/American%20International%20Group%20Inc%20logo%20on%20bhone-%20by%20rafapress%20via%20Shutterstock.jpg)

New York-based American International Group, Inc. (AIG) offers insurance products for commercial, institutional, and individual customers in North America and internationally. With a market cap of $45.9 billion, AIG operates through General Insurance, Life and Retirement, and Other Operations segments.

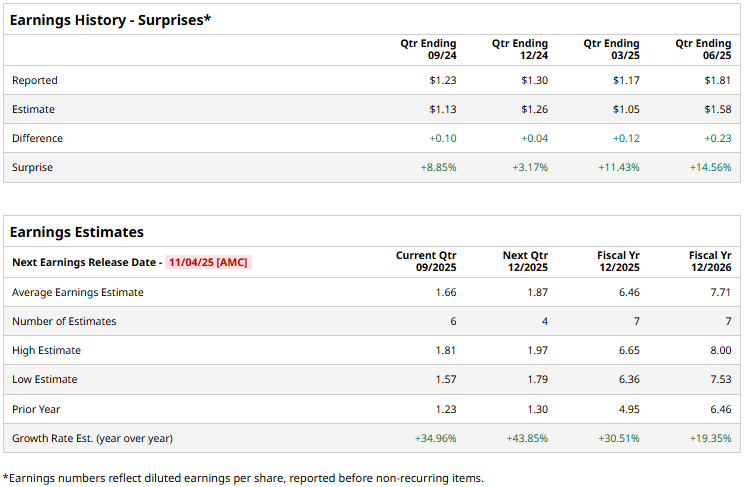

The insurance giant is set to announce its third-quarter results after the markets close on Tuesday, Nov. 4. Ahead of the event, analysts expect AIG to report a non-GAAP profit of $1.66 per share, up a staggering 35% from $1.23 per share reported in the year-ago quarter. Further, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For the full fiscal 2025, analysts expect AIG to report an adjusted EPS of $6.46, up 30.5% from $4.95 in fiscal 2024. In fiscal 2026, its adjusted earnings are expected to further grow 19.4% year-over-year to $7.71 per share.

AIG stock prices have inched up 5.6% over the past 52 weeks, notably lagging behind the Financial Select Sector SPDR Fund’s (XLF) 13.5% returns and the S&P 500 Index’s ($SPX) 14.7% gains during the same time frame.

Despite reporting better-than-expected results, AIG stock prices dipped 3.1% in the trading session following the release of its Q2 results on Aug. 6. The quarter was marked with higher underwriting gains, robust net investment income, and disciplined capital management. The company’s topline for the quarter surged 8.1% year-over-year to $7.1 billion, beating the Street’s expectations by a notable margin. Further, its adjusted EPS soared 56% year-over-year to $1.81, surpassing the consensus estimates by 14.6%. Following the initial dip, AIG stock remained in the green for the next two trading sessions.

Analysts remain cautiously optimistic about the stock’s prospects. AIG has a consensus “Moderate Buy” rating overall. Of the 23 analysts covering the stock, opinions include nine “Strong Buys,” two “Moderate Buys,” and 12 “Holds.” Its mean price target of $89.50 suggests a 10.1% upside potential from current price levels.