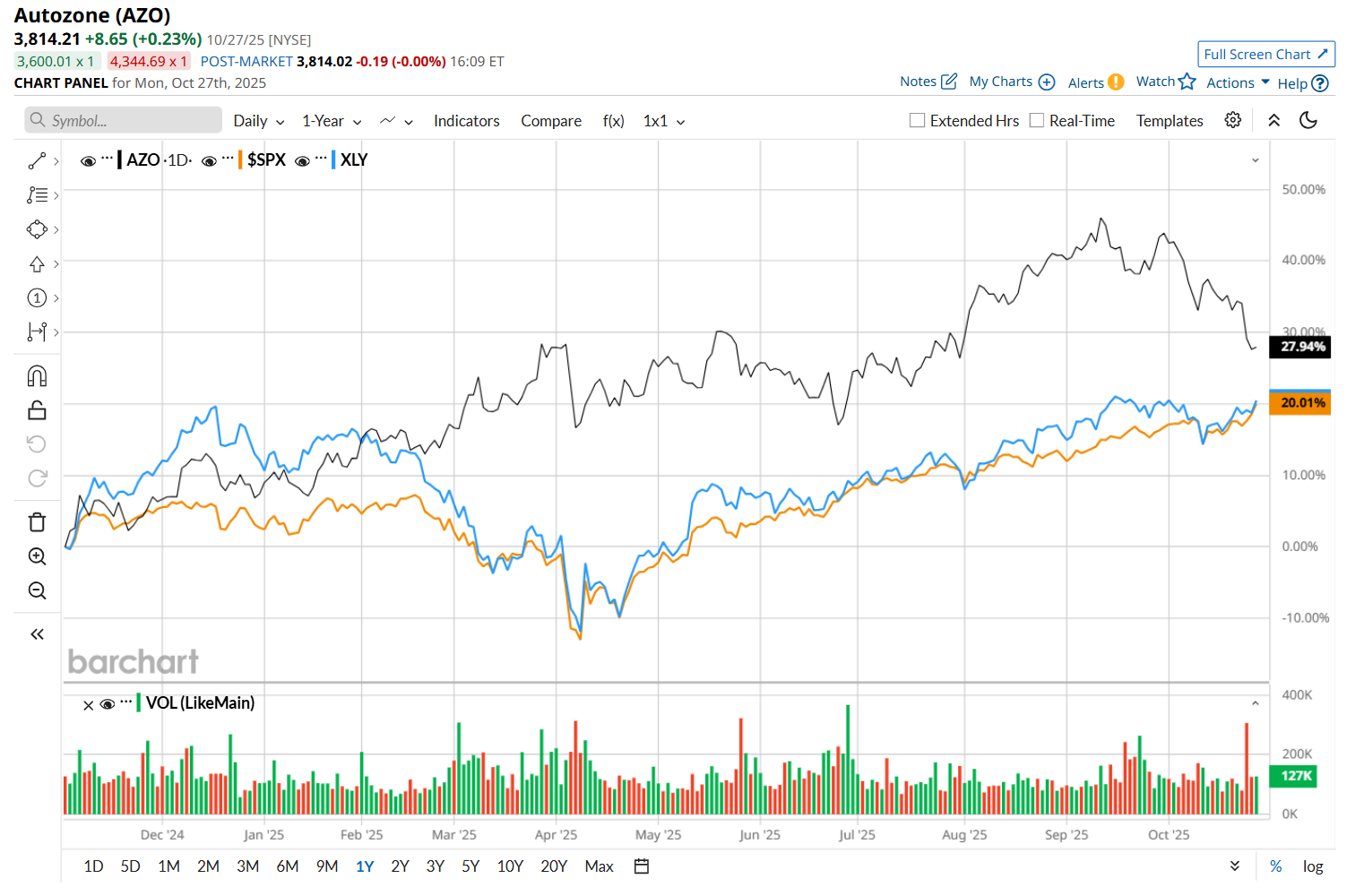

Shares of AZO have surged 21.8% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 18.4% return and the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 19.6% uptick over the same time frame.

Shares of AZO remained fairly stable on Sep. 23, after its mixed Q4 earnings release. On the downside, while the company’s adjusted EPS of $48.71 grew 1.2% from the year-ago quarter, it fell short of the consensus estimates by 3.6%. However, this was cushioned by a 6.9% year-over-year rise in its adjusted net sales to $6.2 billion, which topped analyst expectations by a slight margin. Adding to the positives, its overall same-store sales increased 5.1% from the same period last year on a constant currency basis, with domestic sales rising by 4.8% and international sales growing by 7.2%.

Wall Street analysts are highly optimistic about AZO’s stock, with an overall "Strong Buy" rating. Among 28 analysts covering the stock, 22 recommend "Strong Buy," two indicate "Moderate Buy," three suggest "Hold,” and one advises a "Strong Sell” rating. The mean price target for AutoZone is $4,539.75, implying a 19% potential upside from the current levels.