Dallas, Texas-based AT&T Inc. (T) provides telecommunications and technology services worldwide. Valued at $193.5 billion by market cap, the company provides local and long-distance phone, wireless and data communications, Internet access and messaging, IP-based and satellite television, telecommunications equipment, and directory advertising and publishing services. The telecom giant is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 22.

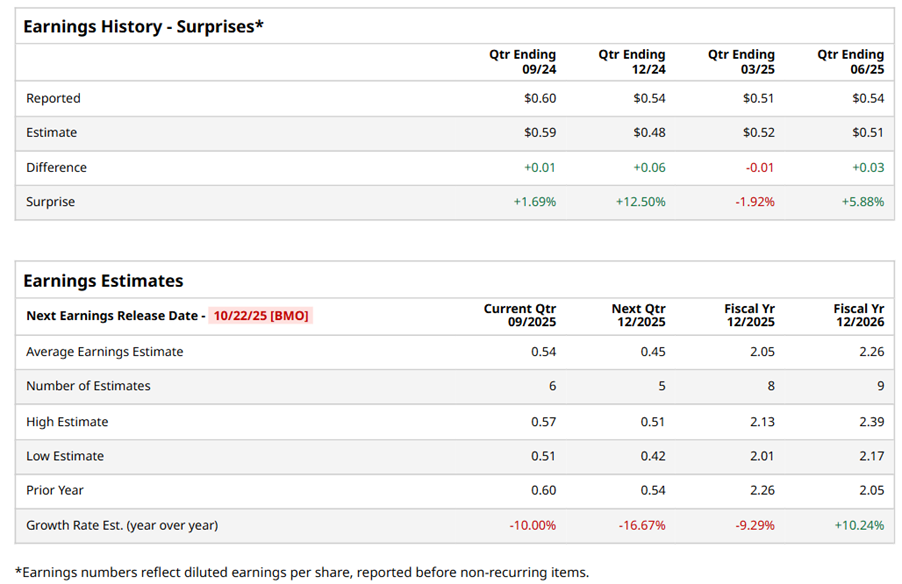

Ahead of the event, analysts expect T to report a profit of $0.54 per share on a diluted basis, down 10% from $0.60 per share in the year-ago quarter. The company beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

For the full year, analysts expect T to report EPS of $2.05, down 9.3% from $2.26 in fiscal 2024. However, its EPS is expected to rise 10.2% year-over-year to $2.26 in fiscal 2026.

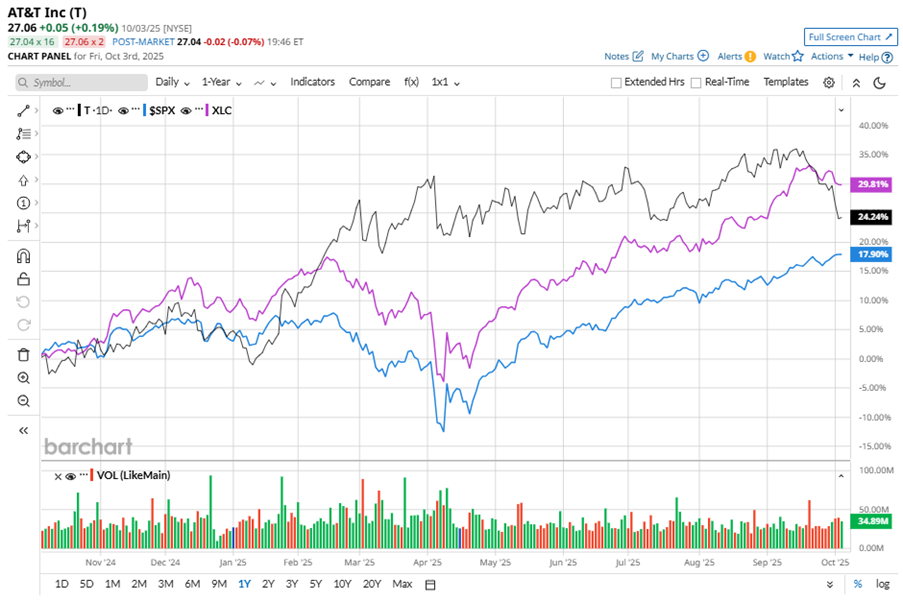

T stock has outperformed the S&P 500 Index’s ($SPX) 17.8% gains over the past 52 weeks, with shares up 22.7% during this period. However, it underperformed the Communication Services Select Sector SPDR ETF’s (XLC) 29.5% uptick over the same time frame.

AT&T's strong performance is fueled by its customer-focused approach, robust postpaid wireless growth, and strategic investments in 5G and fiber infrastructure. The company is upgrading its network, expanding fiber broadband, and partnering with tech giants like Microsoft Corporation (MSFT) and Alphabet Inc.’s (GOOGL) Google Cloud to enhance services and drive long-term growth.

On Jul. 23, T shares closed up more than 1% after reporting its Q2 results. Its adjusted EPS of $0.54 beat Wall Street expectations of $0.51. The company’s revenue was $30.8 billion, topping Wall Street forecasts of $30.5 billion. T expects full-year adjusted EPS in the range of $1.97 to $2.07.

Analysts’ consensus opinion on T stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 29 analysts covering the stock, 16 advise a “Strong Buy” rating, three suggest a “Moderate Buy,” nine give a “Hold,” and one recommends a “Strong Sell.” T’s average analyst price target is $30.57, indicating a potential upside of 13% from the current levels.