Shares of Robinhood Markets Inc (NASDAQ:HOOD) are trading slightly higher Tuesday afternoon. This comes on the heels of major positive developments for the financial technology firm. Here’s what investors need to know.

What To Know: On Monday, Robinhood’s stock soared following the announcement of its upcoming inclusion in the S&P 500 index, a move that solidifies its position as a major player in the financial landscape. This inclusion is expected to drive significant demand for the stock from index funds.

Adding to the bullish sentiment, Bernstein analysts on Tuesday raised their price target for Robinhood to $160. The firm cited expectations of a compound annual revenue growth rate of over 51% through 2026, fueled by the company’s expanding market share in U.S. retail crypto and equity options trading.

Bernstein also highlighted Robinhood’s potential in wealth management and its innovative plans for a blockchain-based marketplace for tokenized assets as key future growth drivers.

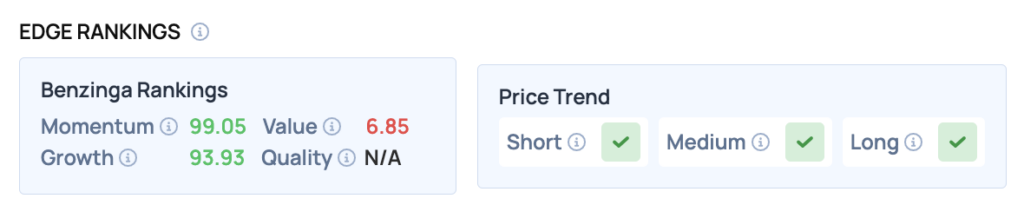

Benzinga Edge Rankings: Reflecting its recent strong performance, Benzinga Edge stock rankings assign HOOD an exceptionally high Momentum score of 99.05.

Price Action: According to data from Benzinga Pro, HOOD shares are trading flat at 0.99% to $118.42 Tuesday afternoon. The stock has a 52-week high of $117.70 and a 52-week low of $18.82.

Read Also: Dell Shares Fall On Surprise CFO Departure: What Investors Need To Know

How To Buy HOOD Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Robinhood Markets’ case, it is in the Financials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock