Shares of ad-tech leader Trade Desk Inc (NASDAQ:TTD) are trading marginally higher Tuesday, staging a modest rebound after a near 50% plunge since the beginning of August. Here’s what investors need to know.

What To Know: The stock has faced significant headwinds in recent weeks, including a downgrade last Wednesday from Morgan Stanley, which lowered its rating to Equal-Weight from Overweight and cut its price target to $50 from $80.

Mounting competitive pressures from tech giants like Amazon and reports that partner Walmart might be distancing itself from The Trade Desk’s platform as reasons for the bearish outlook.

Despite the downgrade, The Trade Desk’s latest financial report posted in August show consistent revenue growth and a customer retention rate of over 95%. The company recently posted second-quarter revenue of $694 million, beating analyst expectations and representing a year-over-year increase.

The company also issued a third-quarter revenue forecast of at least $717 million. Investors will be watching to see if this operational strength can outweigh the recent market anxieties and analyst concerns.

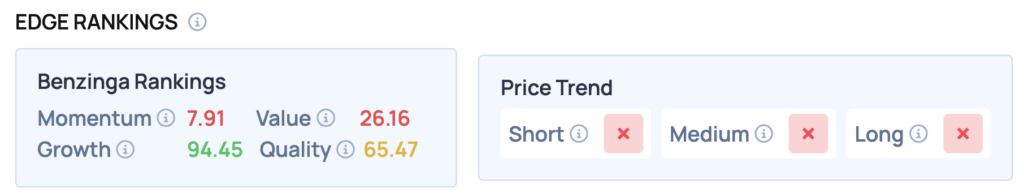

Benzinga Edge Rankings: This contrast between market sentiment and business performance is mirrored in Benzinga Edge rankings, which awards the company an exceptional 94.45 out of 100 for its Growth metric.

Price Action: According to data from Benzinga Pro, TTD shares are trading marginally higher by 1.38% to $46.16 Tuesday. The stock has a 52-week high of $141.53 and a 52-week low of $42.96.

Read Also: Rocket Lab Stock Is Sliding Tuesday: Here’s Why

How To Buy TTD Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Trade Desk’s case, it is in the Communication Services sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock