/Abbott%20Laboratories%20vials%20and%20Logo-by%20Melniov%20Dmitriy%20via%20Shutterstock.jpg)

North Chicago, Illinois-based Abbott Laboratories (ABT) discovers, develops, manufactures, and sells healthcare products. Valued at $232.4 billion by market cap, ABT is a global leader in the large and growing in-vitro diagnostic market, and its products include pharmaceuticals, nutritional, diagnostics, and vascular products. The medical device manufacturer is expected to announce its fiscal third-quarter earnings for 2025 before the market opens on Wednesday, Oct. 15.

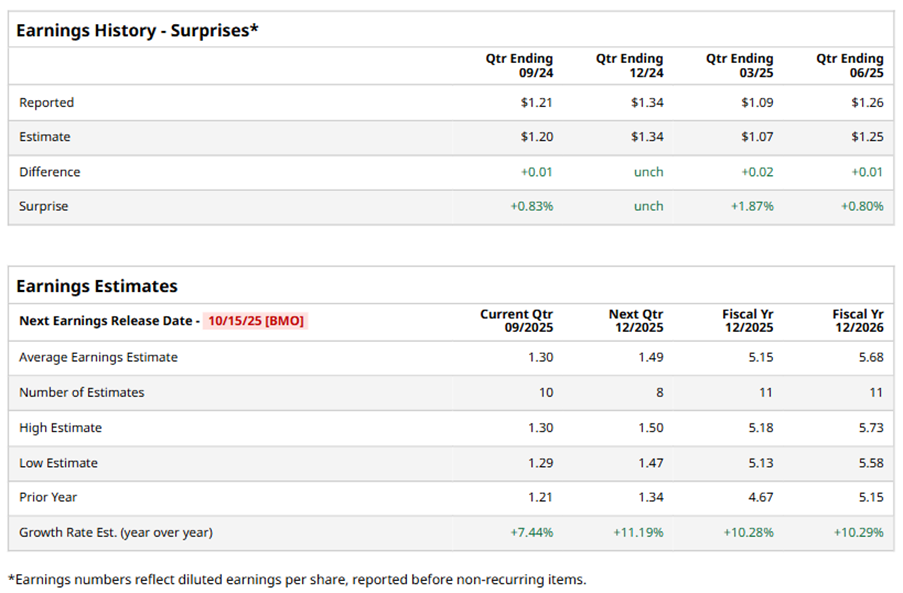

Ahead of the event, analysts expect ABT to report a profit of $1.30 per share on a diluted basis, up 7.4% from $1.21 per share in the year-ago quarter. The company has beat or matched Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect ABT to report EPS of $5.15, up 10.3% from $4.67 in fiscal 2024. Its EPS is expected to rise 10.3% year-over-year to $5.68 in fiscal 2026.

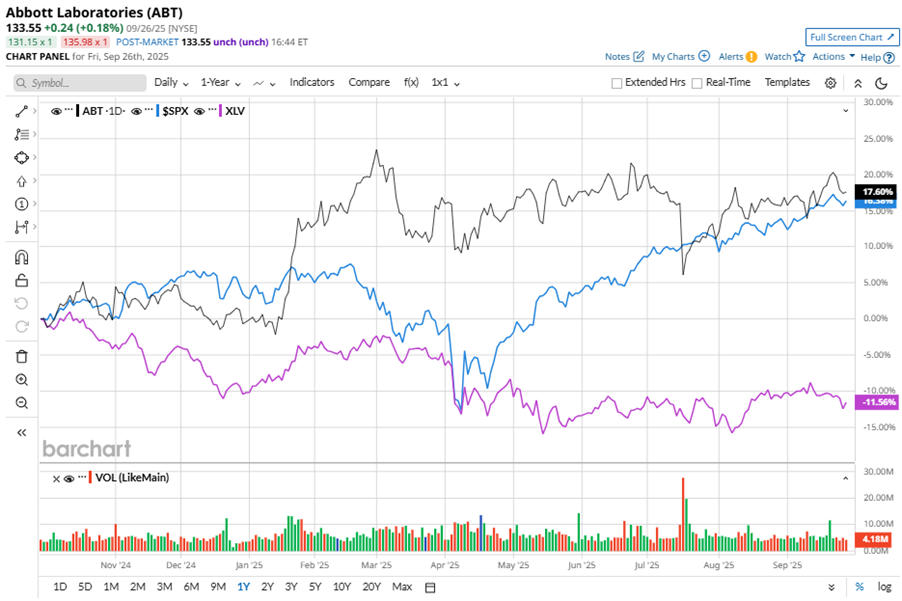

ABT stock has outperformed the S&P 500 Index’s ($SPX) 15.6% gains over the past 52 weeks, with shares up 18.5% during this period. Similarly, it considerably outperformed the Health Care Select Sector SPDR Fund’s (XLV) 11.5% dip over the same time frame.

On Jul. 17, Abbott released its Q2 results, reporting a 7.4% year-over-year revenue growth to $11.1 billion, slightly exceeding consensus estimates. The company's adjusted EPS of $1.26 increased 10.5% from the same quarter last year, beating analyst expectations by a penny. Despite the better-than-expected performance, ABT's shares dropped 8.5% following the earnings release.

Analysts’ consensus opinion on ABT stock is bullish, with a “Strong Buy” rating overall. Out of 27 analysts covering the stock, 19 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and six give a “Hold.” ABT’s average analyst price target is $144.48, indicating a potential upside of 8.2% from the current levels.