/Ansys%20Inc_%20logo%20on%20laptop-by%20monticello%20via%20Shutterstock.jpg)

Valued at a market cap of $32.9 billion, ANSYS, Inc. (ANSS) is a leading provider of engineering simulation software used to design and test products across industries such as aerospace, automotive, healthcare, and electronics. Headquartered in Canonsburg, Pennsylvania, the company delivers advanced, physics-based simulation solutions that help drive innovation, improve product performance, and reduce development costs.

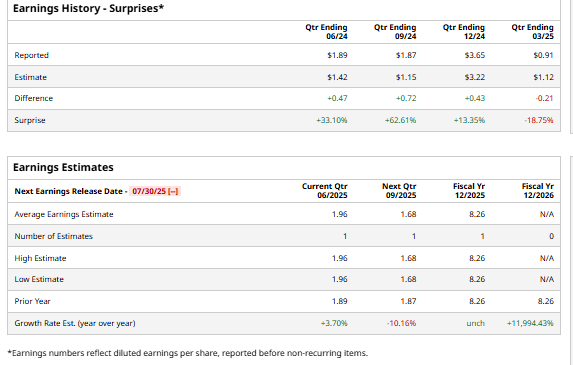

ANSYS is expected to unveil its Q2 2025 earnings after the market closes on Wednesday, Jul. 30. Ahead of this event, analysts expect ANSYS to report adjusted earnings of $1.96 per share, reflecting a growth of 3.7% from $1.89 per share reported in the same quarter last year. The company has surpassed Wall Street's bottom-line estimates in three of the past four quarters while missing on another occasion.

For fiscal 2025, analysts project ANSYS to deliver an adjusted earnings per share of $8.26, in line with its fiscal 2024 performance.

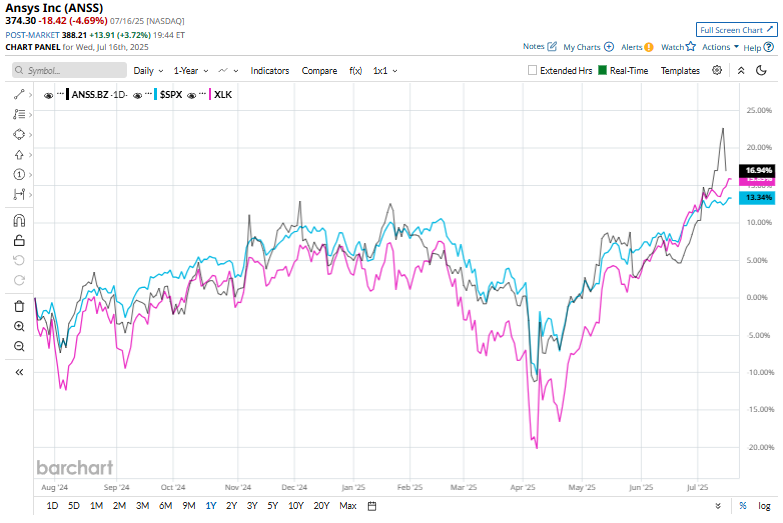

ANSS stock has surged 13.3% over the past 52 weeks, lagging behind the S&P 500 Index’s ($SPX) 13.6% gain and the Technology Select Sector SPDR Fund’s (XLK) 16.3% return during the same period.

On April 30, shares of ANSYS declined marginally after the company posted mixed results for Q1 2025. Its revenue for the quarter grew 8.2% year-over-year to $504.9 million but fell short of Wall Street expectations. Similarly, adjusted earnings rose 18% to $1.64 per share, yet still came in below analyst forecasts.

Analysts' consensus view on ANSS is cautious, with an overall "Hold" rating. Among 10 analysts covering the stock, nine recommend a "Moderate Buy,” and one gives a “Strong Sell” rating. The stock currently trades above its mean price target of $359.88.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.