/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

Alphabet Inc. (GOOG) is a multinational technology holding company headquartered in Mountain View, California. Alphabet’s portfolio spans internet search, digital advertising, cloud computing, hardware, artificial intelligence (AI) and more. Its market cap stood at $3.1 trillion, reflecting its status among the largest publicly traded companies in the world. The tech giant is expected to announce its fiscal Q3 2025 earnings after the market closes on Wednesday, Oct. 29.

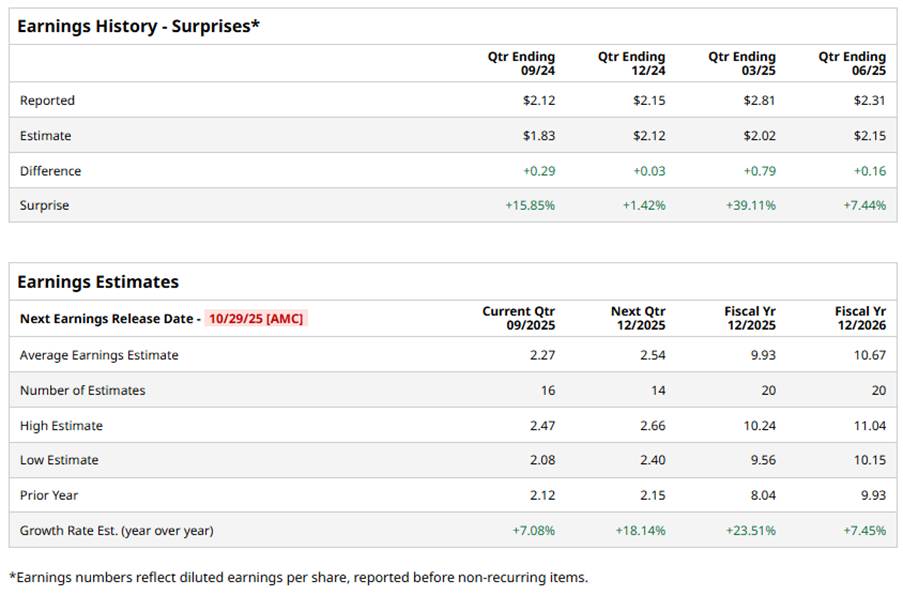

Ahead of this event, analysts expect Alphabet to report a profit of $2.27 per share, up 7.1% from $2.12 per share in the prior-ago quarter. The company has an impressive trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters.

For fiscal 2025, analysts anticipate Alphabet’s EPS to be $9.93, representing a 23.5% increase from $8.04 in fiscal 2024. Furthermore, its EPS is expected to grow 7.5% year over year (YoY) to $10.67 in fiscal 2026.

GOOG stock has surged 51.6% over the past 52 weeks, significantly outpacing both the S&P 500 Index’s ($SPX) 15.1% return and the Communication Services Select Sector SPDR Fund’s (XLC) 28.4% rise over the same time frame.

Shares of Alphabet have been climbing amid investors’ continued optimism about its prospects. Also, the company secured a favorable U.S. antitrust ruling last month that lifted a major regulatory overhang, alleviating investor fears that it would be forced to break up or divest key assets.

The market is increasingly optimistic about Alphabet’s prospects in growth areas such as cloud computing and AI, especially amid rising demand for its cloud business and its ability to leverage AI across products.

Wall Street analysts remain positive about Alphabet’s stock, with an overall “Strong Buy” rating. Among 56 analysts covering the stock, 42 recommend a “Strong Buy,” five suggest a “Moderate Buy,” and nine are cautious with a “Hold.” Its mean price target of $258.96 indicates a modest upside potential of 3%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.