Tesla Inc (NASDAQ:TSLA) shares are trading higher and trending on Wednesday, despite a lack of company-specific news for the session. Here’s what investors need to know.

What To Know: CEO Elon Musk recently predicted that the company’s Optimus humanoid robot could one day account for over 80% of Tesla’s value. The commentary from Musk has shifted focus from the electric vehicle market to the potentially massive robotics and artificial intelligence sectors, exciting investors about the company’s long-term growth prospects.

Despite the positive market sentiment Wednesday, Tesla faces a mixed bag of recent news. The company is challenging a $243 million judgment in a Florida crash case, arguing the court’s decision “flies in the face of common sense.” This legal battle, coupled with a class-action lawsuit over its Full Self-Driving system, highlights ongoing scrutiny of its autonomous driving technology.

Internationally, the picture is complex. Tesla has slashed the price of its Model 3 Long Range in China amid sluggish sales and intense competition. In India, the company’s mid-July launch has seen a lukewarm response, with just over 600 orders, falling short of initial expectations. However, Tesla continues its push into new markets, recently hinting at testing its Robotaxi service in New York City.

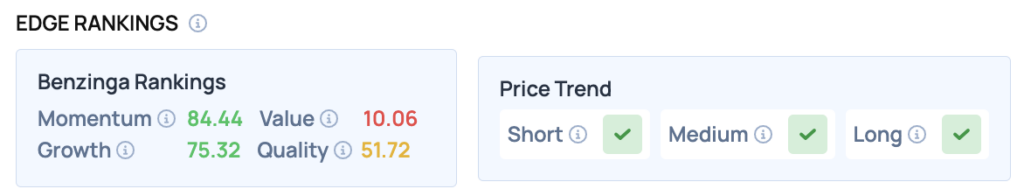

Benzinga Edge Rankings: Reflecting Wednesday’s move higher, Benzinga Edge stock rankings show Tesla with a strong Momentum score of 84.44, contrasted by a low Value score of 10.06.

TSLA Price Action: According to data from Benzinga Pro, Tesla shares are trading higher by 3.79% to $341.80 on Wednesday. The stock has a 52-week high of $488.54 and a 52-week low of $210.56.

Read Also: Google’s No Longer Just Search – And Microsoft’s Not Sleeping Well

How To Buy TSLA Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Tesla’s case, it is in the Consumer Discretionary sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: courtesy of Tesla