/Aflac%20Inc_%20sign-%20by%20yu_photo%20via%20Shutterstock.jpg)

Valued at $57.6 billion by market cap, Aflac Incorporated (AFL) is a leading provider of supplemental health and life insurance products, primarily operating in the United States and Japan. Founded in 1955 and headquartered in Columbus, Georgia, the company is best known for its iconic Aflac Duck marketing campaign.

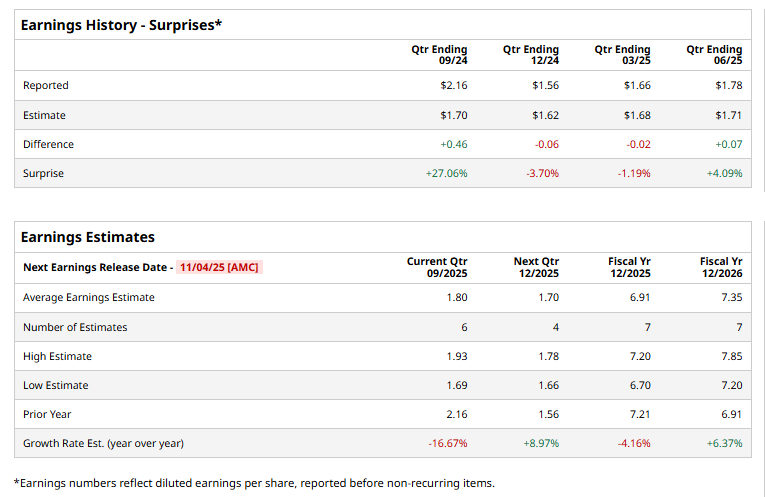

The insurance company is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Tuesday, Nov. 4. Ahead of the event, analysts expect AFL to report a profit of $1.80 per share on a diluted basis, down 16.7% from $2.16 per share in the year-ago quarter. The company beat the consensus estimates in two of the last four quarters while missing the forecast on two other occasions.

For the full year, analysts expect AFL to report EPS of $6.91, down 4.2% from $7.21 in fiscal 2024. However, the setback appears temporary, and earnings are forecast to bounce back by 6.4% year over year to $7.35 in fiscal 2026.

AFL stock has declined 6.3% over the past year, underperforming the S&P 500 Index’s ($SPX) 14.1% gains and the Financial Select Sector SPDR Fund’s (XLF) 9.6% gains over the same time frame.

On October 14, shares of Aflac climbed 1.1% after Bank of America Securities analyst Joshua Shanker reaffirmed a ”Buy” rating on the stock, maintaining a price target of $130.

Analysts’ consensus opinion on AFL stock is cautious, with a “Hold” rating overall. Out of 17 analysts covering the stock, two advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 11 give a “Hold,” and three recommend a “Strong Sell.” AFL’s average analyst price target is $108.57, indicating a marginal upside from the current levels.